Forbes has released the third* Fintech 50 list, which this year features 17 Finovate alums, many of which have made the list for the third time. The Fintech 50 list highlights the top private fintechs that have operations, customers or impact in the U.S. The list excludes public companies and divisions of public companies.

Forbes has released the third* Fintech 50 list, which this year features 17 Finovate alums, many of which have made the list for the third time. The Fintech 50 list highlights the top private fintechs that have operations, customers or impact in the U.S. The list excludes public companies and divisions of public companies.

Here are the alums honored in this year’s compilation:

Among 22 newcomers to this year’s list.

- Founded: 2008

- HQ: Menlo Park, CA

- Funding: $106 million

- FinovateFall 2014 demo

The company’s third time making the list.

- Founded: 2008

- HQ: New York City, New York

- Funding: $275 million

- FinovateFall 2011 demo

Among 22 newcomers to this year’s list.

- Founded: 2012

- HQ: San Francisco, CA

- Funding: $160 million

- FinovateSpring 2016 demo

Among 22 newcomers to this year’s list.

- Founded: 2011

- HQ: London, U.K.

- Funding: $70 million

- FinDEVr 2014 presentation

The company’s third time making the list.

- Founded: 2014

- HQ: San Francisco, CA

- Funding: $43.7 million

- FinDEVr San Francisco 2015 presentation

The company’s second time making the list.

- Founded: 2012

- HQ: San Francisco, CA

- Funding: $217 million

- FinovateFall 2011 demo

The company’s third time making the list.

- Founded: 2007

- HQ: San Francisco, CA

- Funding: $368.5 million

- FinovateStartup 2009 demo

Among 22 newcomers to this year’s list.

- Founded: 2008

- HQ: San Mateo, CA

- Funding: $182 million

- FinovateEurope 2014 demo

Gusto (formerly ZenPayroll)

The company’s second time making the list.

- Founded: 2011

- HQ: San Francisco, CA

- Funding: $176 million

- FinovateSpring 2014 demo

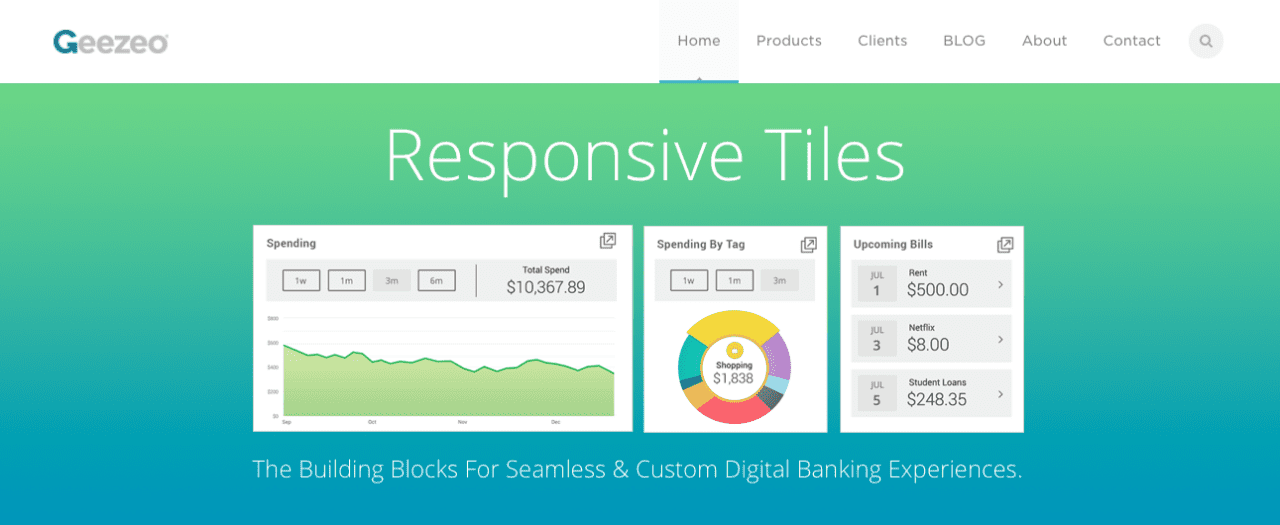

The company’s second time making the list.

- Founded: 2009

- HQ: Atlanta, GA

- Funding: $500 million

- FinovateSpring 2015 demo

The company’s third time making the list.

- Founded: 2013

- HQ: Cambridge, MA

- Funding: $150 million

- FinovateEurope 2014 demo

The company’s third time making the list.

- Founded: 2012

- HQ: San Francisco, CA

- Funding: $60 million

- FinDEVr San Francisco 2014 presentation

The company’s second time making the list.

- Founded: 2012

- HQ: Stockholm, Sweden

- Funding: $17.3 million

- FinovateSpring 2014 demo

The company’s third time making the list.

- Founded: 2012

- HQ: San Francisco, CA

- Funding: $93.6 million

- FinovateSpring 2013 demo

Among 22 newcomers to this year’s list.

- Founded: 2014

- HQ: New York City, New York

- Funding: $15.4 million

- FinDEVr New York 2016 presentation

The company’s second time making the list.

- Founded: 2014

- HQ: Palo Alto, CA

- Funding: $234 million

- FinDEVr New York 2017 presentation

The company’s third time making the list.

- Founded: 2010

- HQ: London, U.K.

- Funding: $397 million

- FinovateEurope 2013 demo

In 2016, the list contained 20 Finovate alums, including Betterment, Chain, Coinbase, Credit Karma, Gusto, Kabbage, Kensho, Klarna, Motif, Personal Capital, Plaid, Qapital, Quantopian, Ripple, Signifyd, SoFi, Symphony, TransferWise, TrueAccord, and Xignite.

The list from three years back also contained 20 Finovate alums. Algomi, Betterment, Braintree, Chain, Credit Karma, HelloWallet, Kensho, LearnVest, Motif, Personal Capital, Plaid, Prosper, Quantopian, Ripple, Simple, TransferWise, TrueAccord, Vouch, Wealthfront, and Xignite made the list.

*Forbes skipped this compilation for 2017.

Presenters

Presenters Eszter Vass, Senior Product Strategist and Head of Presales

Eszter Vass, Senior Product Strategist and Head of Presales

Presenters

Presenters Matthew Kane, Co-Founder

Matthew Kane, Co-Founder

Marek Lesiak, President & CTO

Marek Lesiak, President & CTO