Plaid, a company that has been called the plumbing of fintech, offers technology that allows apps to connect to users’ bank accounts. Today, the San Francisco-based company is making its first move to international territory– Plaid is launching in Canada.

Not only is Plaid’s full API suite available to Canadian developers, the company also added coverage for the region’s largest financial institutions, including Royal Bank of Canada, Scotiabank, TD Canada Trust, Bank of Montreal, CIBC, and Tangerine. It also supports cross-border institutions such as American Express and Capital One.

This announcement comes after the company underwent a months-long beta test with a handful of its Canadian customers, including Drop and Wave. Access is now available to developers looking to launch in Canada and to U.S. developers seeking to expand their services to Canadian citizens.

Plaid has 100+ employees and offers 6 products, including Auth, an account authentication tool; Balance, which pulls account balance information in real-time; Identity, which leverages bank data to verify consumer identity; Transactions, which pulls bank statement data across banks; Assets, a verification of assets tool; and Income, a tool that validates a consumer’s income and verifies direct deposit data. Since it was founded in 2012, Plaid has analyzed more than 10 billion transactions.

Plaid has raised $59.3 million to date. At FinDEVr San Fransisco 2014, the company’s founder Zach Perret gave a presentation about leveraging the Plaid API for financial infrastructure. Plaid has been listed as a Forbes Fintech 50 honoree for three consecutive years and was named to CB Insights’ Fintech 250 list in June of last year.

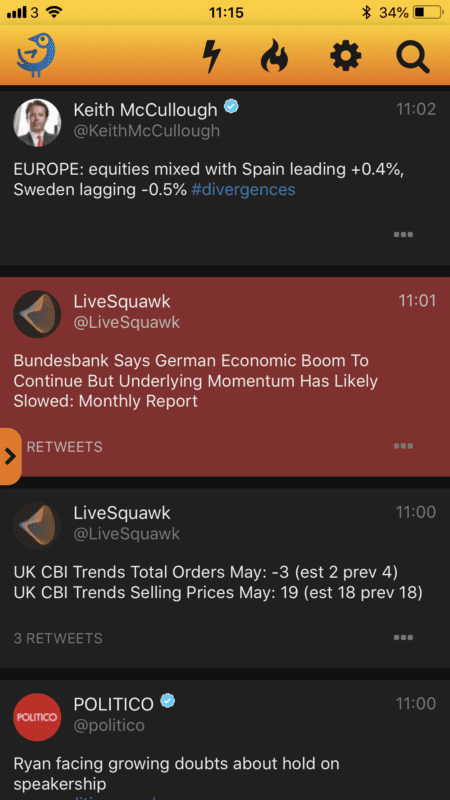

Market EarlyBird offers a read-only, anonymized Twitter service designed for financial markets professionals that enables them to spot trading opportunities and quickly identify potentially market-moving news before it makes the headlines. The platform helps satisfy compliance requirements by recording, logging, and timestamping Tweets as they appear – as well as including them in MiFiD II Transaction Reconstruction where appropriate. And by blocking users from tweeting and direct messaging, the platform satisfies one of the principal challenges for financial professionals using Twitter.

Market EarlyBird offers a read-only, anonymized Twitter service designed for financial markets professionals that enables them to spot trading opportunities and quickly identify potentially market-moving news before it makes the headlines. The platform helps satisfy compliance requirements by recording, logging, and timestamping Tweets as they appear – as well as including them in MiFiD II Transaction Reconstruction where appropriate. And by blocking users from tweeting and direct messaging, the platform satisfies one of the principal challenges for financial professionals using Twitter.