Financial data aggregator and insights provider Finicity continues to make moves in mortgagetech by partnering with fellow Finovate alum, Mortgage Cadence. The two have teamed up to integrate Finicity’s Verification of Assets (VoA) solution into Mortgage Cadence’s loan origination platform.

“Our goal as a financial data aggregator is to find best-in-class partners who are also committed to data access, quality, and insights, and ultimately a better experience for borrowers,” Finicity CEO Steve Smith said. “We are excited to work with Mortgage Cadence to accelerate and improve the digital loan process.”

A short online process lets borrowers give consent to have their financial data accessed, enabling lenders using Mortgage Cadence with the VoA integration to generate a verification report with a single click. This, according to Finicity, can cut the traditional closing time by as much as six days.

Finicity’s VoA solution provides bank-validated insight into the borrower’s assets including information on accounts at multiple financial institutions, account types, balances, and detailed transactions, as well as the account owner(s) and address(es). Available via a simple API integration, the technology enables lenders to digitize and streamline asset verification.

“Our agreement with Finicity simplifies yet another important step in the mortgage process for both borrowers and lenders, getting everyone involved in the transaction to the closing table more quickly and with fewer steps,” executive managers of Services Center for Mortgage Cadence Brian Benson said.

Finicity demonstrated its Verification of Income (VoI) and Verification of Assets (VoA) credit decisioning solutions at FinovateFall 2017. Founded in 1999 and headquartered in Salt Lake City, Utah, Finicity has raised more than $50 million in funding and includes fellow Finovate alum Experian among its investors. The company has also been a contributor to our developers conference, FinDEVr, presenting “The Frictionless Aggregation Experience” at FinDEVr New York 2017.

Winning the FinTech Breakthrough Awards’ Best Personal Budgeting Service category earlier this month for its Mvelopes solution, Finicity partnered with digital mortgage marketplace provider BeSmartee in March, integrating its Verification of Assets solution into BeSmartee’s point-of-sale mortgage origination platform. The same month, Finicity announced that its asset verification technology would be integrated with Ellie Mae’s Encompass digital mortgage solution.

Making its Finovate debut at FinovateFall 2017 last year, Mortgage Cadence demonstrated its Collaboration Center. The platform provides lenders with a secure, multi-party communications portal that brings all parties, their workflow and information for the loan into a single, secure location.

Mortgage Cadence’s deal with Finicity is the company’s latest initiative to enhance its platform’s asset verification capabilities. In April, Mortgage Cadence integrated FormFree’s AccountCheck asset verification service into its Enterprise Lending Center. In terms of partnerships, the company secured the largest credit union in Oklahoma, Tinker Federal Credit Union with more than $3.6 billion in assets and 360,000+ members, as a technology partner in March.

Founded in 1999 and with offices in Denver, Colorado, and Minneapolis, Minnesota, Mortgage Cadence is a wholly owned subsidiary of Accenture, and serves more than 600 lenders across the U.S.

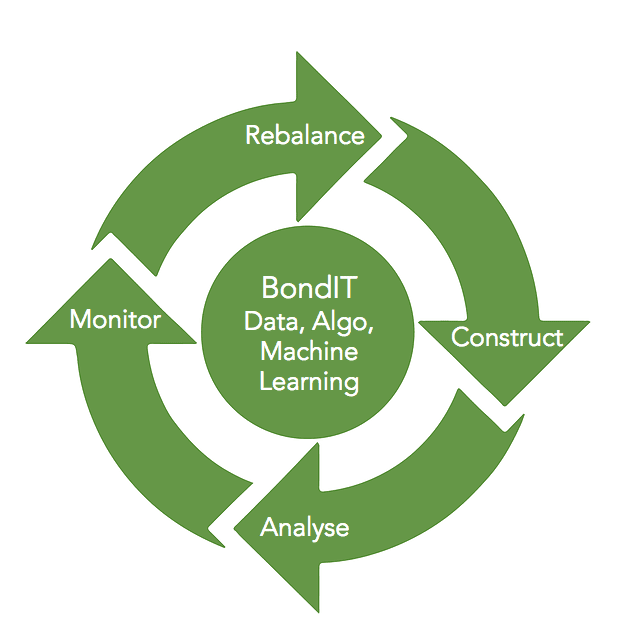

In the press release, John Prickett, Chief Operating Officer at FIIG Securities described how more investors are interested in the diversification that corporate bonds can bring to their portfolios and that this spike has increased the demand for fixed income and corporate bonds. He added, “The BondIT software will further enhance our offering, pairing the knowledge of our expert team with the latest technology to identify more fixed income opportunities for our clients and help them maximize their investments.”

In the press release, John Prickett, Chief Operating Officer at FIIG Securities described how more investors are interested in the diversification that corporate bonds can bring to their portfolios and that this spike has increased the demand for fixed income and corporate bonds. He added, “The BondIT software will further enhance our offering, pairing the knowledge of our expert team with the latest technology to identify more fixed income opportunities for our clients and help them maximize their investments.”