What do you get when you combine Intuit, Lending Club, and Wealthfront? We’re about to find out, thanks to Intuit’s announcement today that it is making user data available to third party providers.

California-based Intuit partnered with P2P lending company Lending Club and roboadvisor Wealthfront this week. These partnerships are fueled by Intuit-owned Turbox, leveraging the more than 80,000 data fields on the TurboTax return, including income, employment, housing, etc. With one click, TurboTax users can save time during LendingClub’s loan application process by importing their data. Similarly, shared TurboTax and Wealthfront clients can open an account much faster and receive more personalized financial advice based on their tax return data.

Lending Club noted the capability will do more than just speed up the application process. Cole Gillespie, Vice President and Head of Business Development at LendingClub, said that the TurboTax data will “unlock the access to credit for customers that ordinarily we might not be able to serve… this partnership is a step in leveraging alternative data sources to help us increase the speed and access to credit.”

Andy Rachleff, CEO of Wealthfront said that partnering with a company like Intuit is “a dream come true.” He explained, “They don’t just pay lip service to caring about the client. They constantly challenge themselves to provide more value. Integrating with TurboTax data that customers agree to provide will allow Wealthfront to continue to raise the bar on what it means to deliver accessible, convenient, and deeply personalized financial planning. We can’t wait to do more together.”

Intuit is also leveraging the data to pre-fill applications within PFM platform, Mint; financial recommendations site, Turbo; and existing external Intuit partners. By combining household data to give lenders a view of shared household income, credit score, and debt, Intuit offers a fuller picture of total borrowing and savings power. The company estimates pre-qualification leveraging TurboTax data generates a conversion rate of up to 9x in offer performance.

“With more than 25 million users and rich insights into their financial profile, Mint and Turbo are uniquely positioned to deliver value to both consumers and strategic partners,” said Varun Krishna, VP of product management for Intuit’s Consumer Division. “Using machine learning, we are able to provide consumers a comprehensive view of their finances and highlight relevant opportunities to save time and money and generate unique value to our partners.”

Best known for its Quickbooks accounting software, Intuit most recently demoed at FinovateFall 2009. The company has 20 locations across 9 countries and employs 9,000 people. Founded in 1983, Intuit went public 10 years later and today has a market capitalization of $54.6 billion.

Founded in 2006, Lending Club demoed at FinovateSpring 2009 and at the inaugural Finovate in 2007. Earlier this summer, the company appointed Ronnie Momen as Chief Lending Officer. Lending Club went public in 2015 and today the company’s market capitalization sits at $1.54 billion.

Wealthfront debuted as KaChing at FinovateSpring 2009. The company began 2018 by landing $75 million in funding, bringing its total raised to $205 million. A few weeks later, the company launched a home ownership planning tool.

Presenters

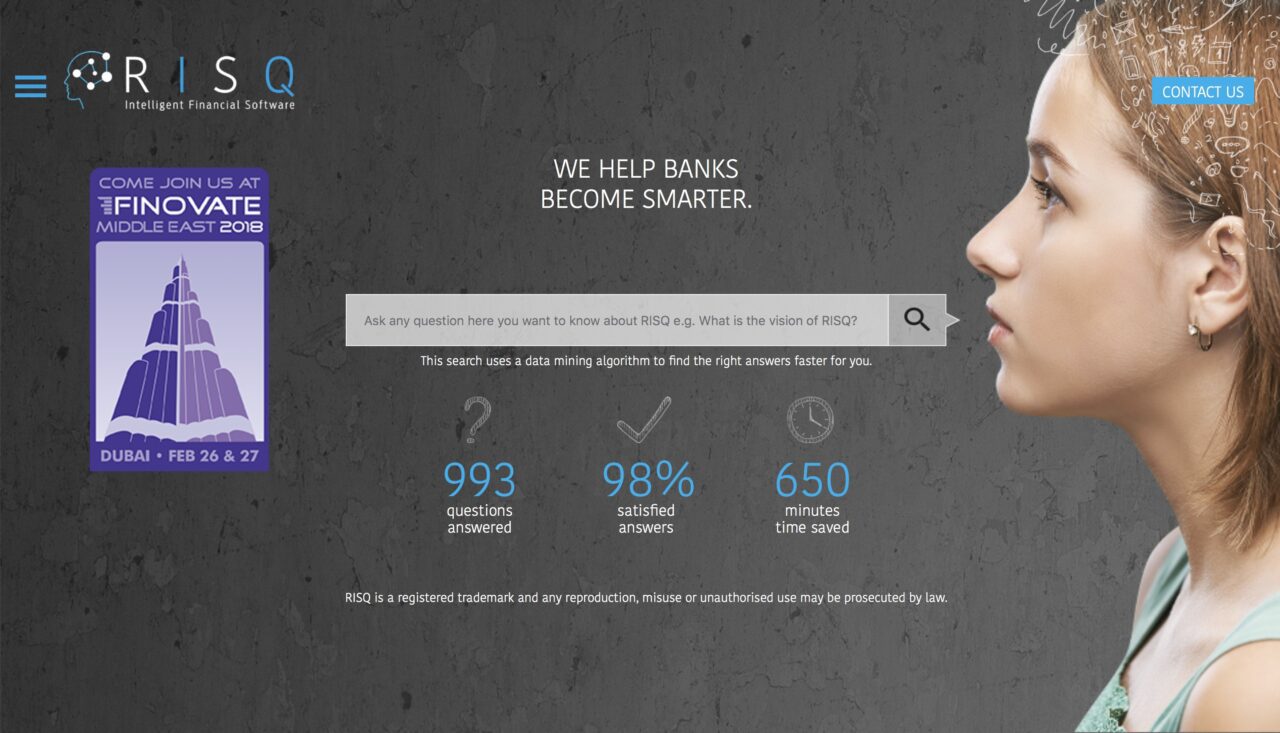

Presenters Abhishek Joshi, Senior Associate

Abhishek Joshi, Senior Associate

Presenters

Presenters Bodo Grauer, Head of Digital Strategy and Transformation

Bodo Grauer, Head of Digital Strategy and Transformation

Presenters

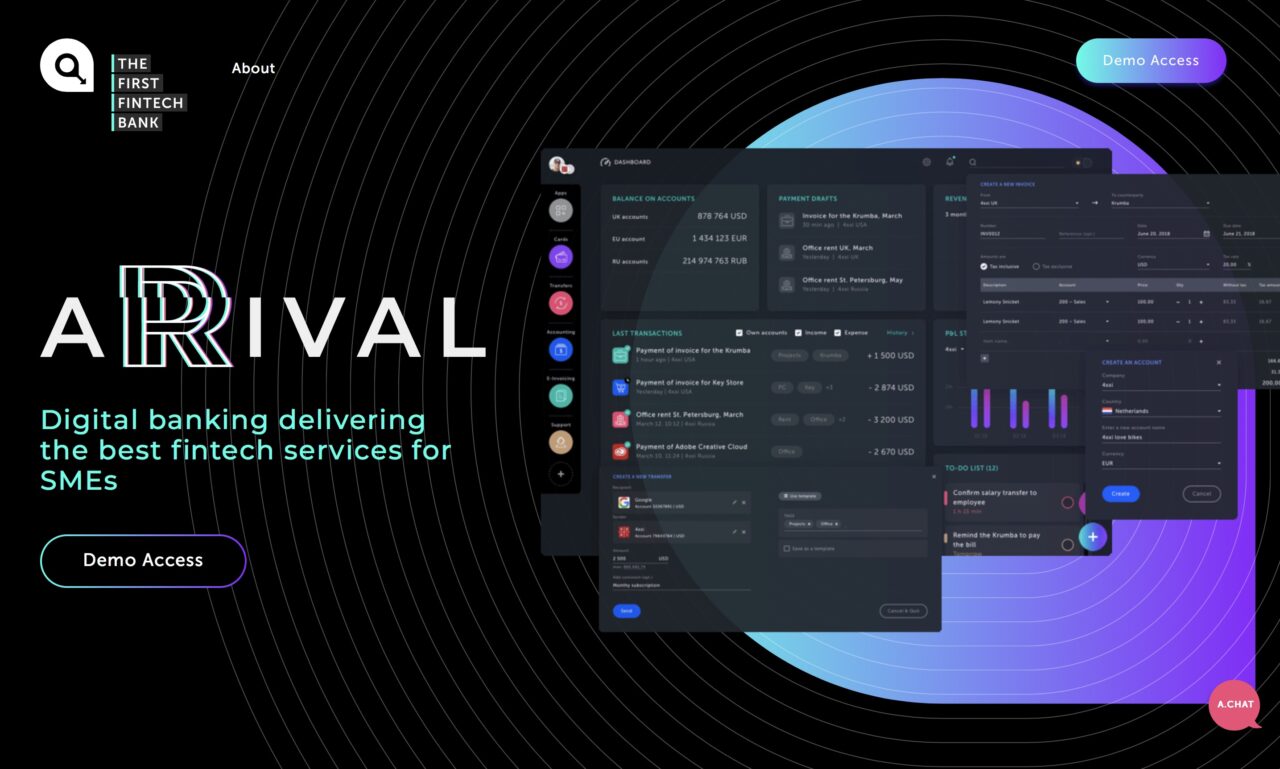

Presenters Igor Pesin, Co-Founder and CFO

Igor Pesin, Co-Founder and CFO

Presenters

Presenters Ozan Vakar, CTO

Ozan Vakar, CTO

Presenters

Presenters Justin Lai, Sales and Marketing Director

Justin Lai, Sales and Marketing Director

Presenters

Presenters Piyachat Kunthachaem, Business Platform Officer

Piyachat Kunthachaem, Business Platform Officer Sukanya Bowornsettanan, Project Manager, Transformation

Sukanya Bowornsettanan, Project Manager, Transformation