Miss an episode of the Finovate Podcast during the holiday rush? No need to fear; the Finovate blog has got your back.

From insights into the rise of embedded finance and prospects for “technosocialism” to discussions with innovators in the field of personal finance and roboadvisory, the Finovate Podcast is your one-stop-shop for fascinating, in-depth conversations between Finovate VP Greg Palmer and fintech’s finest analysts and entrepreneurs. Today we’re sharing some end-of-year episodes of the podcast that might have slipped beneath your radar as 2021 drew to a close.

Find the Finovate podcast at Soundcloud and follow Greg Palmer on Twitter for the latest in programming news and updates.

Chris Karageuzian, CEO and Co-founder, Help With My Loan. Host Greg Palmer and Chris Karageuzian talk about how the Finovate newcomer is making the lending process more pleasant for borrowers.

“I was in the industry for 20+ years so I felt the frustration – that’s why I left and created this company. (There’s a) lack of technology and fragmented software – you have to use almost seven to ten pieces of software just to deal with one file. That’s really not productive in my opinion. We closely work with banks right now. We have 300+ banks signed up in our database and in our software. So deals get automated and matched and we are within an earshot of every deal.”

Vivek Krishnamurthy, Principal, Commerce Ventures. Host Greg Palmer sits down with Vivek Krishnamurthy for a conversation on “embedded finance” and an overview of the field’s opportunities and pitfalls.

“There’s a split between the infrastructure layers that enable third parties to launch financial services products. And then there are the instances in which financial services products are launched inside of other ecosystems. We think that latter aspect, that latter space of being able to turn on a financial services product in the customer journey inside of a non-financial services ecosystem, that’s what we think about as ’embedded finance.'”

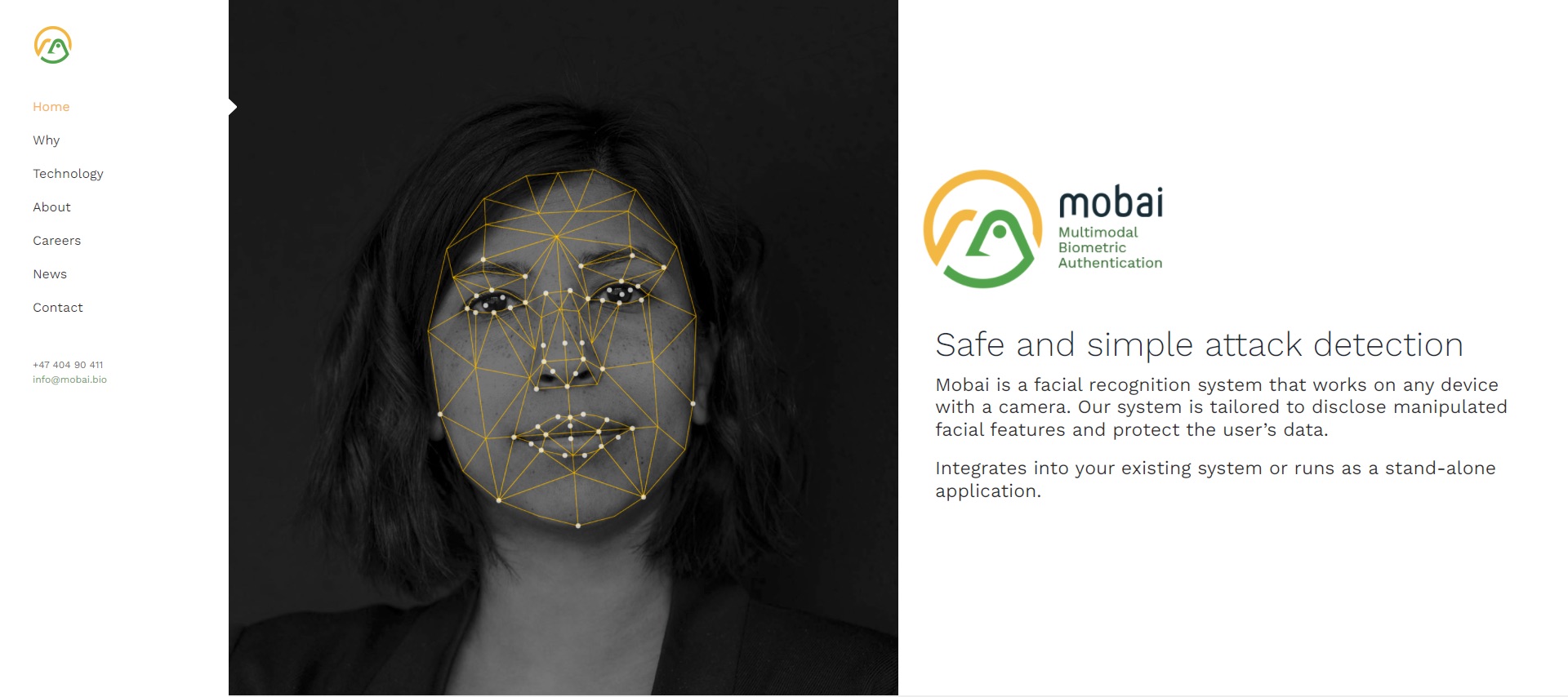

Ned Phillips, Founder and CEO, and Mike Larsen, Head of Sales, Bambu. Host Greg Palmer talks about the challenges facing the automated investment business with Ned Phillips and Mike Larsen of Best of Show winning roboadvisor Bambu.

“We are a B2B wealthtech. So what does that mean? We design, build, and deploy those roboadvisor, savings and investment apps for financial institutions. So if a financial institution wants its own Betterment or its own Wealthfront, they come to us for the tech and we build it. And at Finovate, we built one on stage in seven minutes!”

Will Graylin, Chairman and CEO, OV Loop; CEO, Indigo Technologies. Host Greg Palmer chats with serial entrepreneur Will Graylin about contactless payment adoption, super apps, and the future of mobile payments.

“Why haven’t we adopted (contactless payments) in much more mass given that Apple Pay has been out for over seven years, and Samsung Pay has been out for six years, and Google Pay has been out there for seven years – eight years now? Why haven’t we adopted en masse? (Our situation is) unlike China’s WeChat/WeChat Pay/AliPay. For those solutions, they are adopted to the order of about 83% of all consumer transactions, whereas we’re still in single digits in the United States. Why?”

Brett King, Author, The Rise of Technosocialism; Founder of Moven. Host Greg Palmer and Brett King talk about King’s latest book, The Rise of Technosocialism: How Inequality, AI, and Climate Will Usher in a New World.

“When you think about why it is that we haven’t been able to tackle (climate change) and get agreement on this, part of the core problem is that we tend to be quite short-term focused in our planning as a species. We’re focused on the next quarter, the next year, in terms of financial reporting, or maybe the next two years or four years in terms of political cycles. But when it comes to planning out things for 20 years in our future or 30 years in our future, the big problem is we just ask ‘who’s going to pay for it?'”

Lindsay Holden, Co-founder and CEO, Long Game. Host Greg Palmer discusses loyalty, education, Millennials, and gamification with Lindsay Holden, founder of FinovateFall Best of Show winner, Long Game.

“Long Game is a mobile game. It’s an app that sits on top of your bank account and rewards customers for learning about financial literacy and for positive financial behaviors like saving. For banks, we are helping them have a branded experience that’s super-fun for customers, they can acquire new customers with us, and also increase their customer LTV through promoting their products, increasing savings, and increasing direct deposits.”