It's been awhile since we've had an installment of What NOT to Do! (note to self: think of a catchier title). There have been a number of candidates in recent weeks, but the winners are HSBC, M&T, and TCF, which have elected to get out of the federal student-loan business (FFEL) (see notes 1, 2).

It's been awhile since we've had an installment of What NOT to Do! (note to self: think of a catchier title). There have been a number of candidates in recent weeks, but the winners are HSBC, M&T, and TCF, which have elected to get out of the federal student-loan business (FFEL) (see notes 1, 2).

Although overshadowed by the Bear Stearns debacle and other unpleasant economic news, these three banks managed to make the first page of Thursday's Personal Journal section in The Wall Street Journal (here) as well as a number of regional news sites (here and here).

It's a difficult time for financial companies (except Visa of course), so I understand how it would be appealing to exit this relatively low-profit market until the credit markets calm down. However, what's a sound short-term financial decision could be a public relations and brand image disaster.

If there's one thing most Americans believe in, it's the importance of education. Sen. Kennedy's recent statement from the Senate floor provides a sample of how the general public views student loan support or lack thereof (the full text of the March 8 address is here):

Americans are anxious about their economic futures. They’re seeing volatile markets, disappearing jobs, home foreclosures, rising debt, and declining benefits. Now the crisis in the credit markets stemming from irresponsible lending practices in the mortgage industry may impact their ability to secure student loans at fair rates so their children can go to the college of their choice.

With consumer confidence down, investors losing faith in the financial markets, and Congress pointing fingers at mortgage lending practices, this is not the time to exit a business that's associated with all things good about our country. It's like saying you're temporarily eliminating charitable contributions until the economy picks up.

If there is something fundamentally unprofitable with student lending, by all means pull back, raise prices, redeploy resources, lobby Congress, whatever you have to do to save the bottom line. But unless you are in dire financial straits, don't risk your brand's reputation by turning your back on a market segment that needs your support now more than ever.

What to do

This is a perfect opportunity for banks and credit unions to distance themselves from the big banks pulling out of student lending:

- Develop a multi-media campaign, "we're on your side" that reaffirms your support of higher education through all that you do: scholarships, internships, donations, and a variety of loan options.

- Contact the local press and reiterate the above points and make executives available to speak to the strategic importance students and student loans are to your company.

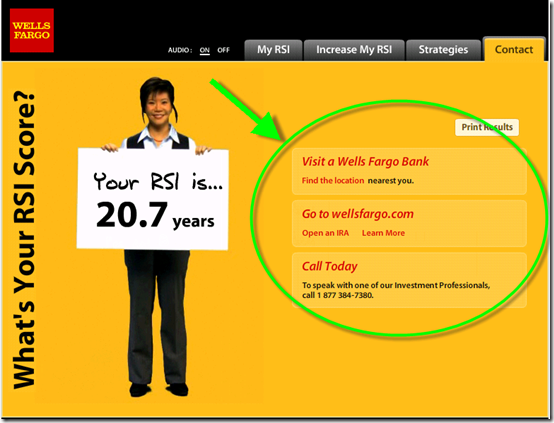

- Release a microsite that serves as resource for students weighing financing options.

Notes:

1. We have less of an issue with the smaller lenders that have exited the FFEL program including: Boeing Employees Credit Union, First Niagra Bank, Spokane Teachers Federal Credit Union, and Kansas State Bank of Manhattan (see the full list of dropouts at FinAid.org here). Smaller financial institutions, with less of a brand name to protect and fewer resources, may have to make the hard decision to exit an unprofitable product line.

2. The graphic image is for effect. We do not expect HSBC to close their online Student Center, although it will need a major redo, and quickly.