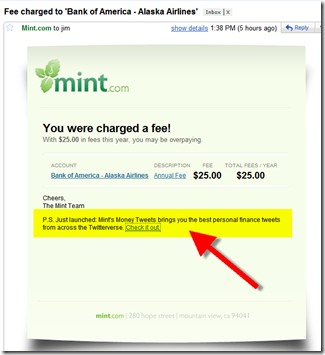

![]() I received an email this morning (see below) from Chase Bank inviting me to participate in a new Business Advisory Board, powered by Lightspeed Research. My colleague also received the same invite for his separate account, so it doesn’t appear to have been a particularly selective emailing. Both accounts were acquired by Chase in the 2008 WaMu debacle.

I received an email this morning (see below) from Chase Bank inviting me to participate in a new Business Advisory Board, powered by Lightspeed Research. My colleague also received the same invite for his separate account, so it doesn’t appear to have been a particularly selective emailing. Both accounts were acquired by Chase in the 2008 WaMu debacle.

To sign up, users simply complete a 10-question one-page online form (first part shown below in screenshot 2) which took just under six minutes (note 1).

After completing the registration, I expected to be ushered into some type of special club, but all I received was a 15-word paragraph telling me to confirm my email address (screenshot #3). That’s a bit of a letdown after giving the bank nearly 10 minutes of my day. I surmised the big payoff would come after confirming and logging back in.

I was wrong. After logging in, I was greeted with a short thank-you statement and an invitation to take the “welcome survey,” which turned out to be three questions about the 2010 economic outlook (screenshot #4). And that was it. Nothing more to see or do. No blog. No “online community” (promised in email). No special offers (note 2). They didn’t even have the courtesy to share the results from the survey I just took (note 3). I began to wonder if I’d been scammed.

Analysis: On the surface I love this idea: inviting customers to participate in an online advisory board. Customers like to be noticed and heard, and a chance to win $100 is icing on the cake. But if you intend to ask business customers to take 15 minutes out of their day, it better be for something real. So far, I just feel stupid for signing up and thinking that I was actually going to make a difference at the bank.

Hopefully, they’ll make up for the bad start with interesting opportunities down the road. But the bank will have to work doubly hard to get my attention after this wasted effort.

Email from Chase Business Banking (received 19 Jan. 2010, 1:55 PM Pacific)

Note: Highlighting mine

1. Landing page from email (link, 19 Jan. 2010)

2. Registration page (click to enlarge; link)

Note: Registrants are entered into a sweepstakes to win one of ten $100 prizes.

3. Registration thank-you screen

4. Three-question welcome survey is available after confirming your email address

Notes:

1. Although the site says it’s for business-banking customers of Chase and WaMu, it appears that anyone that finds the website can join.

2. Under the “Rewards” tab, information tantalizes regarding earning “cash, prizes, sweepstakes entries” for survey-respondents. But there are no examples or surveys available, so it’s one more small letdown.

3. Business owners that read through the online FAQs will find out that they may be contacted one or two times per month with “research opportunities,” but Chase shouldn’t bury this key info in the FAQs where only a small percentage of users will find it.

4. See our recent Online Banking Report for more ideas on how to serve small- and micro-businesses through the online and mobile channels.

![image_thumb[7]](http://s3.amazonaws.com/finovate-archive/old/WindowsLiveWriter/7cb11ef65bb9_97C7/image_thumb%5B7%5D_thumb.png)

![image_thumb[6]](http://s3.amazonaws.com/finovate-archive/old/WindowsLiveWriter/7cb11ef65bb9_97C7/image_thumb%5B6%5D_thumb.png)