Since we began publishing Online Banking Report in 1995, we’ve taken a deep dive into the small- and micro-business online banking market five times. The latest was published yesterday (here). Online Banking Report subscribers can access it now as part of your subscription (note 1). Others may purchase it for US$495 (abstract here).

Since we began publishing Online Banking Report in 1995, we’ve taken a deep dive into the small- and micro-business online banking market five times. The latest was published yesterday (here). Online Banking Report subscribers can access it now as part of your subscription (note 1). Others may purchase it for US$495 (abstract here).

Small business banking is one of my favorite subjects. It’s near-and-dear to our hearts because we’ve experienced first-hand the frustration of trying to manage our business with neither the resources, nor frankly the interest, to tap sophisticated business-management tools.

So, we’ve hobbled along over the years using Word, ACT, Excel, Microsoft Money, a hand-written ledger, and a moderately customized ecommerce back-end on our website. But we’ve clearly paid a price (note 2) for our lackadaisical approach to business finance.

The reason I share our foibles is to point out the need for banks (note 3) and others to look at the opportunity more broadly. You can do so much more than simply help small businesses manage their checking accounts and credit lines. It’s the day-to-day business drudgery, billing, account receivables, record-keeping, tax prep, payroll, compliance, and so on, where small and micro businesses really need help.

As I’ve said many times over the past decade, I’d gladly pay $500 per MONTH for an online, small-business financial management service that handled ALL our needs. Ultimately, it would save us thousands per year, while delivering much more timely info about the health of our business.

Our latest report is a true product-manager’s guide to small-business product/service development with 76 pages of ideas plus examples from leading banks worldwide. We tie it all together with detailed descriptions of four levels of small-business package accounts (starting on p. 45 in the OBR Small Business Report; note 4):

- Virtual Checking Account: A transaction-oriented service priced at $25 or so per month

- Virtual Business Manager: Organizes most financial management duties for $50 to $100 per month

- Virtual CPA: Handles most business-management functions including customer relationship management and billings for a monthly fee of $100 to $250

- Virtual CFO: The works for $500+ per month

The report also includes data on the size of the U.S. market and a forecast for online banking usage for the next 10 years.

Notes:

1. Printed copies will be mailed late next week.

2. According to our accountant, we’ve spent well into five-figures more than necessary, mostly in extra taxes. Then again, we’ve avoided paying bookkeeping and software expenses that could have been just as high.

3. Why do I think this is an opportunity for banks and credit unions, when it is outside of their core deposit and credit offerings? Very small businesses have neither the time nor resources to search for solutions, and then perform the due diligence necessary to determine whether the solution provider or professional services firm is trustworthy. On the other hand, while business owners may not always hold their bank in the highest regard, they at least trust them to safeguard their info. An army of regulators and class-action lawyers makes sure that the bank does not take its fiduciary responsibilities lightly.

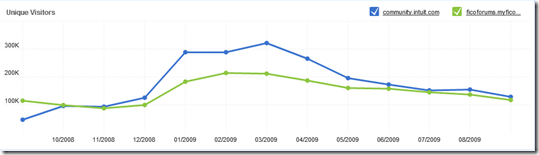

But few financial institutions will look to build sophisticated financial management features in house. Most will look to outsiders, both startups such Outright.com and established bank-tech firms such as Intuit, to build and maintain the business-management features.

4. See also, our recent post on small-business dashboards.

In an article in today’s Austin Business Journal about the coming launch of mShift-powered mobile remote deposit at Randolph-Brooks Federal Credit Union, the CU revealed its penetration number in its EasCorp-powered, home-scanner-based service, eDeposits:

In an article in today’s Austin Business Journal about the coming launch of mShift-powered mobile remote deposit at Randolph-Brooks Federal Credit Union, the CU revealed its penetration number in its EasCorp-powered, home-scanner-based service, eDeposits: USAA was the first major financial institution to launch mobile remote deposits in August. But WV United beat them to market in July earning our OBR Best in the Web award. And this week, speaking at BAI Retail Delivery, Bank of America’s Doug Brown was bullish on the feature, leading many to believe that the giant would add the feature to its mobile offering at some point (see note). And if that happens, it’s not inconceivable the feature could show up in television commercials, either from BofA or Apple.

USAA was the first major financial institution to launch mobile remote deposits in August. But WV United beat them to market in July earning our OBR Best in the Web award. And this week, speaking at BAI Retail Delivery, Bank of America’s Doug Brown was bullish on the feature, leading many to believe that the giant would add the feature to its mobile offering at some point (see note). And if that happens, it’s not inconceivable the feature could show up in television commercials, either from BofA or Apple.