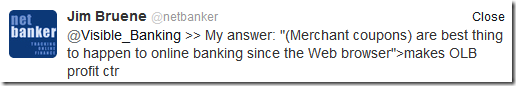

Last week, Christophe Langlois @Visible-Banking tweeted a question about the value of in-statement rewards programs:

And my answer:

My response was partly 140-character hyperbole. It’s Twitter after all. But after sleeping on it, I think what I said might actually be true.

What’s the biggest problem facing online/mobile banking?

The cost to the bank. Always has been and always will be. And it’s not going to get less expensive anytime soon (note 1). Every time we write about the next must-have online bell or mobile whistle, it just gives bank CFOs another gray hair.

Up until recently there were only three ways to pay for these extra expenses:

- Charge direct fees for the channel, which customers hate

- Cross sell, which is hard to attribute solely to the online channel

- Cover the costs with other revenue streams

The vast majority of banks, and every one in the United States, took the last approach. Unfortunately, this can lead to unwise pricing decisions such as the one that gave rise to the “$35 cup of coffee.”

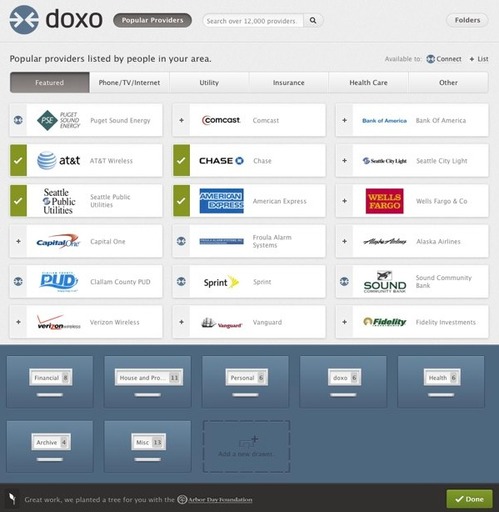

But thanks to Cardlytics, who recently took home Best of Show honors at Finovate Europe, and others, we are entering into a new era of advertising-supported banking. And that could finally make direct banking a revenue generator on its own. Not enough to pay all its costs, but enough to alter the game.

Let’s assume banking customers redeem 2 offers per month and the average commission to the bank is $1 each (note 2). That’s $2/mo in new revenues, almost entirely attributable to the online/mobile channel (note 3).

A bank with 25,000 online banking customers would earn about $600,000 annually. That will buy a several bells and a decent whistle.

———————-

Notes:

1. It can be argued that in the long-term support costs per banking customer will fall dramatically as branches and human customer support are downsized.

2. Using Aite’s forecasted $1.7 billion in-statement commissions in 2015 and dividing by 70 million online banking household (link).

3. You have to have the debit or credit card too, so the revenue might need to be shared with the card P&L.

4. We published a report on in-statement rewards in 2011 in our Online Banking Report.

![]()