This is a guest post written by Dr. Anette Broløs of Broløs Consult and Dr. Erin B. Taylor of Finthropology.

Finances have long been considered a man’s domain. Women’s economic power is, however, growing along with growing equality in education, changing family patterns, and more focus on gender diversity.

With growing economic power, the market potential to serve women with suitable financial solutions is growing, too. During the last 5 to 10 years, there has been rapid growth in the number of organizations offering female-focused financial services. Yet Oliver Wyman estimates that companies are missing out on $700 billion in profit by not catering to the female market.[1]

What can we do to tap into the female financial market?

This question is at the center of two reports we published in the last year asking why women might need or want their own financial services.[2] How does women’s behaviour differ from that of men? What kinds of features might women need in financial services that are different to those for everyone? And is there anything special about serving women, or is it just part of the broader trend towards developing client-centric solutions?

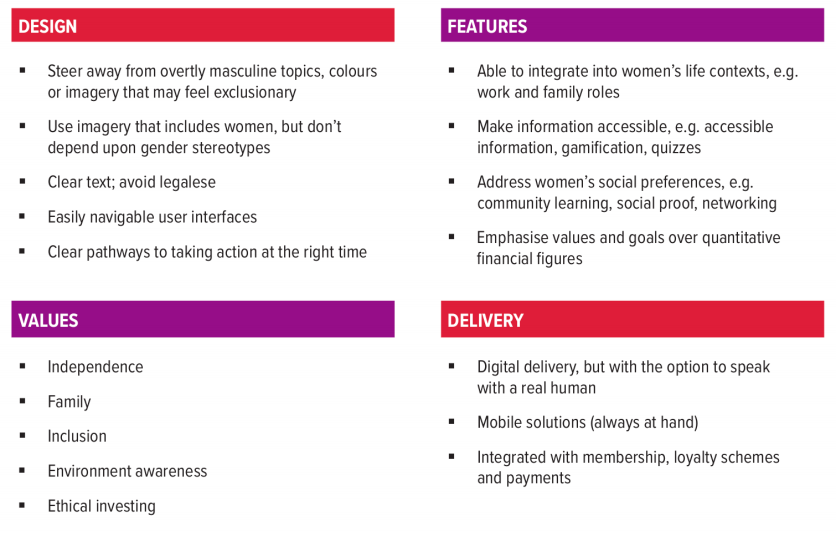

Figure 1: What goes into designing financial services for women?

In the first report, Female Finance: Digital, Mobile, Networked (2020), we explored solutions for women in-depth and presented an analysis of what makes financial solutions ‘female.’ In the second report we studied the characteristics of 102 organizations offering financial services to women, comparing them with external statistics and reports.

We found that there are– at least for now– definite differences between what men and women look for in financial services. In Figure 1 we provide an overview of what makes a product or service targeted at women: looking at design, features, values, and delivery.

We also found that many providers offer “traditional” services (savings, investment, credit, etc.) embedded in other services such as advice, impact solutions, education, mentorship, and networks. Women seem to value these integrated services more than men because they provide a more personal and social approach to finances. Interestingly, there are an increasing number of networks, associations, and NGOs that offer services like learning and networks without actually offering traditional financial services— a new development in the market.

The values of companies that focus on women are also different from those catering to a broader market. The latter tend to focus on “value for money,” whereas the female-focused organizations focus on culture, empowerment, creativity, and freedom.

And so, providing female-focused financial services isn’t just about improving messaging or offering ‘wrap around’ services on existing offers. The majority of organizations that we studied designed their services for women from the outset, and many of them were founded— and led— by women. Many founders come with a solid background in financial services.

So, what can fintechs and incumbent financial service providers do to tap into this important market?

We find that two elements are at the core of successfully reaching this market. [3] The most important is to develop a holistic understanding of customer needs. Women look for assistance to achieve financial health and wellbeing for themselves and their families, and so they prefer solutions that fit into their real life, rather than just considering factors like risk and return.

This means, for example, that investment services for women should not only focus on helping them get the highest profit possible, but also on investing in education, a better life, and security for women and their families.

Offering services to women also means going beyond questions of financial literacy. Good financial services for women will help them to gain control over economic decisions in both the short and long term.

Another important element to understand is how digital solutions can support the provision of holistic services. Women are avid users of integrated, easy-to-access solutions.

A good place to start is to invest in better understanding the female market and its characteristics. This may be assisted by connecting with other organizations to share best practices and create co-learning opportunities.[4]

Another important focal point is the generation of reliable data and insights. To assist with this, companies can collect sex-disaggregated data on customers to shed insights into gender differences in product and service use. They can also take the time to research female customers’ behaviour and user experience, including their life contexts, needs, and preferences.

Companies can adapt the innovation and development process to be more customer-focused and less technology-driven. They can introduce customer knowledge into innovation and put co-creation at the centre of the process.

We encourage organizations to develop holistic value propositions that integrate financial offerings into everyday activities, as well as personal networks and communities. As part of this, they can communicate with women in ways that speak to their life contexts, and which are inclusive rather than exclusive.

When developing services for women it is also important to have an appropriately diverse team to research and design them. Companies can work on internal organizational diversity, including capitalizing on team diversity to reduce the risk of unconscious biases entering into service design. This may be assisted by partnering with fintechs that are already

experienced in providing services for women.

This is a simple enough recipe that also fits the general trend towards customization, so there is really no excuse not to get started.

[1] Oliver Wyman. 2020. Women in Financial Services 2020. May

[2] Anette Broløs and Erin B. Taylor. 2020. Female Finance: Digital, Mobile, Networked. EWPN and Keen Innovation and Erin B. Taylor and Anette Broløs. 2021 Female Finance in Figures. EWPN, Keen Innovation and Bank Cler.

[3] We decided to focus on the general findings and perspectives here. There are many important learnings to put to use in developing services for women-led SME’s and particularly to the economic access and development in poorer economies.

[4] We take inspiration from the Financial Alliance for Women. In their October 2020 report they indicate a number of ways to push forward: 1) Collecting sex disaggregated data; 2) Understanding women’s realities, needs and preferences; 3) Working with gender biases; 4) Developing holistic value propositions; 5) Setting these in marketing that appeals to women.