We’ve seen some bad news in the tech sector lately. YCombinator is asking its portfolio founders to “plan for the worst” and prepare for a downturn and Klarna is laying off 10% of its employees. Headlines such as, “Tech’s High-Flying Startup Scene Gets a Crushing Reality Check” aren’t helping consumer or investor sentiment, either. It can be tough to remain optimistic.

The good news is that the fintech industry is resilient. So amid the recent onslaught of disheartening news, here are four reasons you can be optimistic about fintech right now.

DeFi is promising

Fintech’s future is bright, and one shining light is decentralized finance (DeFi). It’s hard to know the exact implications DeFi will have on banks, fintechs, and other traditional financial (TradFi) organizations.

However, it’s clear that decentralizing traditional operations such as money transfers and loans will make a more efficient financial system. What’s more, DeFi is poised to help the 1.7 billion unbanked individuals across the globe benefit from financial services they’ve previously never had access to.

The best innovations are born when times get tough

It’s true that necessity is the mother of invention. Whether it’s an economic downturn, a pandemic, or a crisis in a different form, difficult times have proven to motivate people to develop creative solutions. This can be seen in countless examples from the COVID Recession of 2020. After the COVID pandemic hit, businesses were forced to figure out a way to convert their offering or service into the digital channel. In fact, many fintech companies grew while firms in other sectors were forced to make major cuts.

With new crises come new issues, and new problems that businesses and consumers need help solving. A bear market or an economic downturn would be no different; the best innovations are yet to come.

Still room for improvement

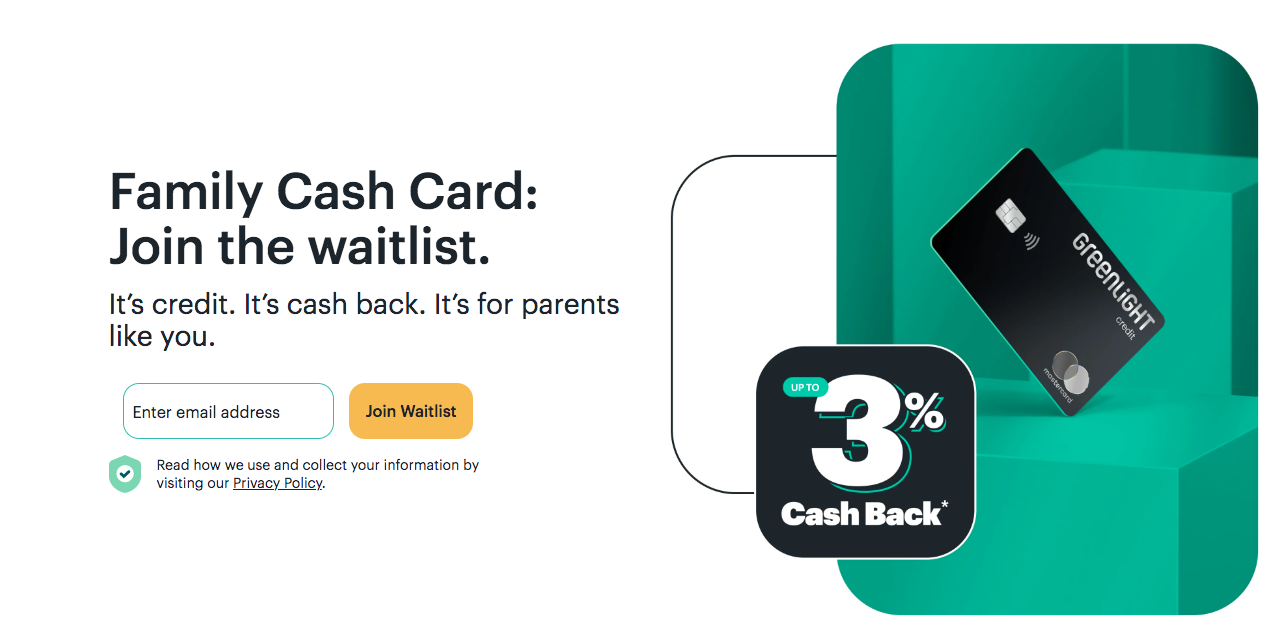

Because the fintech industry is relatively nascent, many of the problems the industry set out to solve still exist. In a piece we published earlier this month titled, “Has Fintech Failed?” we took a look at all of the ways fintech is failing to help consumers and businesses. As a few examples, underbanked populations are still lacking quality financial solutions, there are no open banking mandates in the U.S., fraud is rampant, and digital identity is flawed. The good news is that this leaves a lot of room for improvement, and therefore a lot of room for new competitors.

Fintech is here for a reason

When all is said and done, fintech is made to help individuals and businesses better manage their finances and more easily access financial services. Because money is not an optional tool for survival in the modern economy, financial services companies have a unique ability to help others through a recession or slowdown in their own industry. This pervasiveness makes for endless opportunities for banks, fintechs, and DeFi alike.

The fintech industry is not just here to serve financial services organizations, but rather to help people in this world that need financial services the most. That’s why we’re here, and it’s certainly something to be optimistic about.

Photo by Marija Zaric on Unsplash