The world of banking is ever-evolving, and NCR has been part of this evolution since it was founded in 1881.

To get some insight from a firm that has had a front-row seat to industry changes– and to get a glimpse of what’s next– we spoke with NCR Chief Product Officer Erica Pilon. She has spent more than 20 years in the fintech industry, having also spent time at FIS managing three unique digital banking platforms.

What products and technology are resonating with NCR’s 600+ institution clients?

Erica Pilon: Our clients are really responding to data enhancements, crypto, and self-service support. Consumers today expect all interactions to be hyper-personalized, which is impossible without real-time, reliable data. At NCR we are helping financial institutions personalize banking experiences for customers at scale through enriched data and analytics. For example, we recently announced that Allegacy Federal Credit Union has partnered with us and Google Cloud for our data warehousing and analytics solution to make data actionable, unlock predictive insights, and drive innovation and financial health.

Another service resonating with our clients is the ability to offer buy/sell/hold of bitcoin within digital banking as it drives opportunities to build relationships, increase data insights, and generate revenue. Our clients have also shown increased interest in and excitement around enhanced self-service offerings, such as the Kasisto intelligent digital assistant, which provides human-like digital customer support.

What trends are making the largest impact in fintech in the coming year?

Pilon: Community financial institutions no longer only compete with the institution down the block but also with nontraditional threats like neobanks, big techs, and fintech providers. There is a new sense of urgency for financial institutions to provide modern, convenient experiences with robust, innovative products and services to retain customer loyalty, trust, and market share.

Open banking is a massive trend that is transforming the fintech space; it’s creating an opportunity for banking as a service and giving smaller fintech players the ability to try and steal market share from traditional institutions. To compete, banks and credit unions must work with partners that will help them stay open while continuing to leverage the significant trust advantage they have with customers and members. This is another reason why personalizing the experience within digital channels is so important; it helps community financial institutions retain their differentiator and compete with emerging threats.

How is NCR preparing itself for web3?

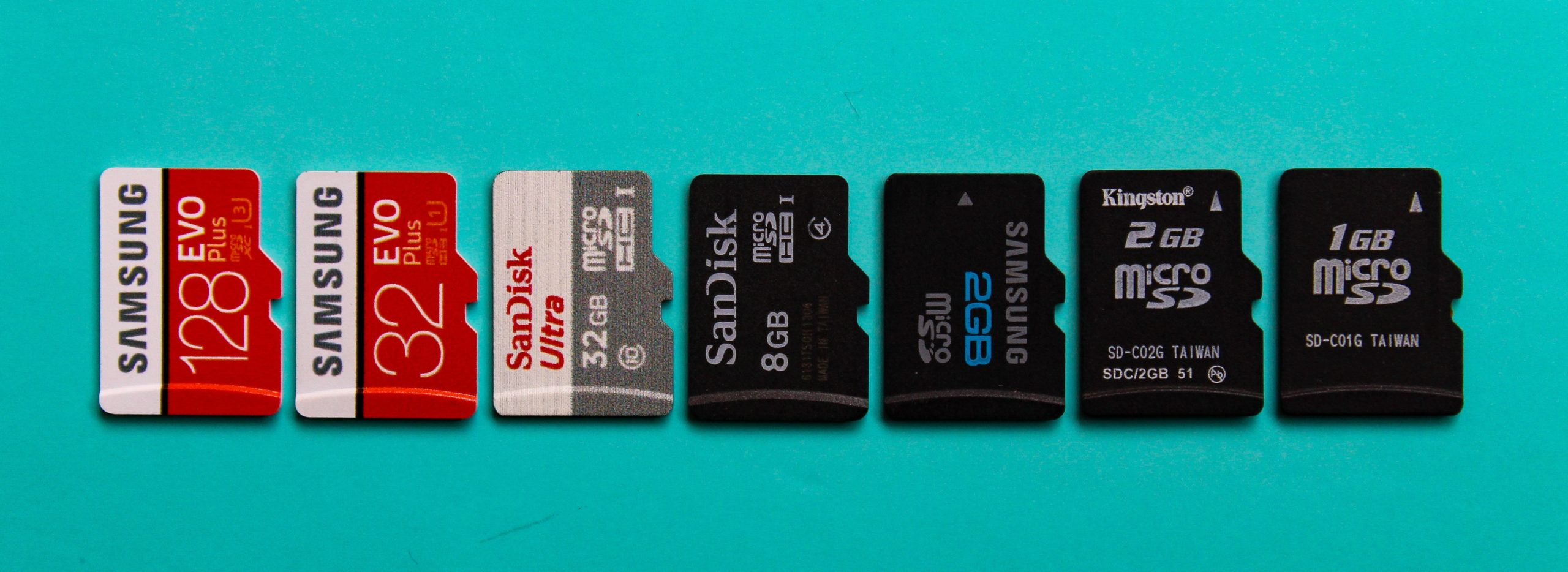

Pilon: We recently acquired LibertyX, a leading cryptocurrency software provider, which lays the groundwork for us to deliver a complete digital currency solution to our customers. This includes the ability to buy and sell cryptocurrency, conduct cross-border remittance, and accept digital currency payments across digital and physical channels.

NCR remains committed to delivering the agile software platform and services necessary for institutions to power flexible, efficient, and modern banking experiences across all customer touchpoints. Our platform is designed to help our clients quickly innovate and deliver new offerings to keep pace with emerging preferences and trends.

How has the recent consumer-first narrative changed how NCR develops its banking products?

Pilon: NCR continues to prioritize consumer-first, mobile-first experiences in our technology solutions. Now, in a world with so much optionality, banks and credit unions must be able to offer a wide range of choices for how consumers can conduct their banking. This means robust self-service capabilities with strong support options like video chat, as well as sophisticated physical footprints.

The consumer-first narrative is another reason NCR is so focused on data; banking interactions today must be personalized, or customers will quickly go elsewhere. This doesn’t just mean knowing basic details like names and birthdays, it also means being able to provide meaningful advice and guidance related to things like financial health and wellness.

How has NCR evolved to serve bank clients in today’s digital-first era?

Pilon: We firmly believe that digital-first doesn’t mean digital-only, but rather digital everywhere. This is where NCR is uniquely differentiated in the market; we have the ability to offer sophisticated digital solutions for both physical and digital touchpoints, enhancing the customer experience and increasing efficiencies. For example, we can facilitate the ordering ahead of cash or coin for small businesses or starting an account opening process online and then finishing it in the branch. NCR bridges the gap between physical and digital touchpoints.

The pandemic only emphasized what NCR and our clients have known all along: the future is digital, and it’s time to adapt. NCR remains dedicated to providing the flexible, innovative, and efficient technology needed to power excellent banking experiences and strengthen credit unions and community banks’ competitive positions.

Photo by Supratik Deshmukh on Unsplash