This post is part of our live coverage of FinovateFall 2013.

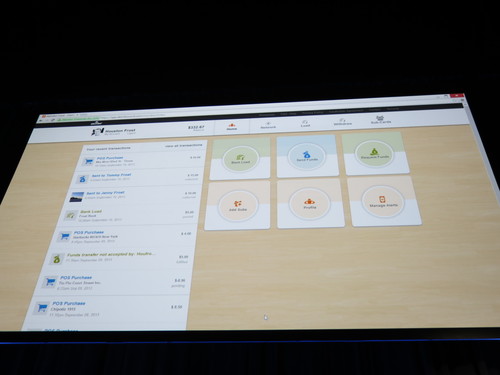

Yodlee took the stage next to debut its new

TANDEM product:

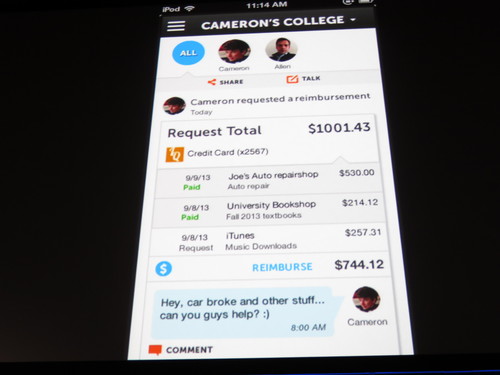

“When it comes to finances, where you stand depends on which “hat” you’re wearing. Most people have several “shared finances” in their life. Elderly parents. Spouses. Children. Friends. Now, through a single app, you can manage them all. Yodlee created TANDEM to enable safe and meaningful dialogue about finances between individuals and among groups.

With its unique tools to access, learn, manage, project, and control, TANDEM empowers you to make financial decisions as a family, a couple, a group, or a parent. And making financial decisions has never been more rewarding or more actionable. Close, Closer, Closest. Regardless of the relationship(s), you get one app, different views, full financial control.”

Product Launch: September 2013

Metrics: Yodlee is a global financial leader with 600+ customers, 50M+ users, and more than 700 employees worldwide. From leading financial institutions to Fortune 500 consumer service companies to the coolest startups, Yodlee powers innovative digital services shaping the future of customer interactions. With 25%+ year-over-year revenue growth, Yodlee continues to expand in existing and new markets globally.

Product distribution strategy: Direct to Business (B2B), through financial institutions, & through other fintech companies and platforms

HQ: Redwood City, CA

Founded: February 1999

Twitter: @yodlee

Presenting Anil Arora (President & CEO) and Katy Gibson (VP Applications)

The full demo video will be available at finovate.com in mid-September.

![]()