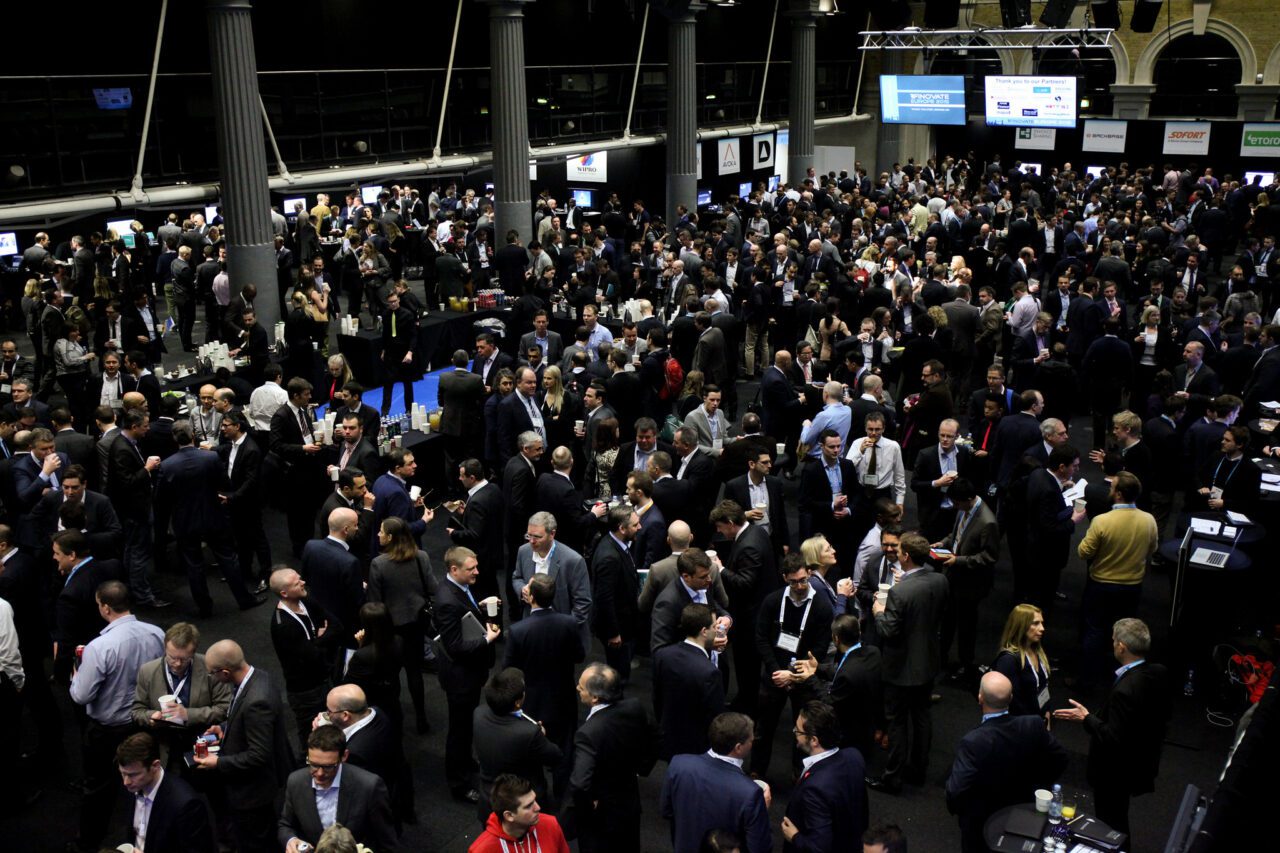

We’re surfing a wave of momentum from FinovateEurope last week. The sold-out show, dubbed by Business Insider as the “debutante ball for innovative financial technology startups,” featured new fintech from 70 companies. The ideas that flowing from onstage offered analysts, bloggers, and press plenty to write about.

If you missed it, you can check out our live coverage on Twitter.

Here is what the press is saying:

Aite

FinovateEurope 2016: A Change of Approach

By Virginie O’Shea

Aixigo

7 Minutes of Fame or How it Feels to be at FinovateEurope

By Mario Alves

Arctic Startup

Norwegian Startup Unveils First Savings Service For Women

by Tarmo Virki

BankInnovation

Breaking Banks: Finovate and London FinTech [AUDIO]

BankNXT

Benzinga

This Benzinga Fintech Award Nominee Just Won ‘Best In Show’ At Europe’s Largest Fintech Conference

bobsguide

Business Insider

Business.com

Top FinTech Trends, Fresh From Finovate Europe 2016

Byte Academy

Chris Skinner’s Blog

Reflections on Finovate Europe 2016

By Chris Skinner

Crowdfund Insider

Der Brutkasten

Change FinTech Startups Rules in the Fight Against Fraudsters

By Fabian Graber

Directors Talk Interviews

Q&A with Jeremy Nicholds, the new Non-executive Director at Vipera Plc

By Amilia Stone

Ewise blog

FinovateEurope: the place to be if you’re a fintech enthusiast

By Dean Young

Financial Observer

Opinion – Global players seek out fintech partners

By Mark Fordree

Financial Planning

More Risk than Reward for Early Tech Adopters

By Miriam Rozen

Finance Magnates

Finovate Europe: Fintech’s ‘Give-and-Take’ With Institutions Shifting

By Anna Reitman

Finextra

FindBiometrics

Fintech Finance

FinovateEurope video series

The Fintech Times

Finovate

By Bird Lovegod

Forrester’s Benjamin Ensor’s Blog

Finovate 2016: Automation and Personalization Take Centre Stage

by Benjamin Ensor

Forrester’s Oliwia Berdak’s Blog

The Gods of Fintech Are Harsh And Fickle

By Oliwia Berdak

FStech

Finovate Europe 2016 winners announced

Het Financieele Dagblad

Nederlandse start-ups presenteren zich in Londen aan financiële sector

By Rutger Betlem

HTEKONOMI

Finovate Londra’ya FinTech katıldı

IBSintelligence

Finovate 2016 round-up: biometrics, blockchain and deep web risk assessment

By Alex Hamilton

IT Finanzmagazin

Innovative financial and banking technology: Finovate Europe 2016 in London – FinTech for banks

Sven Korschinowski

Inn Poland

Polskie firmy w awangardzie technologii finansowych

By Barbara Żbik

Jewish Business News

Capitali.Se Wins Finovate Europe ‘Best In Show’

By Viva Sarah Press

L’Atelier

#Finovate : la carte du futur sera un ordinateur à part entière

By Aurore Geraud

Medium

FinovateEurope & Social Data

By Noel Peatfield

Mondato

Fitnech: London’s New Big Bang?

MoneyMorning

I Might Have Found the Next ‘Xero’ at Europe’s Best FinTech Conference

By Sam Volkering

Nasdaq

More Risk than Reward for Early Tech Adopters

Nic Sheen’s Blog

Finovate Day 1

NoCamels News Flash

Fintech Startup Capitalise Wins Finovate Europe Competition

Nostrum Group blog

Nostrum Reports on Finovate Europe Day 1

The Official English Blog of the Krakow Start-Up Scene (K’Sup)

VoicePin Wants You to Throw Away your Passwords

By Paul Chen

Octo Talks

FinTech – Finovate 2016 Londres – notre résumé

By Sylvain Fagnent

PaymentEye

What will be the hottest trends of 2016?

By Ben Rabinovich

Polskie Radio

ShiftDelete.net

FinTech İstanbul, Finovate Londra’da

Silicon Republic

Israeli fintech AI start-up wins Finovate Europe ‘Best in Show’

By Colm Gorey

TeknoYo!

FinTech İstanbul uluslararası ilk adımını Londra’da attı

Time Turk

Finovate Avrupa 2016 Konferansi

Tech in Asia

A fintech VC on the best startups at a less-than-stellar Finovate London

By Vladislav Solodkiy

Verdict Financial

VoicePIN blog

Finovate Europe 2016

Webrazzi

FinovateEurope 2016, Avrupa’nın finansal teknoloji girişimlerini ağırladı

By Firat Demirel

World Finance

Finovate 2016

We’ll update the list as more press comes in. If you’ve published a piece you’d like us to include, please email the link to [email protected].

Thanks to everyone for attending, presenting, and covering the conference on Twitter and in the press. We’re already looking forward to next year’s event!

Today’s round, when added to the Texas-based company’s 2014 Seed round of $2 million, brings its total funding to $4 million.

Today’s round, when added to the Texas-based company’s 2014 Seed round of $2 million, brings its total funding to $4 million.

We’re

We’re

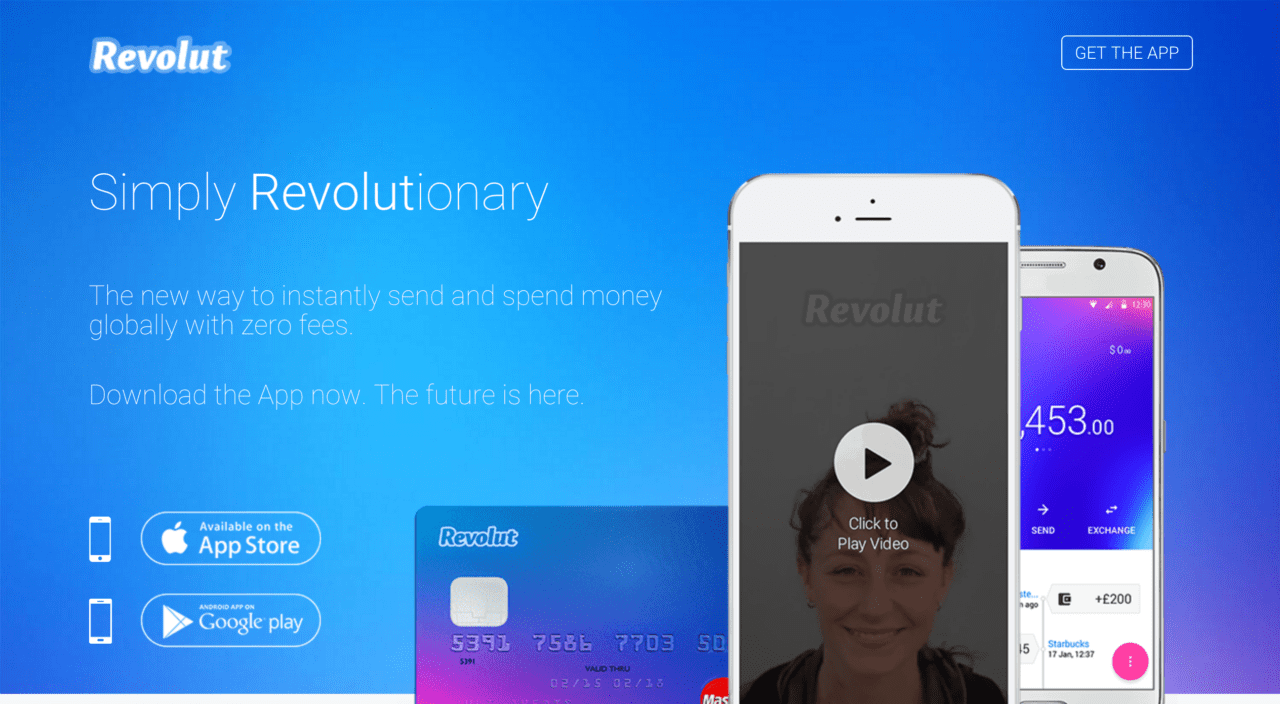

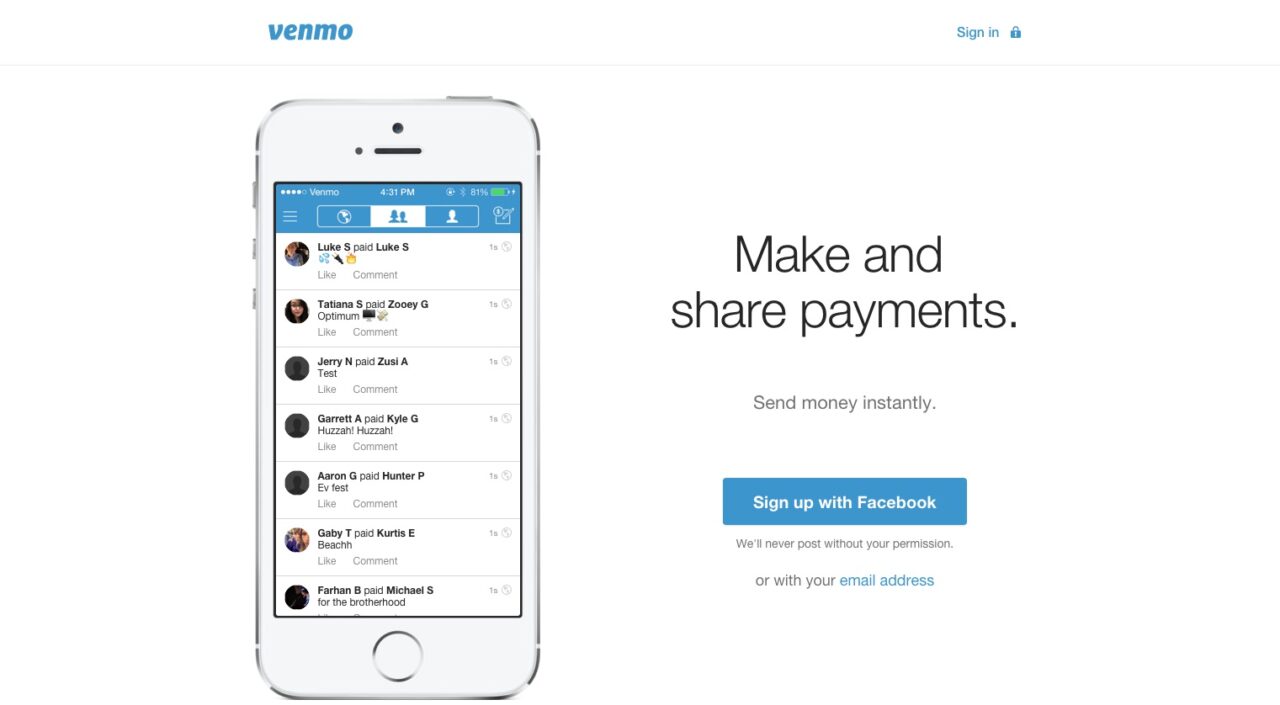

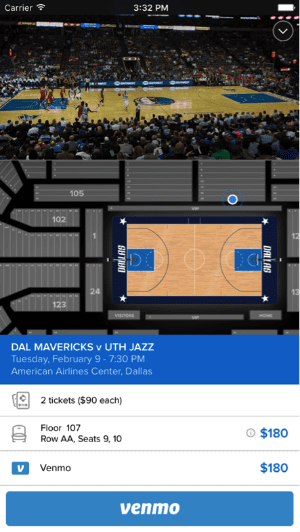

The startup’s peer-to-peer payments service is popular among millennials. It enables users to link their debit card to the platform to transfer money for free; paying with a credit card carries a 2.9% fee. PayPal CEO Dan Schulman reports the average user sends money through the app several times weekly.

The startup’s peer-to-peer payments service is popular among millennials. It enables users to link their debit card to the platform to transfer money for free; paying with a credit card carries a 2.9% fee. PayPal CEO Dan Schulman reports the average user sends money through the app several times weekly.