The name Juvo is Latin for help, aid, or delight. San Francisco’s Juvo lives up to that name by empowering consumers with a single identity with which to access financial services across the globe—a slick trick in relationship building that endears mobile operators to their clients as well.

The name Juvo is Latin for help, aid, or delight. San Francisco’s Juvo lives up to that name by empowering consumers with a single identity with which to access financial services across the globe—a slick trick in relationship building that endears mobile operators to their clients as well.

In his demo at FinovateFall 2016, Juvo CEO and founder Steve Polsky explained the problem Juvo seeks to solve, saying, “Between 500 million and three quarters of a billion people around the globe have a phone, but not enough balance to even use it… the majority of them are unbanked or underbanked, they live in cash-based economies, they have no way to establish a financial identity, and no way to participate in the basic financial services that we all take for granted.”

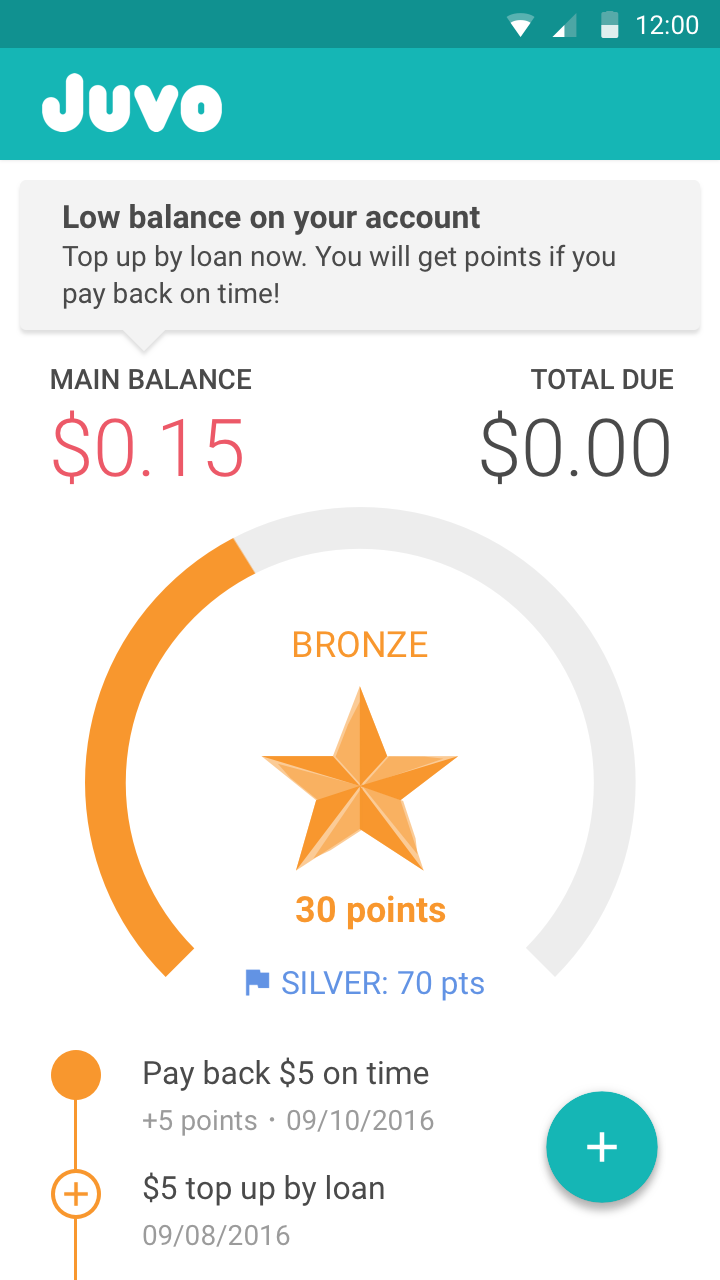

Juvo’s real-time Identity Scoring technology chips away at this problem by combining data science with gamification to match mobile users with their identity. By extending microloans to users, Juvo incentivizes financially underserved consumers to build credit and access financial services. The company’s Identity Stack offers mobile network operators an API to derive customer analytics and insights to encourage customer engagement.

Company facts

- $14 million in Series A funding

- Active in 4 continents and 23 countries

- Reaches 350+ million mobile users

- Conducting 100 million purchase transactions per year

From left: Steve Polsky, CEO, founder, and Jason Robinson, VP product, demo at FinovateFall 2016

From left: Steve Polsky, CEO, founder, and Jason Robinson, VP product, demo at FinovateFall 2016

We interviewed Steve Polsky, CEO and founder of Juvo, to get more information about the company and its plans for the future.

We interviewed Steve Polsky, CEO and founder of Juvo, to get more information about the company and its plans for the future.

Finovate: What problem does Juvo solve?

Steve Polsky: Juvo was founded with an overarching vision: to establish financial identities for the billions of people worldwide who are creditworthy, yet financially excluded. In partnership with mobile network operators, Juvo’s proprietary Identity Scoring technology uses data science, sophisticated credit algorithms, machine learning and game mechanics to create an identity-based relationship with anonymous prepaid users, opening up access to otherwise unattainable mobile financial services.

Finovate: Who are your primary customers?

Polsky: Juvo works with large mobile network operators around the world—such as Millicom; and Cable & Wireless Communications Limited—and we partner with financial service providers. We are currently in 10% of countries around the world, active in 23 markets on four continents, and have a reach of more than 100 million users.

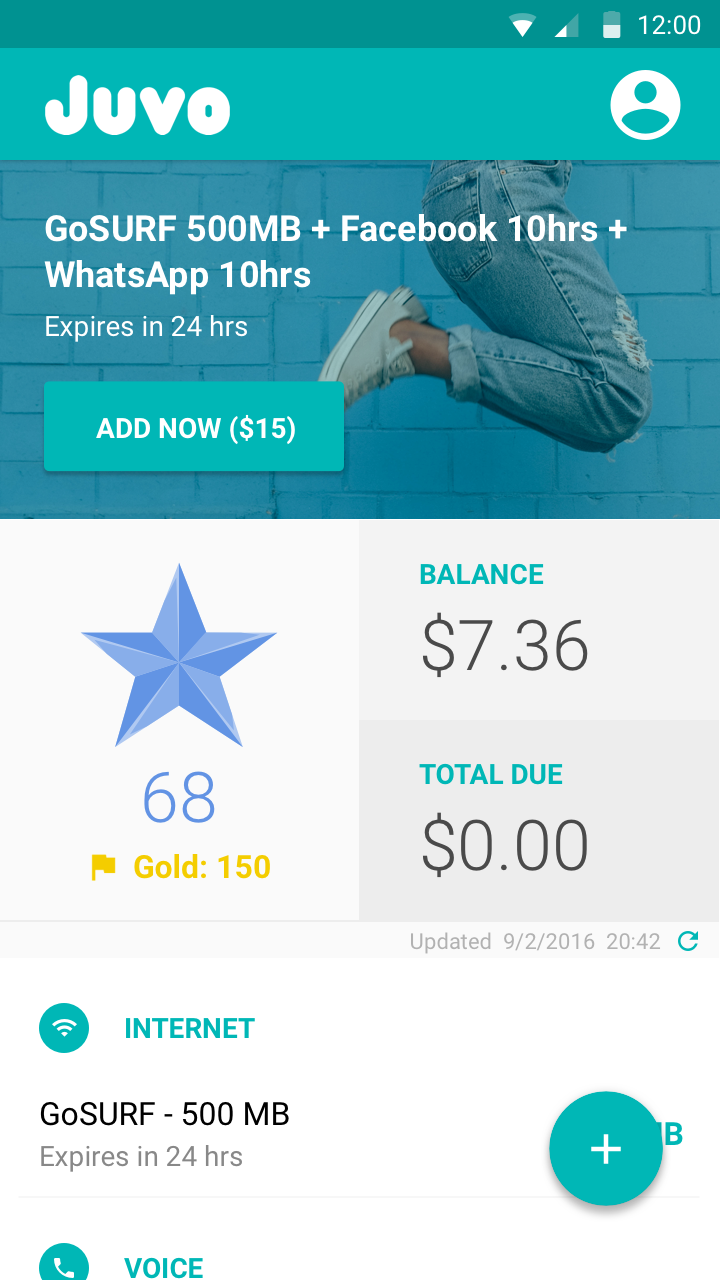

Juvo’s gamified balance screen

Juvo’s gamified balance screen

Finovate: How does Juvo solve the problem better?

Polsky: Juvo merges financial identity, credit scoring and mobile financial services in a single platform—the Juvo Identity Stack—to create an entirely new category: Mobile Financial Intelligence. Other companies may offer elements of what Juvo does, but none are proven to help mobile operators meet challenging KPIs around engagement, churn, ARPU and boosting financial inclusion.

For global carriers the benefits are immediate: more personalized, engaged relationships with customers; easier and more cost-efficient scalability as carriers undergo digital transformation; and immediate ROI—on average, a 10% to 15% increase in ARPU and as much as 50% reduction in churn. For financial service companies, Juvo opens up a user base of 5.7 billion prepaid subscribers worldwide, and for subscribers, Juvo provides an easy and transparent pathway toward financial inclusion.

Finovate: Tell us about your favorite implementation of your solution.

Polsky: I’m not sure I have a favorite, as each of our mobile operator-partners is doing exciting things with Juvo and seeing amazing results with their subscriber base. One particularly fun implementation has been with Cable & Wireless Communications Limited in Latin America, because of the very vocal reaction from their subscribers. There are thousands of positive mentions and reviews of the Juvo-powered app by Flow Lend users, and it is wonderful to hear from end users about how valuable the service is to them.

Finovate: What in your background gave you the confidence to tackle this challenge?

Polsky: The idea for Juvo came from a variety of personal experiences, particularly working with telcos over the years in developing countries. I saw firsthand untapped populations across the globe who are creditworthy, yet never given an opportunity to obtain even the most basic financial services many of us in the Western world take for granted. As a serial entrepreneur, I wanted to build another company with the right team and culture that could create something of value to have a real and lasting impact both for business and society.

The Juvo team is comprised of leading experts in their field who share a passion for creating and delivering a valuable solution to the world. We have extensive experience with mobile operators and a deep understanding of the power of data, particularly as it helps define and explain consumer internet behavior. The convergence of cloud services with big data, combined with a ubiquitous rise in smartphone adoption, gave us the pathway we needed to bring the Juvo vision to life.

Finovate: What are some upcoming initiatives from Juvo that we can look forward to over the next few months?

Polsky: We are excited to announce additional mobile operator launches around the world, share news of expansion into new regions of the world, including Europe and Southeast Asia, and continue to impact the lives of people in developing markets.

Finovate: Where do you see Juvo a year or two from now?

Polsky: We hope to see Juvo continue its expansion with mobile operators into new regions around the world, as well as further engage with financial service companies to offer high-value product and services beyond basic credit. It’s an exciting time for financial services, as technology has paved the way to open many avenues for expanding opportunities to new populations, and we hope to be at the forefront of this emerging fintech revolution.

CEO Steve Polsky, Juvo founder and Jason Robinson, VP, product showcase Juvo at FinovateFall 2016 in New York

![]() A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

The name

The name  From left: Steve Polsky, CEO, founder, and Jason Robinson, VP product, demo at FinovateFall 2016

From left: Steve Polsky, CEO, founder, and Jason Robinson, VP product, demo at FinovateFall 2016 We interviewed Steve Polsky, CEO and founder of Juvo, to get more information about the company and its plans for the future.

We interviewed Steve Polsky, CEO and founder of Juvo, to get more information about the company and its plans for the future. Juvo’s gamified balance screen

Juvo’s gamified balance screen

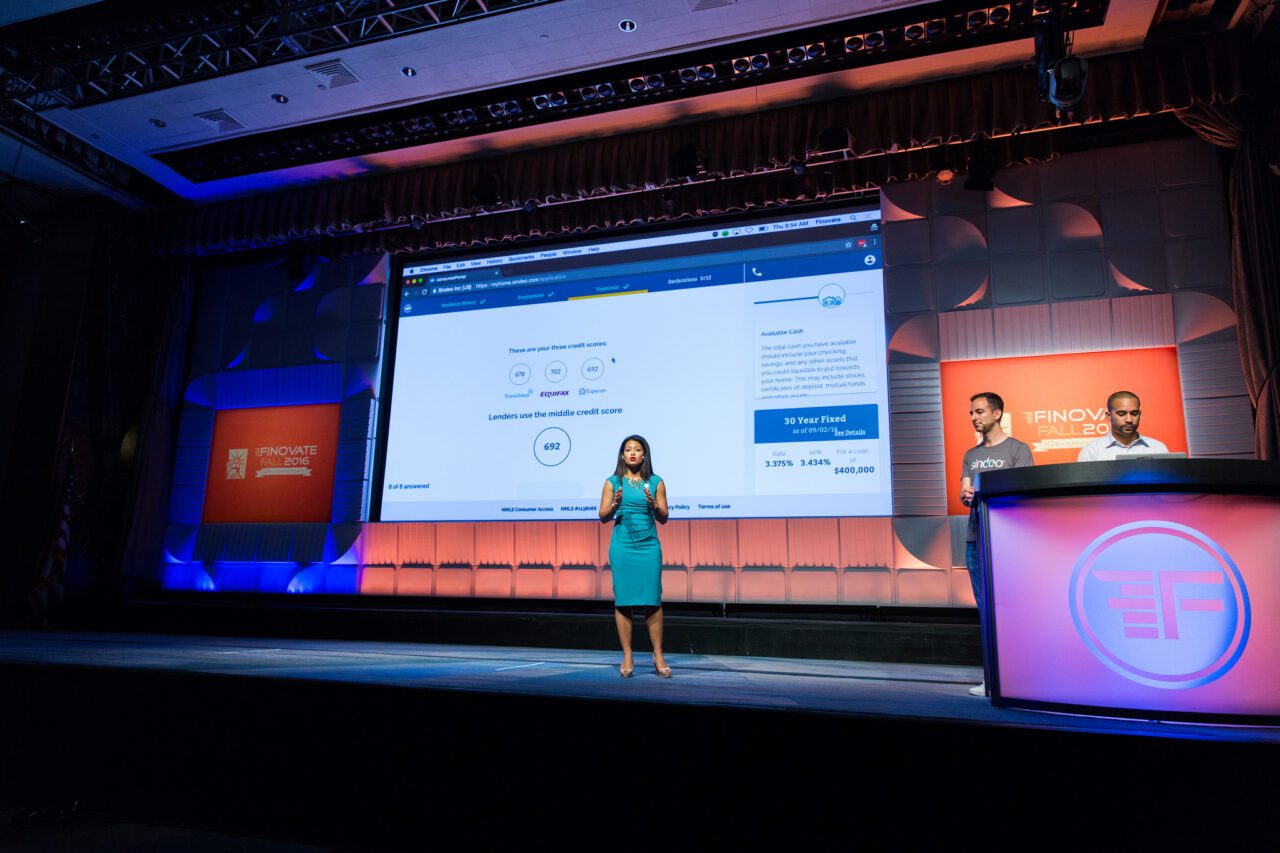

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

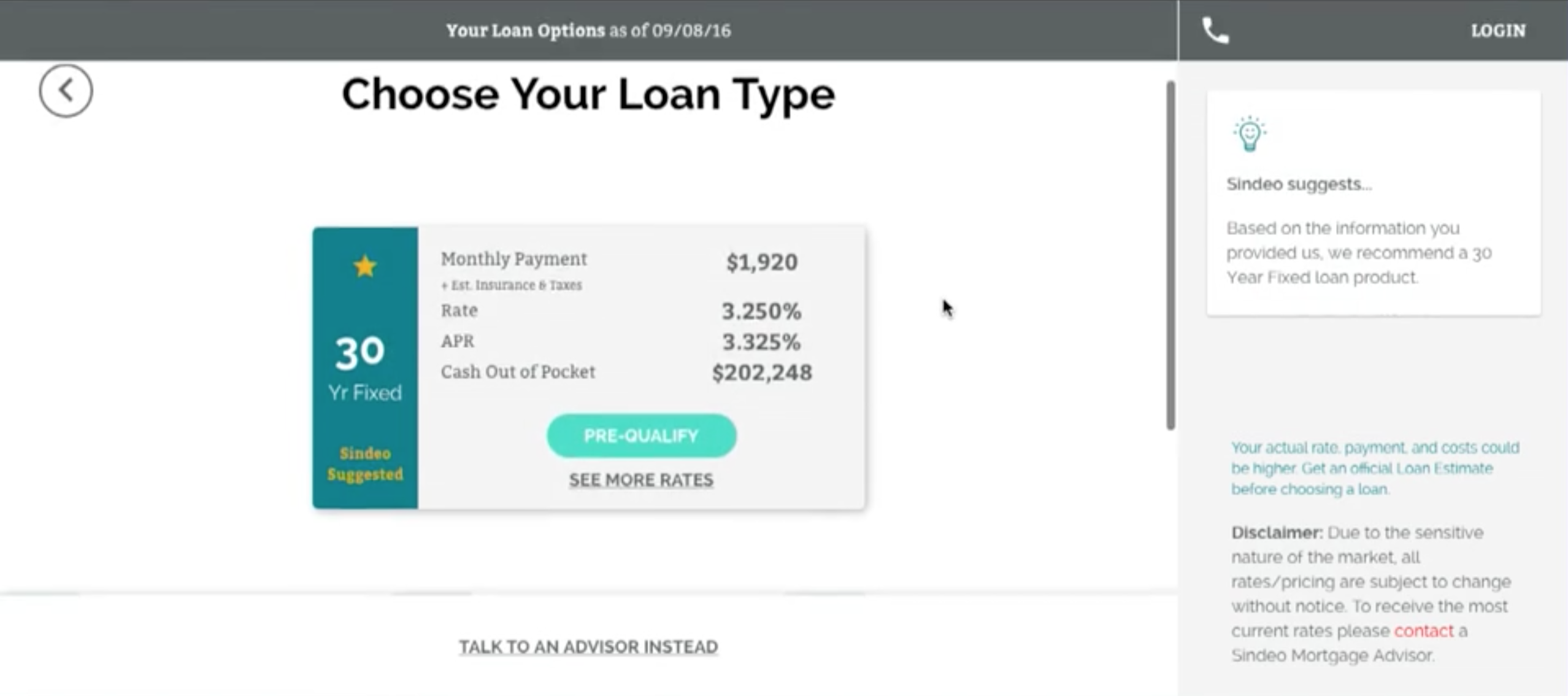

(above) A screenshot from Sindeo’s loan marketplace

(above) A screenshot from Sindeo’s loan marketplace

Presenters

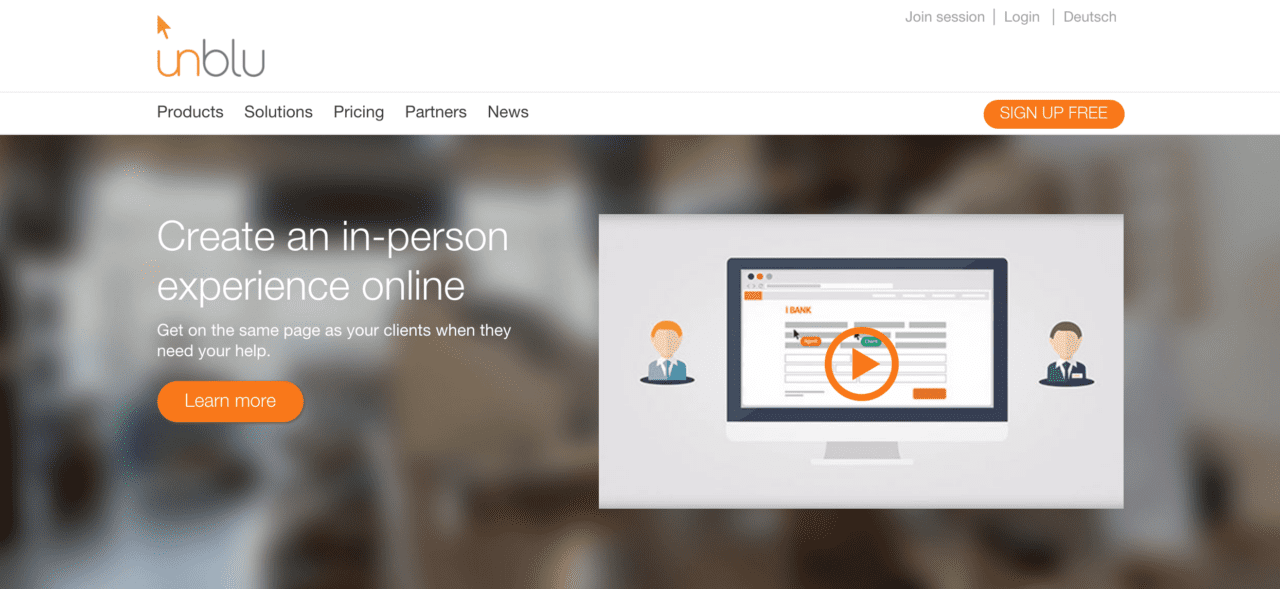

Presenters Luc Haldimann, CEO, unblu

Luc Haldimann, CEO, unblu

Presenters

Presenters Peet Denny, Chief Technology Officer

Peet Denny, Chief Technology Officer