![]() Your best excuse to delay your text-banking project ended today. Bank of America launched the mobile service via an interstitial ad to online banking customers (see below).

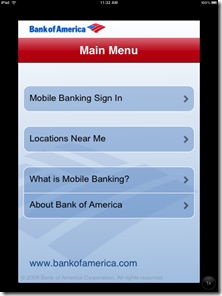

Your best excuse to delay your text-banking project ended today. Bank of America launched the mobile service via an interstitial ad to online banking customers (see below).

The new service may be rolling out in waves since it’s neither mentioned in online news sites, nor featured on the BofA site. And there is only a single Twitter message posted three days ago.

The new service may be rolling out in waves since it’s neither mentioned in online news sites, nor featured on the BofA site. And there is only a single Twitter message posted three days ago.

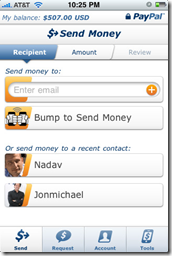

The signup process required the entry of a mobile number and a YES response from that mobile device (see screenshots below). While that’s not much to ask, it did seem unnecessary since I was already signed up for mobile banking through that number.

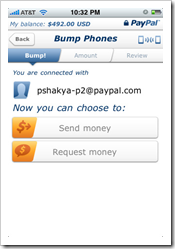

After responding yes from my mobile, I received a welcome text from the bank (see iPhone screenshot right).

That seemed like a nice touch until I clicked on the link and was taken to the regular webpage, rendered impossibly small on my first-generation iPhone, where I first had to select my state. That took me to another page full of barely readable mouse-type regarding text options (see last screenshot).

Action item: If you don’t support text banking yet, it’s time to move it up the priority list.

Bank of America online banking login splash screen (12 April 2010, 6 PM Pacific)

Landing page when selecting “Enroll now” above

Enrollment page (within online banking)

Page displayed while waiting for activation via mobile phone

Page displayed after activating via mobile and clicking “Check Activation Status” button (above)

Mobile help screen as viewed in first-generation iPhone

Note: For more on the importance of mobile banking and payments, see the most recent issue from Online Banking Report.

![clip_image004[4]](http://s3.amazonaws.com/finovate-archive/old/WindowsLiveWriter/CreditKarmaProvidesFreeCreditScorestoSea_118F7/clip_image004%5B4%5D_thumb.jpg)