When your core business has been around for hundreds of years, it’s harder to find new sources of revenue. One area ripe for expansion at many banks is insurance. Wells Fargo, for example, put more emphasis on the area by separating insurance from investments in its June 8, 2013, homepage remodel. See our full insurance report for more info on the market size and opportunities for banks.

When your core business has been around for hundreds of years, it’s harder to find new sources of revenue. One area ripe for expansion at many banks is insurance. Wells Fargo, for example, put more emphasis on the area by separating insurance from investments in its June 8, 2013, homepage remodel. See our full insurance report for more info on the market size and opportunities for banks.

While auto, life, health and home are the biggest in terms of overall premiums, they are also highly competitive with hundreds of thousands of established sales agents in the U.S. alone. But dozens of niche insurance-markets exist that might make it easier to find a foothold.

Take travel insurance.

You’ve seen these policies pitched when you are checking out at Expedia or other travel sites. While it’s tough to compete with the convenience of buying during the travel-booking process, financial institutions still have an advantage that Expedia doesn’t: Trust.

I’ve been using Expedia for 15 years and have booked 100+ trips there with few problems. So I trust them with travel arrangements. But does that trust extend to insuring my travel? Not so much. It’s hard to understand exactly what is included/excluded in their insurance upsells. And the one-size-fits-all approach rarely covers what I’m looking for in travel insurance (which is “no questions asked” cancellation). And often I’m exhausted after making complicated travel arrangements and have no energy left to figure out whether their insurance makes sense.

I’d much rather purchase a policy from a trusted source where I can get answers to specific questions, review policies after the fact, and be able to come back year after year for consistent choices. And since I don’t have a direct relationship with an insurance carrier (everything is bought through a small broker), I would be very interested in buying from my bank.

I’m not sure how many U.S. financial institutions offer travel insurance, but I suspect it’s a small number. But there is one major player with a comprehensive travel insurance offering, BB&T (see screenshots below).

I’m not sure how many U.S. financial institutions offer travel insurance, but I suspect it’s a small number. But there is one major player with a comprehensive travel insurance offering, BB&T (see screenshots below).

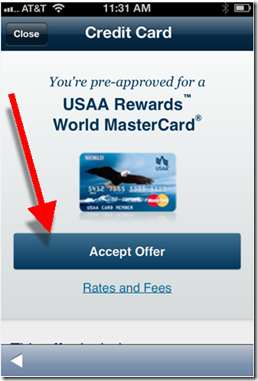

Getting a quote is easy. You simply tell the bank how many travelers you have, their age, travel date and cost. Within seconds, three options are presented (screenshot #1) covering basic trip interruption to one that covers medical evacuation and much more (screenshot #2, note 2). It even allows you to upgrade to “cancel for any reason” for a reasonable additional fee ($63 per person for my hypothetical $3,000 per person trip).

Actually buying the insurance requires a few more fields to be completed (see screenshot #3). But at that point, I already know that it’s worth my while and am not put off by additional data entry. And if I was already logged in, these fields should mostly be prefilled.

Bottom line: With a captive audience of authenticated online and mobile users, banks and credit unions could be the biggest providers of travel insurance. And with the added advantage of seeing travel-reservation charges appearing on debit and credit cards, you can cross-sell the service while the trip-reservation process is still fresh in the customers’ mind.

————————–

1. BB&T produces three options for travelers (24 June 2013)

Notes:

1. Live Chat option in lower right

2. Total cost shown for two travelers going on a $3,000 trip that begins 60 days from now

2. Detailed coverage of BB&T Deluxe Protection Plan

3. Complete application for each traveler

4. BB&T is one of a few financial institutions to include “insurance” as a primary navigation item

———————————–

Notes:

1. See our full Online Banking Report on “Banks in Insurance” here (Dec 2011, subscription)

2. To earn my business, I’d want to mix and match some of these benefits. The policy I want is basic interruption, but with the ability to cancel for any reason and with a deductible to bring the premium down.

3. Picture credit: 1938 vintage travel poster at eBay