This  week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.

week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.

The nearly half-billion this week brings the May total to $1.6 billion. And so far this year, more than $7 billion has been invested in the fintech sector. You can see the weekly reports here.

It was also a record week for Finovate alumni fundings with 9 companies raising $161 million (look further down the page for full details):

- WePay $40 million

- Actiance $28 million

- Ripple $28 million

- EDO Interactive $20 million

- Feedzai $17.5 million

- Credit Sesame $16 million

- PayItSimple $10 million (line of credit)

- Planwise $750,000

- Bitbond $670,000

eProdigy Finance

Tools and programs for alt-lending to businesses

HQ: New York City, New York

Latest round: $100 million Private Equity

Total raised: $100 million

Tags: Lending, credit, underwriting, SMB

Source: Crunchbase

Argon Credit

Online consumer alt-credit

HQ: Chicago, Illinois

Latest round: $75 million debt

Total raised: $85.1 million ($5.1 million equity; $80 million debt)

Tags: Credit, underwriting, consumer, P2P, peer-to-peer, marketplace lending, personal loans

Source: Crunchbase

WePay

Payment services for online marketplaces

HQ: Palo Alto, California

Latest round: $40 million Series D

Total raised: $74.2 million

Tags: Payments, platforms, SMB, Finovate alum

Source: Finovate

Actiance

Enterprise communications platform

HQ: Redwood City, California

Latest round: $28 million

Total raised: $43.6 million

Tags: Analytics, enterprise, Finovate alum

Source: Finovate

Ripple Labs

Open source payment network

HQ: San Francisco, California

Latest round: $28 million

Total raised: $37 million

Tags: Cryptocurrency, virtual currency, currency exchange, Open Coin, Finovate alum

Source: Finovate

Face++

Payments via facial recognition

HQ: Bejing, China

Latest round: $25 million

Total raised: $47 million

Tags: Mobile payments, security, biometrics, Alibaba (customer)

Source: NFC World

EDO Interactive

Card-linked rewards and offers

HQ: Nashville, Tennessee

Latest round: $20 million

Total raised: $93.5 million

Tags: Merchant-funded rewards, debit cards, credit cards, advertising, Finovate alum

Source: FT Partners

Feedzai

Fraud-protection solutions for the enterprise

HQ: San Mateo, California

Latest round: $17.5 million Series B

Total raised: $22 million

Tags: Security, fraud protection, big data, Finovate alum

Source: Finovate

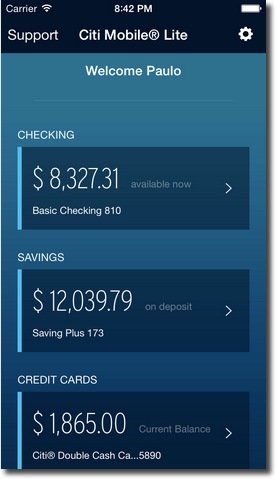

Credit Sesame

Credit reports and debt management

HQ: Mountain View, California

Latest round: $16 million Series D

Total raised: $35.4 million

Tags: Credit, credit scores, debt management, Finovate alum

Source: Finovate

Stride Health

Health insurance selection

HQ: San Francisco, California

Latest round: $13 million Series A

Total raised: $15.4 million

Tags: Insurance, lead gen, cost comparison, marketplace

Source: Crunchbase

Justworks

Payroll and benefits platform

HQ: New York City, New York

Latest round: $13 million

Total raised: $20 million

Tags: Payments, SMB, enterprise, HR, payroll

Source: FT Partners

PayItSimple

Financing at the point-of-sale

HQ: Herzliya, Israel

Latest round: $10 million Debt

Total raised:$10+ million

Tags: Credit, underwriting, POS, merchants, SMB, Finovate alum

Source: Finovate

Stox

Financial data for consumers

HQ: Vancouver, BC, Canada

Latest round: $8 million Series A

Total raised: $8 million

Tags: Investing, analytics, data

Source: Crunchbase

Palico

Online network for private equity community

HQ: New York City, New York

Latest round: $7.3 million

Total raised: $7.3 million

Tags: Investing, social network, private equity, institutional investors

Source: Crunchbase

YCharts

Investment analytics

HQ: Chicago, Illinois

Latest round: $6 million

Total raised: $14.7 million

Tags: Investing, data analytics, charting

Source: Crunchbase

Zeek

Giftcard and retail voucher marketplace

HQ: Tel Aviv, Israel

Latest round: $3 million Series A

Total raised: $3 million

Tags: Prepaid cards, gift cards

Source: Crunchbase

digitalBTC

Virtual currency

HQ: Bentley, Australia

Latest round: $2.8 million

Total raised: $2.8 million

Tags: Bitcoin, cryptocurrency

Source: Crunchbase

Funding Options

Financing search & matching service for businesses

HQ: London, United Kingdom

Latest round: $1.9 million ($6.5 million valuation)

Total raised: $1.9 million

Tags: lending, lead gen, SMB

Source: FT Partners

Planwise

Home buying tools

HQ: San Francisco, California

Latest round: $750,000

Total raised: $1.6 million

Tags: Mortgage, real estate, debt management, refi, Finovate alum

Source: Finovate

Bitbond

Bitcoin-denominated P2P lending

HQ: Berlin, Germany

Latest round: $670,000

Total raised: $900,000

Tags: P2p, peer-to-peer lending, underwriting, Bitcoin, Finovate alum

Source: Finovate

Magick

Online financial and FX trading

HQ: Copenhagen, Denmark

Latest round: $300,000

Total raised: Unknown

Tags: Trading, investing, FX, currency trading

Source: FT Partners

Public Fund Investing Tracking & Reporting (PFITR, LLC)

Public fund accounting and analytics

HQ: St. Louis, Missouri

Latest round: $50,000

Total raised: $800,000

Tags: Accounting, investing

Source: Crunchbase

Oradian

Microfinance solutions provider

HQ: Zagreb, Croatia

Latest round: Undisclosed Seed

Total raised: Unknown

Tags: P2P, underbanked, financial inclusion

Source: FT Partners

Pro Securities LLC (no website)

Alt-stock exchange

Old Bridge, New Jersey

Latest round: Undisclosed sale of 25% of company to Overstock

Total raised: Unknown

Tags: Investing, trading, Overstock (investor)

Source: FT Partners

Tilt (formerly CrowdTilt)

Money collection and management for groups

HQ: San Francisco, California

Latest round: Undisclosed at $400 million valuation

Total raised: $37+ million

Tags: Crowdfunding, social money management, P2P, peer-to-peer

Source: FT Partners

week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.

week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.

Update: An update of this post

Update: An update of this post