aerospike.com | aerospike.com/blog | @aerospikedb

![]() Aerospike helps businesses achieve the speed, scale, and availability required to manage the real-time transactional workloads of modern, mission-critical applications. The Aerospike high-performance NoSQL database is a key value-store written explicitly to run in RAM and Flash to deliver speed at scale. Our technology, also available in open source, includes tools and packages designed to help developers build next-generation applications without worrying about low-level programming. Gartner named Aerospike a visionary in 2014 Magic Quadrant for Operational Database Management Systems. Leading innovators in financial services trust Aerospike to power web-scale workloads.

Aerospike helps businesses achieve the speed, scale, and availability required to manage the real-time transactional workloads of modern, mission-critical applications. The Aerospike high-performance NoSQL database is a key value-store written explicitly to run in RAM and Flash to deliver speed at scale. Our technology, also available in open source, includes tools and packages designed to help developers build next-generation applications without worrying about low-level programming. Gartner named Aerospike a visionary in 2014 Magic Quadrant for Operational Database Management Systems. Leading innovators in financial services trust Aerospike to power web-scale workloads.

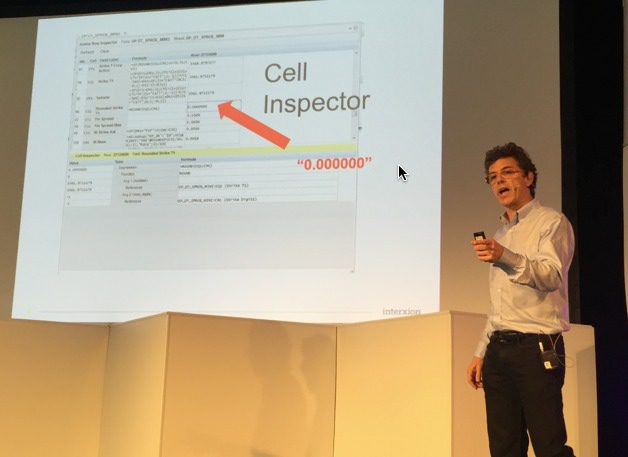

To learn about how internet companies such as adtech, retail, and social have built real-time decision and pricing systems based on stateless compute nodes and a fast, scalable NoSQL data-layer. This new stack allows access to more data (petabytes) and supports, agile, innovative algorithms and libraries that are allowing fintech companies to build vastly better offerings.

Key takeaways:

- When to use NoSQL vs. SQL

- How to model data in NoSQL

- Hardware costs of NoSQL data-layers

Presenter: Brian Bulkowski, CTO , Co-Founder

LinkedIn | @bbulkow | [email protected]

Bulkowski, co-founder and CTO of Aerospike, has 20-plus years experience designing, developing, and tuning networking systems and high-performance web-scale infrastructures. He founded Aerospike after learning firsthand the scaling limitations of shared MySQL systems and realizing the need for a high-performance database that would empower all developers.