Of the 15 first place prizes awarded this month in the 2016 Fintech Innovation Awards, five went to Finovate/FinDEVr alums.

- Fintech Leader of the Year: Zopa Executive Chairman and Co-founder Giles Andrews – FinovateSpring 2008

“This award is recognition of the strength of our idea for peer-to-peer lending and the growth we have seen since then as the idea has moved mainstream,” Giles Andrews said. “Of course, credit should go much more to the team who helped build Zopa’s scale, particularly Jaidev who took the reins last year and led the company to record levels of growth.”

- Innovation in Cyber Security/Anti-Fraud: Global Gateway by Trulioo – FinovateFall 2015

“FinTech continues to be at the forefront of innovation, and that requires equally innovative RegTech solutions for risk management, security, and fraud,” Zac Cohen, Trulioo general manager, said. “Our Compliance-as-a-Service technology addresses that need, enabling pioneering technologies to grow their businesses and protect their users on a global scale.”

- Innovation in Data Solutions: Nomis Solutions – FinovateSpring 2012

“In a shifting U.K. market, our range of price-optimization products are helping banks to better understand their customers’ behaviors and sensitivities through advanced analytics and analysis,” Damian Young, managing director, EMEA at Nomis Solutions, said, “This brings banks significant competitive and market advantage that will help them grow smartly and responsibly in any economic environment.”

- Innovation in Money Transfer/FX: Azimo – FinovateEurope 2013

“It’s brilliant to be recognized by the industry for our work in creating an award-winning money-transfer service, but the best prize of all is our ever-growing number of happy customers,” Azimo founder and CEO Michael Kent said. “They’re all part of the Azimo story – sending money home to support loved ones for all kinds of reasons.”

Also earning recognition at the event was EquityZen. The company, which will make its Finovate debut next month at FinovateSpring 2016 in San Jose, won the Innovation in Wealth, Asset, and Investment Management category.

Hosted by Julia Streets, CEO and founder of Streets Consulting, the 2016 FinTech Innovation Awards winners were chosen by a group of leading fintech specialists chaired by Dan Cobley, managing partner at Blenheim Chalcot. Taking home top honors in the remaining 11 categories were:

- Innovation of the Year: ClearScore

- Fintech Marketing Campaign of the Year: “Cashless on the Catwalk” by The 10 Group and Visa Europe

- Fintech Startup of the Year: ClearScore

- Innovation in Corporate Banking Solutions: Idea Cloud by Idea Bank SA

- Innovation in Insurance: Bought by Many platform by Bought By Many and Ping An Insurance.

- Innovation in Lending: Marketinvoice

- Innovation in Payments: Zwipe Payment by Zwipe

- Innovation in Risk Management: Imagine Software

- Innovation in Trading Systems: FX Connect from State Street Bank

- Innovation in Treasury Management: Walletsizing by Vallstein

The FinTech Innovation Awards were held at The Brewery in London on April 13th. The event featured a keynote address from author and Duke University professor, Dan Ariely, as well as remarks from Minister for the Cabinet Office and Paymaster General, Matt Hancock. Finovate alum Strands was among the event’s sponsors.

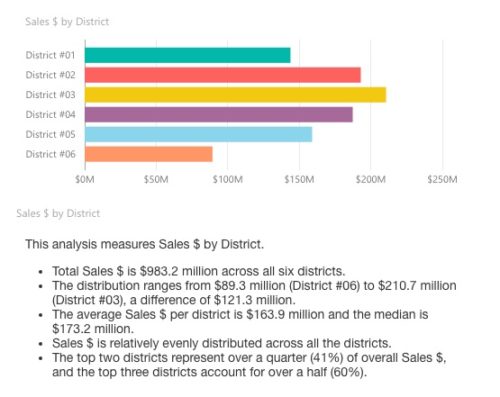

“Put simply, this collaboration not only enhances and amplifies the user experience for customers of Power BI,” Frankel wrote in a blog post about the launch, “but also further drives the democratization of information, where users don’t need to interpret data and visualizations—they simply need to read.” Microsoft Power BI has more than 5 million users and works with Adobe Analytics, Github, Salesforce, and more than 50 other data sources.

“Put simply, this collaboration not only enhances and amplifies the user experience for customers of Power BI,” Frankel wrote in a blog post about the launch, “but also further drives the democratization of information, where users don’t need to interpret data and visualizations—they simply need to read.” Microsoft Power BI has more than 5 million users and works with Adobe Analytics, Github, Salesforce, and more than 50 other data sources.

of us to continue to expand and diversify the firm’s solution-based lending platform,” Deitch said. In addition to his more than seven years at Oaktree Capital Management, Deitch served as COO at Countrywide Bank, a Management Consulting Partner at KPMG, as well as in a number of executive roles at Bank of America. He has a bachelor’s fegree from UCLA and an MBA from University of Southern California.

of us to continue to expand and diversify the firm’s solution-based lending platform,” Deitch said. In addition to his more than seven years at Oaktree Capital Management, Deitch served as COO at Countrywide Bank, a Management Consulting Partner at KPMG, as well as in a number of executive roles at Bank of America. He has a bachelor’s fegree from UCLA and an MBA from University of Southern California.

Jennifer Hughes, Business Development

Jennifer Hughes, Business Development Marco Piovesan, General Manager

Marco Piovesan, General Manager

Kimberly Prieto, Director of Business Development and Alliances, Digital Insight

Kimberly Prieto, Director of Business Development and Alliances, Digital Insight Shuki Licht, Senior Enterprise Architect, NCR Corporation

Shuki Licht, Senior Enterprise Architect, NCR Corporation

Formerly an executive at VISA and First Data as well as an engineer who patented key payments analytic technologies, Tavares leads CardLinx and is a frequent speaker at industry and media events.

Formerly an executive at VISA and First Data as well as an engineer who patented key payments analytic technologies, Tavares leads CardLinx and is a frequent speaker at industry and media events.

Yang is a 16-year finance vet, last as a partner at a $13 billion alternative asset management firm. He left an MD/PhD in computational neuroscience to design financial products and wants to make up for that.

Yang is a 16-year finance vet, last as a partner at a $13 billion alternative asset management firm. He left an MD/PhD in computational neuroscience to design financial products and wants to make up for that.

Victor Yefremov, CEO

Victor Yefremov, CEO Sam Fleming, CTO

Sam Fleming, CTO

Lowell Doppelt, VP of Sales

Lowell Doppelt, VP of Sales Sarah Pilewski, Principal

Sarah Pilewski, Principal