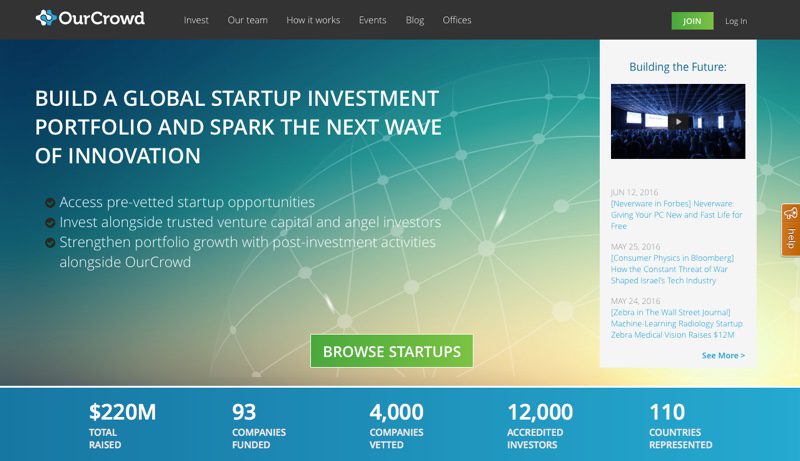

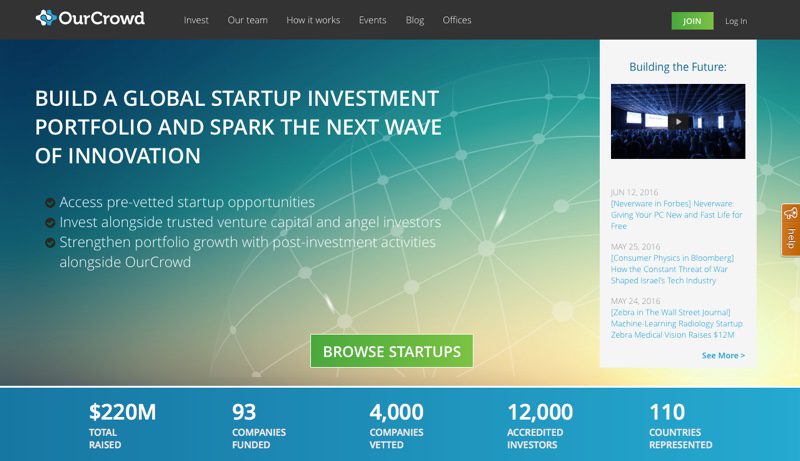

It’s been a busy June for Jerusalem-based, crowd-investing platform OurCrowd. The company picked up a Red Herring award; announced partnerships with Bayer, Dupont, and FinistereAG; and earned positive press from The Times UK and Wired.

“Start-up companies don’t just need cash, they need help,” OurCrowd founder Jon Medved this week told James Hurley of The Times UK. Calling his crowd-investing platform a combination of “old-fashioned venture capital and new-age crowdfunding,” Medved emphasized the amount of due diligence performed in selecting portfolio companies, and said only 2% of the companies seeking a spot on the platform make it.

OurCrowd’s platform enables accredited investors to provide capital to early-stage startups. With as little as $10,000, investors can participate in platform-sponsored funding rounds to purchase equity in the companies. When the funding goal is reached and the round ended, a representative from OurCrowd joins the startup’s board to help advise the company and look after the interests of investors. It is this level of engagement that convinces Medved that private company investment is often a better route for tech startups than going public. “If you really want to have output from your investment,” Medved told Wired UK earlier this month, “you’ve got to be in private company investment.”

CPO Shai Ben-Tovim and VP of Engineering Oshrat Kfir demonstrated the OurCrowd app at FinovateSpring 2016 in San Jose, California.

OurCrowd was one of 19 Israeli companies earning a spot in the RedHerring 2016 Europe Top 100. Not only did OurCrowd hit the Top 100, but also two companies in OurCrowd’s portfolio—CropX and Zebra Medical Vision—made the cut. “There is no doubt about it,” the OurCrowd blog read today, “Israel has become a world leader in startup success.”

OurCrowd’s collaboration with Bayer, DuPont, and FinstereAG has led to the launch of a new accelerator fund, Radicle, that is designed to help foster innovation in early stage agricultural technology startups. The $15 million fund focuses on agricultural technologies that contribute to productivity, sustainability, and quality such as genomics, seed tech, and disruptive or novel farm systems. OurCrowd General Partner David Stark suggested that his firm had a unique understanding of the challenges and opportunities of technology innovations in agriculture.

“Forced to overcome the challenge of making the desert bloom, Israel has a long history of agricultural innovation and today is home to a multitude of world-class AgTech startups,” Stark said. OurCrowd portfolio company and Red Herring Europe Top-100 award-winner CropX specializes in adaptive irrigation technologies.

Founded in 2013 and headquartered in Jerusalem, Israel, OurCrowd demoed its app at FinovateSpring 2016. Via its platform, OurCrowd and investors have put more than $220 million in capital into 100 portfolio companies, with six exits in the past three years.

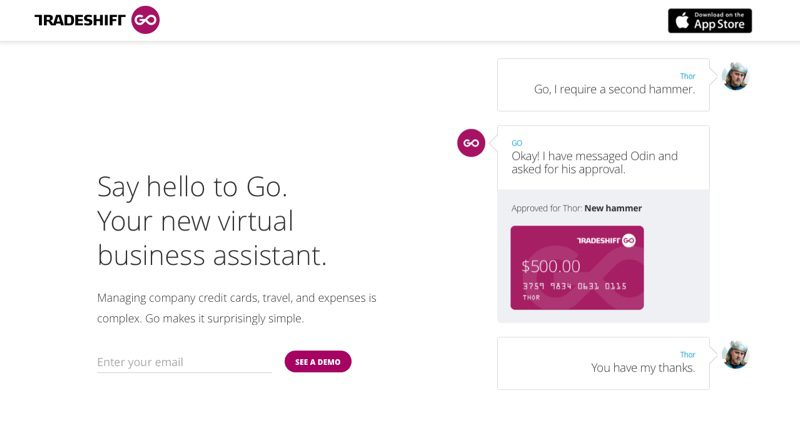

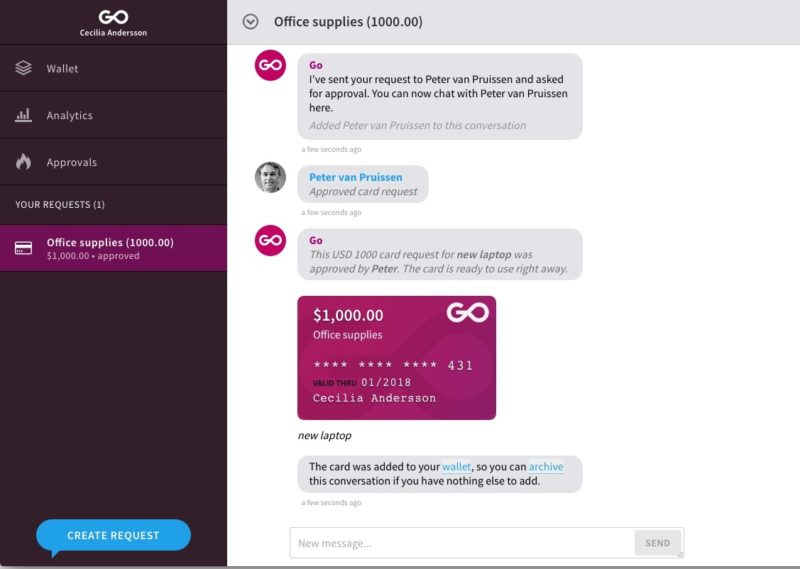

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.