This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

We created LifePay to merge all of our products into one ecosystem that will support B2B and B2C financial services through the entire customer journey for both merchants and individuals.

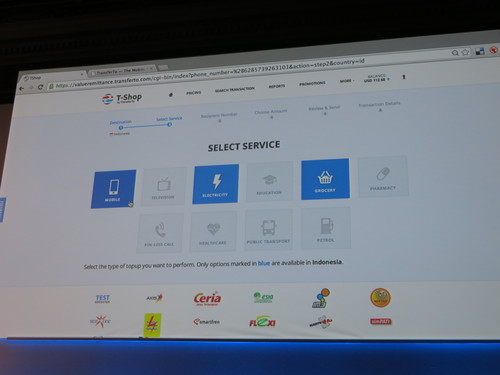

LifePay is rolling out business solutions to new markets in Asia and Europe, including:

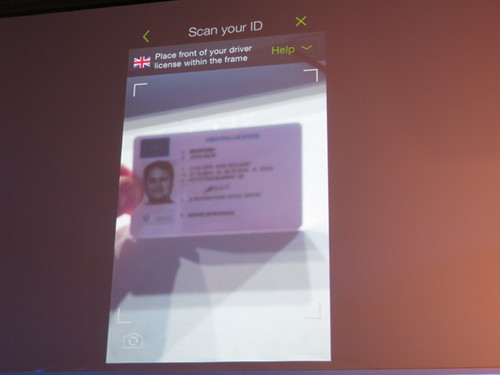

- mPOS

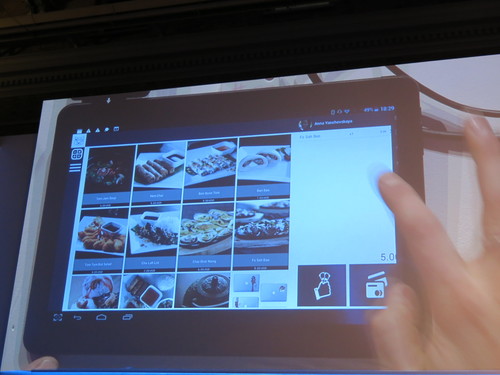

- Cash Register with LifePad and MDM system

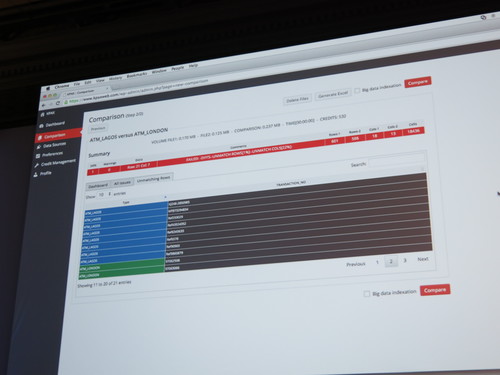

- Merchant portal with CRM and sales analytics

- Online acquiring

- Credits for merchants

- POS credits for individuals

Presenters: CMO Anna Yanchevskaya; Vlad Pyatak, manager of special events; Anna Filatova, marketing specialist