This month, we interviewed Peter Kwakernaak, CEO of AcceptEmail, a company that enables e-billing and payments via email. Kwakernaak became CEO of AcceptEmail in August 2008, and before doing so founded two companies, OK Rent in the Netherlands and Coulorful Manor in South Africa.

AcceptEmail recently demoed at FinovateEurope 2012, where it unveiled its Short Invoicing Service (check out the demo video).

Finovate: Can you take a shot at convincing our readers that AcceptEmail’s email billing and payment solution is the right solution in under 50 words?

Kwakernaak: Managing and paying all your bills straight from your inbox or mobile phone in just a few clicks is extremely fast, simple and safe. No duplications. No errors. No paper, no portals, no registration. AcceptEmail facilitates a smooth, transparent bill payment process. See for yourself and try our demo on http://www.acceptemail.com/en/ae_demo/video/

Finovate: How have you seen the billing industry changing and how is that affecting your strategy?

Kwakernaak: The billing industry is now really moving towards digitalization under the influence of trends in the payment landscape (SEPA), legal/tax regulations (level playing field for paper and digital bills) and efficiency goals (collecting your bills faster with less costs). This opens up endless opportunities for AcceptEmail. The billing industry used to be predominantly focused on business-to-business that shifts more towards business-to-consumer and business-to-small business, which is also helping us. Furthermore we see that billers are more open for a multi-channel approach towards billing – give the customer a choice. E-mail and mobile definitely play a role in that approach.

Finovate: What advice would you give a fintech entrepreneur who is just starting?

Kwakernaak: Find a niche, focus on that until the end, create credibility with all stakeholders and choose a sustainable and scalable business model.

Finovate: How do you ease consumer concerns of AcceptEmail’s security?

Kwakernaak: Communication is key. We help our billers educating and informing their customers about AcceptEmail. It is essential that billers explain their customers what to expect, how it works, how you can be assured an AcceptEmail is safe. Furthermore we ease consumer concerns about security first and foremost by being completely transparent ourselves. We are very easy to find and to contact, our billers can be found on our website and so are our security measures. Also we are being audited by e.g. banks frequently.

Finovate: What are the biggest growth markets for AcceptEmail?

Kwakernaak: Any replacement market for either paper bills, cheques, non-SEPA payment methods or my portals is a growth market for AcceptEmail. Geographically we focus on Europe and will make the step towards the US next year. Vertically the large growth markets are in Insurance, Telecom, Government and Retail.

Finovate: If you could have dinner with any other CEO or entrepreneur, who would it be and why?

Kwakernaak: If he was still alive I’d have liked to have dinner with Steve Jobs. I was fascinated by his biography and with what he has achieved with Apple and Pixar.

Finovate: Can you give us a sneak peek of what’s next for AcceptEmail?

Kwakernaak: We will be announcing several key partnerships with global financial institutions and software companies shortly. That enables us to play in a different league and pave the path for serious international expansion.

To learn more about AcceptEmail, watch its FinovateEurope 2012 demo. Stay tuned for another CEO interview next month.

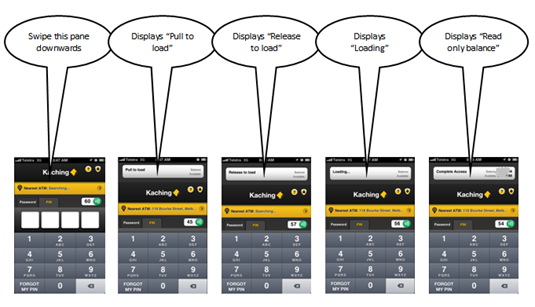

Commonwealth calls the no-login option Simple Balance. With a quick swipe users pull down a

Commonwealth calls the no-login option Simple Balance. With a quick swipe users pull down a