We teamed up with the Fintech Cocktail Club earlier this month to play another game of Fintech Tinder (otherwise known as hot or not).

Here are the rules– we shouted out a list of 20 fintech trends and our cocktail-fueled audience shouted their opinion on whether the trend is hot or not*. The result was a not-quite-scientific analysis of what is trending in U.S. fintech.

The hottest

- Regtech

I was fairly surprised to hear the audience react so strongly to this trend, since the U.S. is lagging in regtech startups and adoption. Out of all 20 trends, however, Regtech was the clear winner.

What’s hot

- AI

Artificial intelligence has been experiencing increased attention in the fintech community since late 2015. As we close out 2017, players in the fintech sector seem to be in all out hype mode on the subject. - Open Banking

Though the U.S. doesn’t have any pending open banking regulation, folks still seemed quite optimistic about this trend. It is worth noting here that most of the audience from whom we received feedback represented non-bank fintech startups. - Mobile account opening

Certainly a necessity for mobile-centric onboarding, mobile account opening has been around for awhile. It seems to have received new life with many enabling technology developments and IoT device launches throughout the years. For example, many companies have incorporated biometrics and Apple Watch capabilities into their mobile onboarding processes. In the future we can expect this trend to surge once again when we see augmented reality incorporated into mobile account opening. - Blockchain

Possible use cases for the blockchain transcend far beyond bitcoin into implementations such as identity management and smart contracts. The audience was apparently well-aware of this, as they almost unanimously categorized blockchain as “hot.” Interestingly enough, our U.K. audience offered a more undecided, split vote regarding blockchain use. - Gamification

It’s good to know that gamification still has skin in the game, so to speak. Using behavioral economics to incentivize behavior pre-dates fintech, and it appears that as techniques improve fintechs are still open to leveraging gamification to motivate user action. - Augmented Reality

With the launch of iOS 11 opening developer capabilities for augmented reality, this is a rising topic in fintech. Expect to see value-added use cases in banking and fintech in the next year. - Challenger banks

With the lack of challenger bank launches in the U.S. (that is, compared to the U.K.), it was surprising to see the group cheer on challenger banks so vociferously. Perhaps a sign that more challenger banks are coming to the U.S.? - Insurtech

Insurtech was another hot-button topic. The audience seemed to heavily favor this trend over others, despite the relative lack of insurtechs in the U.S.

Not hot

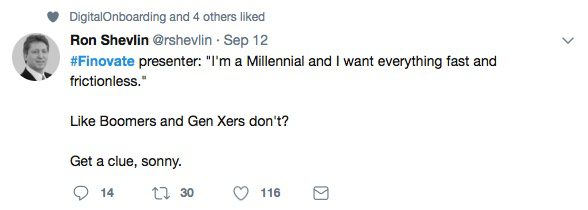

- Chatbots

It was surprising to hear the audience classify chatbots as “not hot,” given that chatbots have been on the rise in fintech lately, and their inclusion among the FinovateFall Best of Show winners. Finn.ai, a Canada-based chatbot, was one of seven Best of Show award winners among the 70 demoing companies at FinovateFall 2017. - Roboadvisory

The wealth tech boom seems to have subsided for a bit. It hit hard between 2014 and 2015, when new roboadvisors– each with its own unique investing algorithm– were launching on an almost daily basis. - ICO’s

Initial Coin Offerings (ICO’S) have been the talk of the fintech town lately. However, because of risk and regulation concerns, many see this fundraising technique as nothing but a fad. - Alternative credit scoring

Recent questions regarding the fairness of traditional credit scores combined with the implementation of enabling technologies such as artificial intelligence and machine learning landed alternative credit scoring in the “not” category. - Voice banking

Voice banking received a few head nods during the demo portion of FinovateFall 2017, but most argued that this is just another solution looking for a problem. - Mobile wallets

I mostly threw this on the list to get a reaction from the crowd– and quite a reaction I got! It’s 2017, and mobile wallets barely have a pulse. - Biometric authentication

This is yet another trend I was surprised to see land in the “not” category. Perhaps the audience was feeling salty by the time they reacted to this trend. I think we’ll continue to see biometrics– in multiple different forms– trend in fintech for years to come. - Card-linked offers

Card-linked offers was another trend I added to the list to illicit a colorful response from the crowd. A trend from 2012, card-linked offers has made an appearance in a few new fintech solutions, but mostly as just an add-on. - Virtual reality

I whole-heartedly agree with the assertion that virtual reality in banking is not hot. The enabling technology has a place in gaming and not as a new channel through which consumers will check their credit score or bank balance. - Alternative lending

This trend peaked in 2015 and began declining in 2016. While many alternative lending companies are still profitable (and thriving) the ones that have landed on profitability and regulatory difficulties have caught a lot of media attention, leading to an overall downturn in this space.

What’s ?

- Mortgagetech/ Proptech

This was the last trend the audience voted on, and I think the cocktails had taken their toll by this time, because almost everyone in the crowd seemed to be confused. My take: it’s hot.

Opinions: U.K. vs. U.S.

You may remember our analysis from earlier this year in our piece Playing Fintech Tinder in which we analyzed the opinions of a U.K.-based audience on 11 fintech trends. The results were surprisingly similar, with only two differences. While in the U.K., the audience was split and/or undecided on two trends– blockchain and challenger banks, the U.S. audience was more vocal and decided about the trends, voting both as “not hot.”

*Note: the actual terminology for feedback was “sexy or not”, since “hot” sounds similar to “not”

Envestnet | Yodlee

Envestnet | Yodlee Finn.ai

Finn.ai Jiffee

Jiffee

Presenters

Presenters Brian Smith, Head of Business Development

Brian Smith, Head of Business Development

Presenters

Presenters Ana Silva, Marketing Manager

Ana Silva, Marketing Manager

Presenters

Presenters Tony Pietrocola, Head of Sales

Tony Pietrocola, Head of Sales