This post is part of our live coverage of FinovateFall 2015.

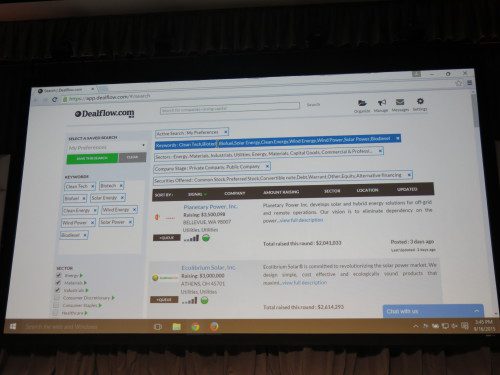

Dealflow showed a new way to raise capital:

Dealflow showed a new way to raise capital:

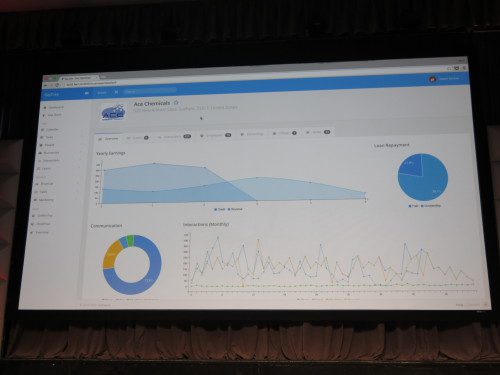

We’re solving the largest problem in the business of raising capital with software that creates targeted outreach to investors based on preferences-data that we use to match investors with opportunities. Companies are increasingly reaching beyond their personal networks to raise capital. They’re using deal portals, social media networks, and a variety of investment databases to find investors. We make the process easier by putting everything in one place and by offering tools that make raising capital efficient.

Presenter: Dealflow CEO and founder, Steven Dresner (standing)

Product Launch: September 2015

Metrics: Raised $2 million; 8 employees; 9,000 registered users

Product distribution strategy: Direct to consumer (B2C); direct to business (B2B); licensed

HQ: New York City, New York

Founded: April 2013

Website: dealflow.com

Twitter: @dealflow