Thanks to prodding from my sons, both long-time podcast listeners, I finally gave them a serious trial during the past month. Despite my skepticism, I’ve become a huge fan as well. And I figured out why I hadn’t embraced the medium; I was consuming on my laptop. Podcasts are clearly a mobile medium. To fully engage, I found that you need to be plugged into headphones and more importantly, away from the distractions of your desktop browser. Finally, I found the “speed-up” button and much prefer 1.5x speed which keeps my mind from wandering.

Podcasts are having a bit of a moment. According to Pew Research, the number of Americans listening to a podcast in the past month has doubled in the past four years to 24% (and 40% have ever listened). This is small compared to the 90+% tuned into conventional radio, TV, or the Internet. However, the podcasting audience is the fastest growing media segment and there are solid opportunities for financial institutions, primarily in the B2B area with content geared to local small business owners.

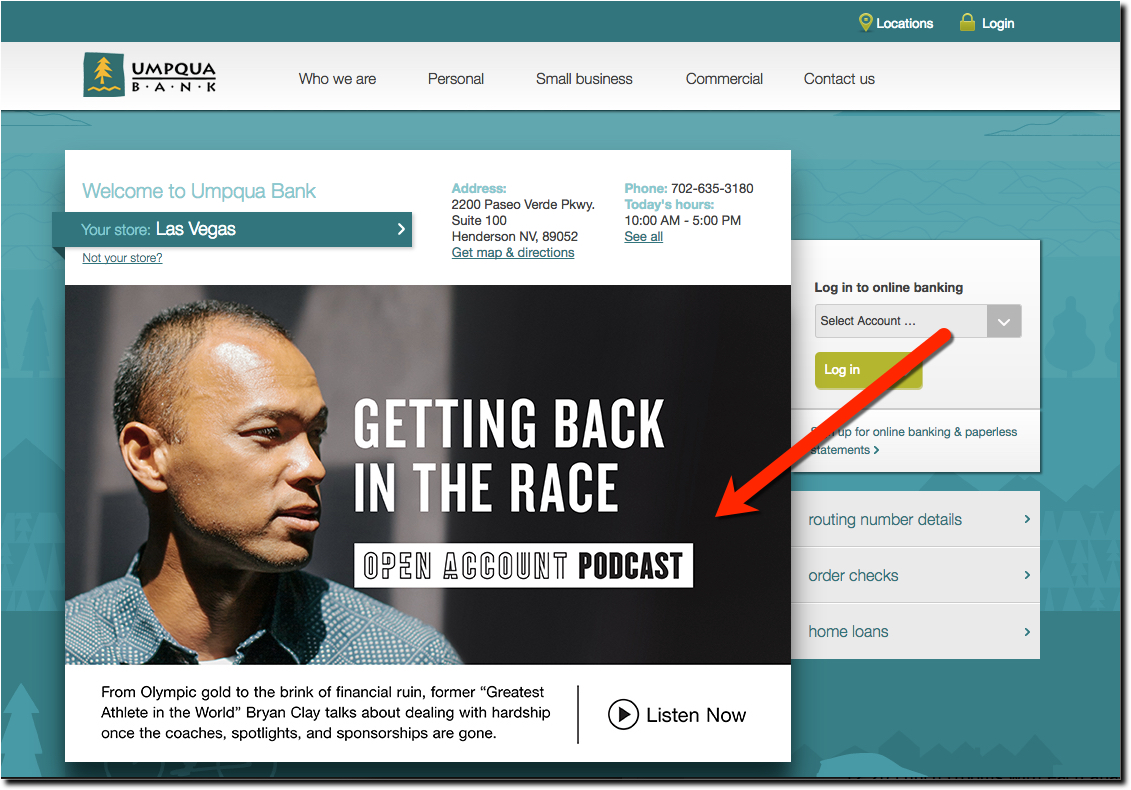

Although, you won’t find them on the iTunes top-100 (except Goldman’s effort, see Table 1, below), many major banks are actively podcasting. Most are aimed at investors or small businesses and are tucked away in the far reaches of their websites. Often, the only way to find them is through a Google search. Even the bank’s own search function, didn’t always locate them. However, Umpqua Bank is an exception with its consumer-focused podcast consistently featured on its homepage (see screenshot above).

Bottom line: Unless you want to make a statement, ala Umpqua, or you have a budding podcaster in-house (quite possible), producing an ongoing interesting podcast is probably not cost effective for most smaller banks. But anyone big enough to be producing custom content for their customers/members/clients, should consider adding podcasts to their communications mix.

Author: Jim Bruene (@netbanker) is Founder & Senior Advisor at Finovate as well as Principal of BUX Advisors, a financial services user-experience consultancy.

Table 1: Selected financial institution podcasts

- Bank of America: Small Business: Small business management topics. Latest episode: “Women’s Business Owners Spotlight”

- BBVA Research, U.S. Weekly Podcast: Touches on home prices, GDP and other economic topics

- Fidelity: Fidelity has three series: Rethinking Time, The Future According to Now, and Market Insights. All are geared to investors and look at industries, innovations, as well as general investing topics.

- Exchanges at Goldman Sachs: Covers industry and investing themes. The podcast currently ranks #54 in the Business category on iTunes.

- JP Morgan Asset Management: Insights Podcast: Market news and insights.

- PNC Bank, Business Webinars & Podcasts: Wide variety of business management topics geared at small business. Most are in webinar format.

- Umpqua Bank: Open Account Podcast: The podcast is located in the “Society & Culture” section and covers much ground. The host is former MTV personality, Suchin Pak and the tagline is “A show about making, losing and living with money.” Latest episode: “Getting Back in the Race” which is an interview of a former Olympic athlete Bryan Clay (see screenshot at top).

- US Bank, Power of Possible: Consumer oriented podcasts exploring financial education and other topics. Latest episode: “From iOT to Blockchain: The intersections of banking and retail”

- Wells Fargo, Conversations: Variety of topics aimed at consumers. Latest episode: “Make Your Giving More Impactful”