Alternative finance solutions provider SoFi and Samsung’s Samsung Pay joined forces this week to launch a debit card.

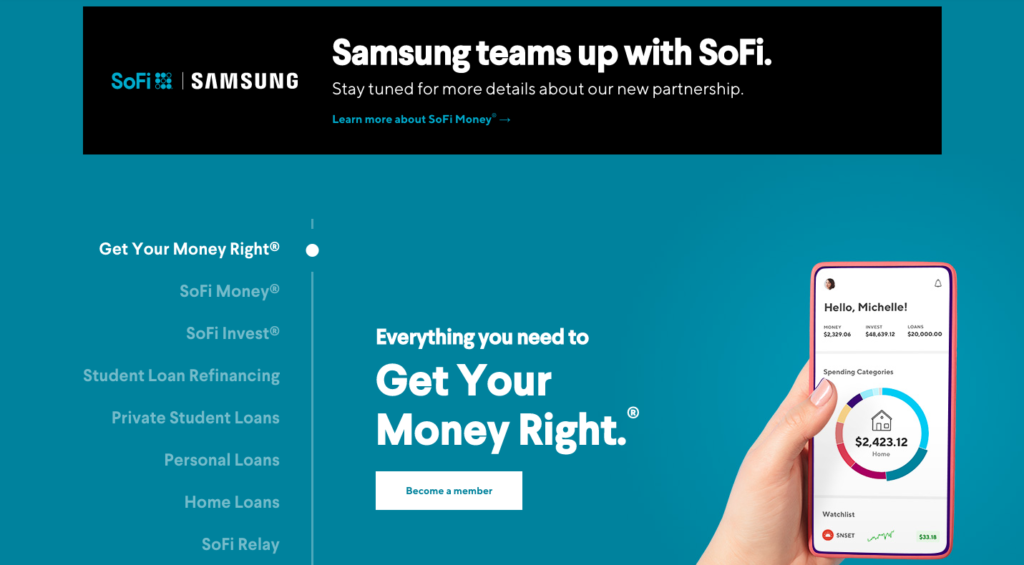

The two have spent the last year collaborating to make a mobile-first money management platform with its own debit card and cash management account.

The initiative is part of Samsung’s broader Samsung Pay mobile payments platform that the company launched in 2015. Samsung’s mobile payments platform uses built-in magnetic secure transmission technology (MST) and NFC functionality to enable users to make contactless payments.

“Our vision is to help consumers better manage their money so that they can achieve their dreams and goals,” said Sang Ahn, Vice President and GM of Samsung Pay, North America Service Business, Samsung Electronics in a blog post. “Now more than ever, mobile financial services and money management tools will play an even bigger role in our daily lives while also opening up new possibilities.”

Specific details about the card are still pending.

The new debit card offering will provide Samsung with a unique way to compete with Apple’s Apple credit card. Compared to Apple’s credit card, however, Samsung’s debit card product sounds more sticky. That’s because budgeting and cash management features built into the app will encourage users to spend more time in Samsung’s app and will keep the company’s debit card– along with its mobile payments service– top-of-mind for consumers.

Samsung’s announcement also comes shortly after news leaked that Google has its own debit card in the works. The debit card will work in conjunction with the Google Pay app.

Samsung’s timing on the launch is fairly ideal, despite the global economic crisis. The coronavirus has turned consumers’ attention toward their finances. Because of this, many banks are seeing record downloads of and engagement with their mobile banking tools. This shift to digital, combined with the new low-touch economy when it comes to everyday payments, provides an ideal environment to launch a contactless payment option.

Despite these conditions, the challenger banking space is becoming increasingly crowded in the U.S. However, Samsung’s choice to partner with an existing player instead of creating a product from scratch is a favorable one.