In a round led by Prosus Ventures and Tencent, Amsterdam-based fintech BUX has secured $80 million in funding that will fuel both international expansion and new product development. The investment also featured a change in the leadership ranks at the company, with founder Nick Bortot handing over the CEO reins to COO Yorick Naeff.

“With this new funding round, BUX will continue to spearhead innovation by implementing advanced features to further shape the future of how Europeans invest,” Naeff said. We are extremely grateful to have top tier investors like Prosus Ventures and Tencent onboard to support us in our mission.”

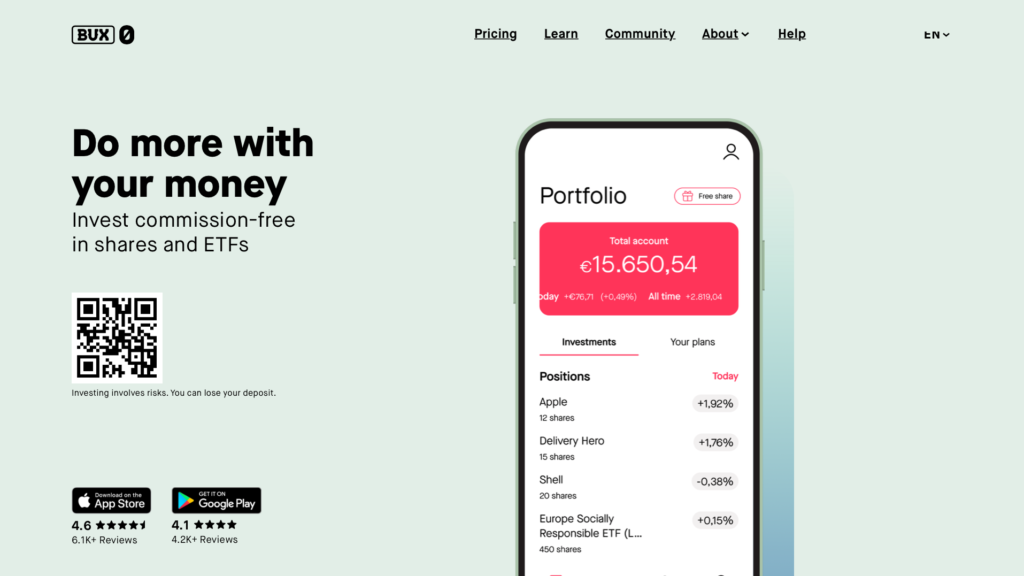

With half a million customers in the Netherlands, Austria, Belgium, France, and Germany, BUX enables investors to buy and sell shares and exchange-traded funds (ETFs), without having to pay commissions. Dubbed the “Robinhood of Europe”, BUX is a response to what Naeff said is a growing awareness of the importance of investing by younger Europeans. Naeff underscored financial uncertainty as a major concern among the younger generation and credited them for realizing that investing is “one of the few viable ways left” to manage that uncertainty. The self-directed nature of investing on BUX’s platform – for shares and ETFs, as well as cryptocurrencies on its BUX Crypto app, and CFDs on its BUX X solution – is another appealing aspect, Naeff said.

“Traditional financial market investing comes with a lot of friction and we firmly believe in the democratization of access to financial services for the next generation of investors,” Head of Europe Investments for Prosus Ventures Sandeep Bakshi said. “The existing solutions are expensive, complex and not designed for younger generations.” Alex Leung, Assistant GM at Tencent, Strategic Development, noted that Bux’s business model does not depend on some of the revenue-raising strategies that have been criticized at rivals like Robinhood. “BUX is the only neo-broker in Europe that offers zero commission investing without being dependent on kickbacks or payments for order flow,” Leung said. “This ensures that its interests are fully aligned with its customers.”

No valuation information was provided as part of the funding announcement. The company noted that its signature BUX Zero solution “has more than doubled its assets under management” in the past three months.

Here is our weekly look at fintech around the world.

Central and Southern Asia

- Revolut appointed Paroma Chatterjee as its new CEO for India.

- Indian e-commerce company Flipkart partnered with credit insights and technology company CreditEnable.

- Fi, a new challenger bank focused on India’s salaried millennials, launched this week.

Latin America and the Caribbean

- Brazilian mobile payments company and super app provider PicS (PicPay) filed for an $100 million IPO in the U.S.

- Mexico-based SME lending platform Credijusto announced its acquisition of data analytics and digital factoring platform Visor.

- Silicon Valley-based cross border B2B payments company Tribal Credit raised $34.3 million in Series A funding to fuel its expansion in Mexico.

Asia-Pacific

- Currencycloud opened its APAC headquarters in Singapore.

- Bank Rakyat Indonesia (Bank BRI) secured the Celent Award for Financial Inclusion.

- Plentina, a buy now pay later company based in the Philippines, raised $2.2 million in seed funding.

Sub-Saharan Africa

- Nigerian fintech Okra secured $3.5 million in funding in a round led by Susa Ventures.

- Ghanaian fintech Zeepay acquired 51% of its Zambian counterpart Mangwee.

- Appzone, a fintech software provider based in Nigeria, raised $10 million in Series A funding to fuel expansion.

Central and Eastern Europe

- Russian fintech Tinkoff launched the country’s first digital buy now pay later service, Dolyame.ru.

- Turkish e-commerce platform Trendyol picked up an $330 million investment from current partner Alibaba.

- Bucharest, Hungary-based Fintech OS raised €51m in Series B new financing.

Middle East and Northern Africa

- Moven teamed up with UAE-based Centre Systems Group.

- PayTabs, a payment solutions provider from the UAE, partnered with Visa to launch its Tap to Phone contactless merchant payment acceptance solution.

- Saudi Arabia-based buy now pay later firm Tamara raised $110 million in debt and equity courtesy of a round led by Checkout.com.