We've come a long, long way since the dawn of the commercial Web, which in banking began in May 1995 when Wells Fargo posted the first customer statement on a website.

We've come a long, long way since the dawn of the commercial Web, which in banking began in May 1995 when Wells Fargo posted the first customer statement on a website.

Back then, when we talked about virtual banking, we meant Internet banking. Now, there's the very distinct possibility that banks and credit unions will set up shop in virtual worlds such as Second Life from Linden Lab <secondlife.com>.

Let's call it truly virtual banking. Second Life, with more than 940,000 users, allows the exchange of virtual Linden dollars for real greenbacks, currently at a rate of L$273 to US$1. Due to the possibility of real profits from virtual activities, this metaverse has attracted more than 10,000 businesses including Starwood Hotels and others (see Analysis below).

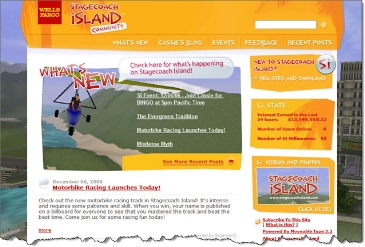

Apparently, the first real-world bank with a truly virtual presence is none other than Wells Fargo, whose Stagecoach Island debuted in Second Life late last year. However, after a few months the site was moved to a standalone site with no connection to Second Life <stagecoachisland.com> (see screenshot below).

In Second Life, the private island was accessible only to Wells Fargo customers who received an invite from the bank. Normal Second Lifers could not gain entry. Users were given a $30 stake in virtual cash. Although the island tempts them with various ways to spend it, the goal is to save, with interest paid at the rate of 10% per day. Users can earn additional cash by taking finance-oriented online quizzes.

The stated purpose of Stagecoach Island is financial education. It is part of a larger program aimed at younger adults. The We Take the Fun of Money Seriously program was piloted in Austin and San Diego last year. Here's an excerpt from the Sept. 14, 2005, press release:

Wells Fargo is hosting a series of live "We Take the Fun of Money Seriously" events throughout Austin and San Diego during September and October where young adults can participate in various activities — from karaoke and trivia games to athletic challenges and photo booths — and win prizes while learning about banking basics. Event participants will receive the Web address and a unique log-in code for the Stagecoach Island software and will have the opportunity to play the online game at home for 30 days.

Apparently, the pilot was successful. This year, the program was used at summer rock concerts, primarily a dozen venues of The Warped Tour, and at 19 college campuses this fall. The first stop was Aug. 20 at the University of Nebraska and the tour ends Nov. 1 at Central Washington.

The bank was assisted by Swivel Media, a San Francisco-based marketing firm which hosts a Web page and short video devoted to the game at <www.swivelmedia.com/fun_money.htm>. According to a July blog post at Clickable Culture, the company paid $17,000 to Second Life freelancers to build the game.

Analysis

Online gaming, or advergaming as it's sometimes called, is a good way to make an impression with younger users, even though it may be difficult to create a game not considered totally lame by the target audience. We recommend keeping it simple, and bribing the target audience with numerous prizes.

The bigger issue, whether to create a presence in Second Life and/or other metaverses, is more complicated. Several major brands have recently taken the plunge including American Apparel, Starwood Hotels, and others.

The Starwood's program is interesting. They are using the Second Life hotel project, aloft, to create a buzz for a real-world brand they intend to introduce in 2008 under the same name. The hotel's Second Life effort is chronicled in its own blog, <virtualloft.com>, which includes a virtual grand opening featuring Ben Folds scheduled Oct. 19.

The Starwood's program is interesting. They are using the Second Life hotel project, aloft, to create a buzz for a real-world brand they intend to introduce in 2008 under the same name. The hotel's Second Life effort is chronicled in its own blog, <virtualloft.com>, which includes a virtual grand opening featuring Ben Folds scheduled Oct. 19.

Financial institutions, looking to create some buzz, should consider a presence in Second Life. With an expected population of one million by year-end, the marketing opportunities within the metaverse are intriguing. But more importantly, a Web-based blog and marketing campaign could yield millions of free impressions for online and offline media.

However, this is not as easy as it seems. There are numerous risks and obstacles that must be overcome. The largest banking operation in Second Life, Ginko Financial <ginkofinancial.com> which lends Linden dollars at 44% interest, has been plagued with accusations of fraud, specifically of being a Ponzi scheme (read Reuters article here). There have also been recent incidents of Second Life hacking that have caused problems.

But the biggest risk is to your reputation. Not only are you vulnerable to the whims of the game players, you also risk being associated with the more adult-themed activities in Second Life. Before taking the plunge, you should have a staffer join the metaverse and consult with seasoned players for advice on proper "game etiquette" (remember "netiquette" ten years ago?). You want to make sure you position yourself as "less lame" than the average financial institution.

But those risks are manageable; in fact, they are similar to the problems you deal with in the real world. And given the potential buzz from a successful Second Life brand, it's worth your while to investigate the potential.

P.S. If you think this is all a fad, consider the source of the Ginko Financial article cited above. It was written by a new full-time reporter from Reuters who works IN Second Life (see NY Times story here).

Resources:

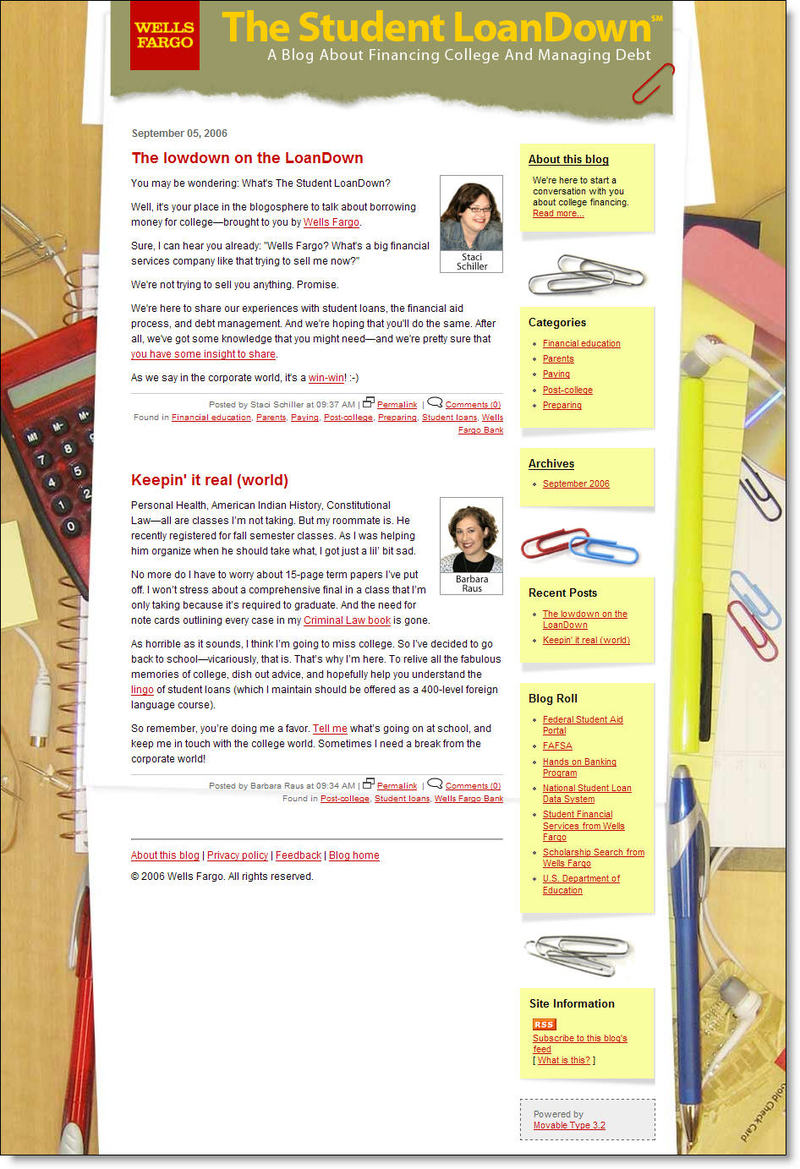

Wells Fargo marked the one-year anniversary of its first blog, Guided by History, with a Q&A today with the bank's Social Media VP, Ed Terpening. The post appeared in the the bank's Student LoanDown blog (post here), which just made it past the six-month mark. I've already weighed in on its blogging strategy (see previous coverage here), so I won't repeat myself.

Wells Fargo marked the one-year anniversary of its first blog, Guided by History, with a Q&A today with the bank's Social Media VP, Ed Terpening. The post appeared in the the bank's Student LoanDown blog (post here), which just made it past the six-month mark. I've already weighed in on its blogging strategy (see previous coverage here), so I won't repeat myself.

No matter how comfortable and convenient your branches are, forcing customers to rush to the branch to cash a check before closing time is not helping cement the relationship. And it leaves you vulnerable to competitors with longer hours or branches that are closer to your customer. And extending hours into the evening and weekend may be great for the customer, but its tough on the bottom line.

No matter how comfortable and convenient your branches are, forcing customers to rush to the branch to cash a check before closing time is not helping cement the relationship. And it leaves you vulnerable to competitors with longer hours or branches that are closer to your customer. And extending hours into the evening and weekend may be great for the customer, but its tough on the bottom line.