Denmark-based Subaio announced this week that it was teaming up with fellow Danish fintech – and fellow Finovate alum – Aiia. Subaio will leverage its partnership with Aiia to better assess creditworthiness for its new white label offering. The collaboration will streamline creditworthiness assessment through a combination of Aiia’s access to financial data and Subaio’s recurring payments detection technology.

“To create automation and a product that works for solid credit scoring across industries, we need as solid and deep quality of data as possible to label the transactions and categorize them afterwards,” Subaio Chief Commercial Officer Soren Nielsen said. “That’s why we chose Aiia to help us bring this next exciting step in the Subaio journey up to speed.”

In some ways, partnerships like this are being encouraged by regulatory decisions. The EU’s revised Consumer Credit Directive of 2021 mandates that financial services firms document customer income and recurring expenses before offering financing to help lower the number of non-performing loans.

“With Aiia, Subaio will be able to offer their customers a hassle-free, cost-efficient and data-driven solution to assess creditworthiness,” Aiia SMB & Fintech Director Tanya Slavova said. “With our high quality data in mind, this open banking empowerment will grant borrowers better loan assessments based on the accurate overview of the consumer’s actual financial situation.”

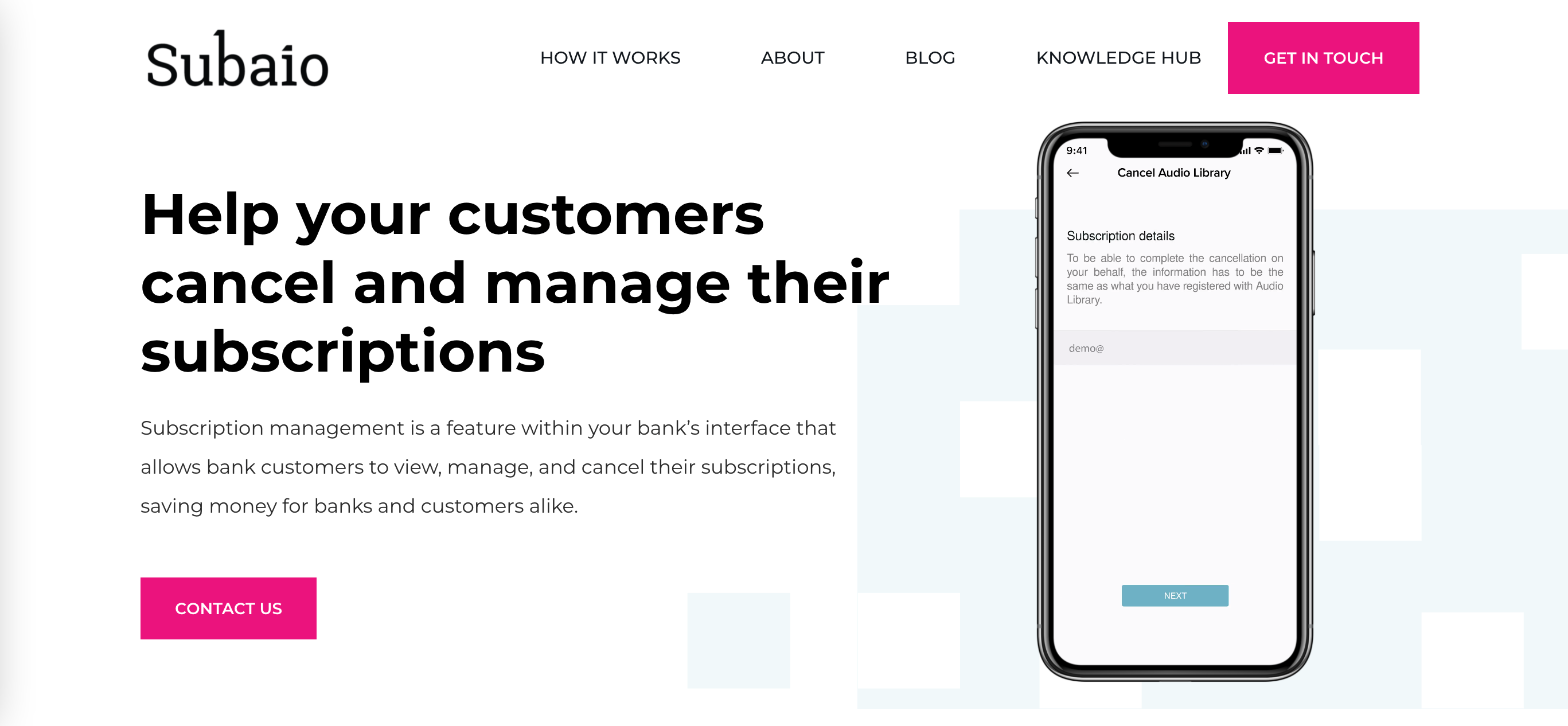

Founded in 2016 and headquartered in Denmark, Subaio made its Finovate debut at FinovateEurope 2020 in Berlin. At the conference, the company demoed its white label subscription management service, which gives customers a comprehensive overview of their recurring payments, helps them cancel unwanted subscriptions, and provides notifications to enable customers to avoid “subscription traps.” The company returned to the Finovate stage two years later for FinovateEurope 2022 in London with a demo of its automatic creditworthiness assessment solution.

Subaio has raised $4.9 million in funding from investors including Global PayTech Ventures. Thomas Laursen is CEO.

Making its Finovate debut at our all-digital FinovateEurope 2021 conference, Copenhagen, Denmark-based Aiia was launched in 2017. A leading open banking platform in Northern Europe, the company demoed its account-to-account payment services at FinovateEurope 2021, showing how the technology facilitates everything from one-off payments for ecommerce to bulk payments for SMEs using a single API. Aiia was acquired by Mastercard in the fall of 2021 for an undisclosed amount. Rune Mai is CEO and co-founder.

In other fintech news from the Nordics, Boost.ai, a Finovate alum from Norway, announced that it will bring its conversational AI technology to Nordic bank DNB. Specifically, DNB will use Boost.ai’s technology to automate more than half of the bank’s chat traffic with its Aino virtual agent. Aino presently automates upwards of 20% of the bank’s customer service requests. According to DNB, more than one million of its customers have interacted with Aino.

Boost.ai VP of EMEA Sanjeev Kumar praised DNB has “one of the many forward-thinking organizations that are reaping the benefits of embracing a conversational AI solution.” Kumar highlighted the fact that conversational AI helps free up staff to enable them to focus on higher-order and more complex customer service tasks. Headquartered in Oslo, DNB is the largest financial services group in Norway. DNB offers a full range of financial services, including loans and savings, insurance and pension products, as well as advisory services for both retail and corporate customers.

“Artificial intelligence is an important part of our digital strategy,” DNB SVP and Head of IT Emerging Technologies Jan Thomas Lerstein said. “In leveraging AI, our aim is to revitalize our value chains, creating better service for our customers and, of course, value for the bank.” Lerstein added that DNB is evaluating other AI-enabled solutions including voice APIs to help the bank reach “higher levels of personalization.”

Boost.ai made its Finovate debut at FinovateFall in New York in 2019, demoing its virtual agent technology. Founded in 2016 and headquartered in Sandnes, Norway, the company introduced a new CEO – Jerry Haywood – in the fall of 2022. Haywood took over the position from founder and previous CEO Lars Selsås, who will focus on product development and innovation going forward.

Here is our look at fintech innovation around the world.

Middle East and Northern Africa

- UAE-based Careem Pay teamed up with Lulu Exchange to offer international remittances.

- American Express agreed to acquire Israel-based B2B payments automation company Nipendo.

- Egypt’s central bank neared launch of the country’s first digital academy to help workers “excel in banking, financial, and fintech industries.”

Central and Southern Asia

- India to spend $320 million to enhance its payments network.

- TechCrunch looked at new guidelines for digital lending issued by Pakistan’s market regulators.

- Indian fintech BharatPe secured in-principle authorization from the Reserve Bank of India to offer online payment aggregator (PA) services.

Latin America and the Caribbean

- Latin American crypto-powered fintech Bitso announced that it would add Euro Coin (EUROC) to its offerings.

- Sergio Tang, Chief Transformation Officer of Peruvian fintech Vivela, was accepted into Forbes Technology Council this week.

- Latin America-based fintech Ebanx introduced new Chief Product and Technology Officer Fabio Scopeta.

Asia-Pacific

- Singaporean car-sharing service GetGo teamed up with Jumio this week.

- South Korea’s SentBe launched its international money transfer service in the U.S.

- Singapore-based B2B Buy Now, Pay Later company actyv.ai raised $12 million in Pre-Series A funding.

Sub-Saharan Africa

- African payments company Flutterwave has become the latest potential acquirer of embedded banking platform Railsr.

- Kenyan fintech Kwara agreed to acquire software firm IRNET.

- African cryptocurrency exchange Yellow Card Financial unveiled its new payment feature, Yellow Pay.

Central and Eastern Europe

- Berlin, Germany-based B2B Buy Now, Pay Later company Mondu raised $13 million in a Series A extension round led by Valar Ventures and FinTech Collective.

- Worldline announced a strategic partnership with Turkey’s Lidio Payment Services.

- Scalable Capital, headquartered in Munich, Germany, topped one million stock and ETF savings plans this week.