This is a sponsored post by Accusoft.

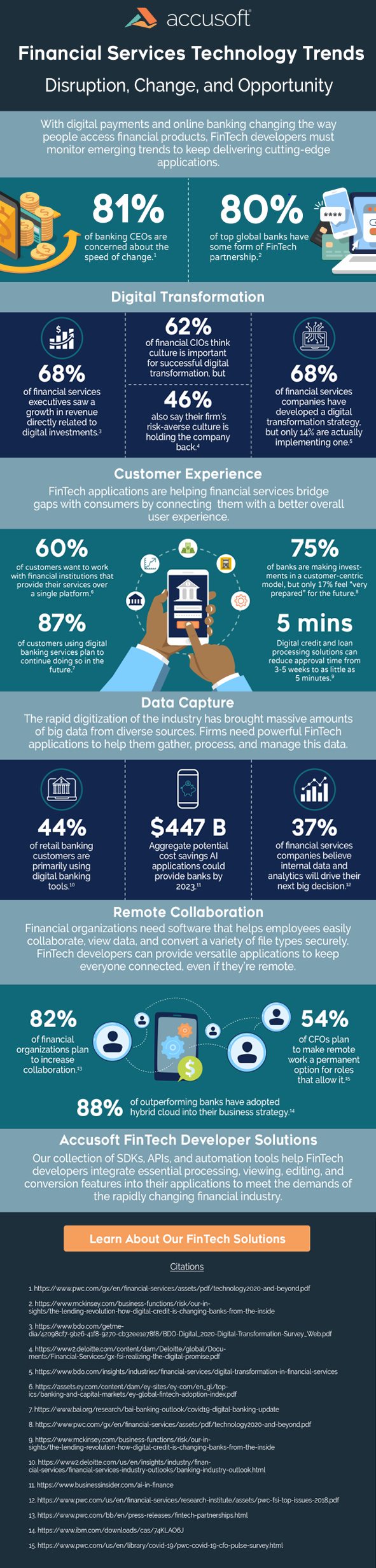

While 2020 made its mark on the financial industry by causing tremendous disruption, 2021 is shaping up to be a year remembered for transformation and adaptation. Companies are hard at work building new digital strategies that will help them to thrive in an increasingly volatile economy.

Fintech developers are taking up the challenge to meet the functionality and performance demands of the financial industry as firms embrace true digital transformation. Their ability to build applications that deliver new features and integrate new capabilities into legacy solutions will be critical for helping firms reshape existing technology infrastructures.

Top 5 Fintech Trends to Watch in 2021

1. Customer-First Solutions

With so many fintech applications to choose from, financial organizations must take the time to consider which solutions are best suited for the needs of their customers. Banks and investment firms once put their own needs at the center of their processes, but in an increasingly competitive marketplace, they have realized that providing a high-quality user experience is paramount to success. They can begin transforming processes by eliminating friction to allow customers to access the services and products they need more quickly.

Fintech developers can help them to eliminate manual processes, reduce external dependencies, and automate common tasks by designing unified digital solutions that address multiple challenges and streamline workflows. By integrating features like document viewing, file conversion, and form data capture into their applications, innovative developers are finding ways to strengthen the connection between firms and their customers.

2. Enhancing Digital Collaboration

In response to the COVID-19 pandemic, much of the financial industry has embraced remote work arrangements for the foreseeable future. The transition has created significant demand for digital tools that can facilitate effective and secure collaboration. Not only must physical documents be converted into digital form, but firms also need ways to make those files available to remote employees without threatening data security or causing version confusion.

Organizations frequently turn to a variety of incompatible software solutions and improvised workarounds to meet their viewing, editing, and document management needs rather than implementing a dedicated, all-in-one solution. Unfortunately, these ad hoc measures create inefficient third-party dependencies, expose data to unnecessary risk, and make human error more likely. Fintech developers can integrate these features into a single application through the use of SDKs and web-based APIs.

3. Managing Big Data

Financial services firms gather massive quantities of data on a regular basis. Although much of that data is unstructured and needs to be filtered through sophisticated algorithms to bring notable trends and risks to the forefront, the industry also collects a great deal of data from structured forms. Structured documents such as loan applications, tax filings, and financial statements all provide valuable data insights that organizations can use to make more informed strategic decisions.

Fintech applications with the ability to extract and process data from structured forms accurately is essential for improving the performance of powerful analytics tools deployed by today’s financial firms. Software integrations can further enhance fintech solutions with image cleanup, document alignment, and form recognition features that make the data collection process more efficient and accurate.

4. Disaster Mitigation

After seeing how the COVID-19 pandemic caused massive disruption to global markets and supply chains, financial organizations are reviewing the way they do business to reduce the impact of similar disasters in the future. One of the key steps in this process will be the rapid transition to paperless workflows and an expansion of electronic data capture capabilities to reduce the reliance upon manual processes.

Solutions that incorporate streamlined document viewing, file conversion capabilities, and data extraction tools will be essential to these “disaster proofing” efforts. By automating previously manual tasks, such as data entry, document assembly, and signature authentication, Fintech solutions can help financial companies protect their business processes from future disruptions.

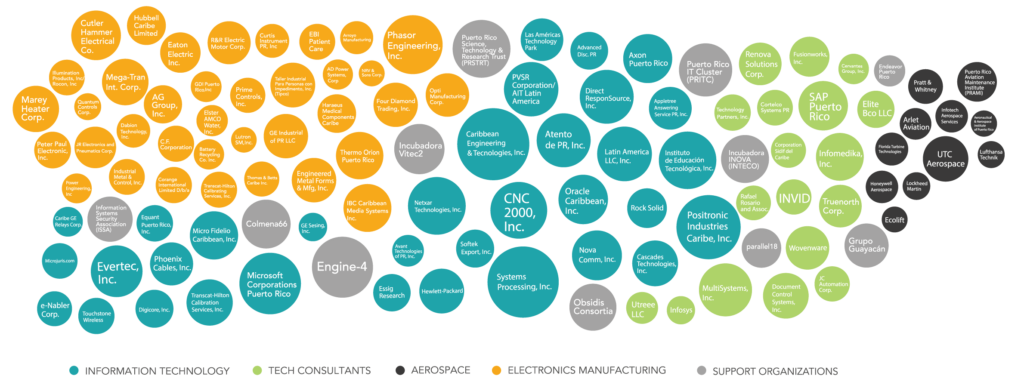

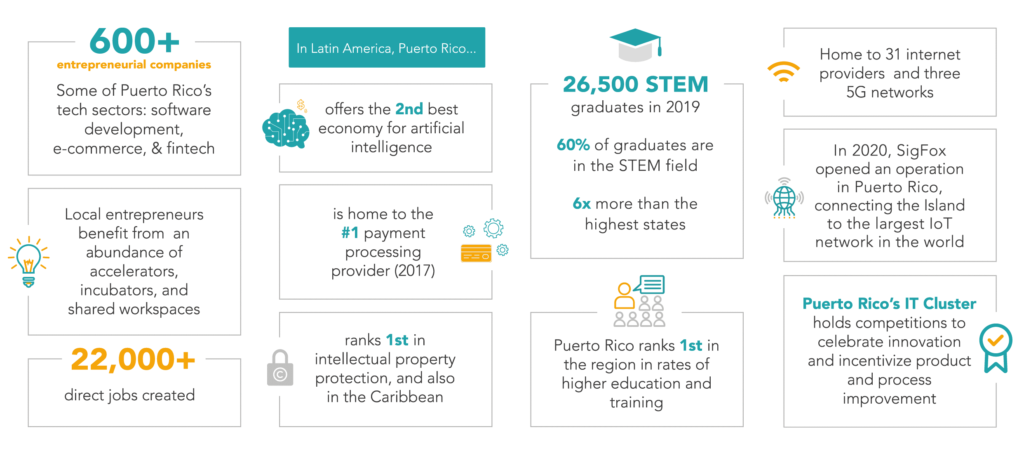

5. Expanded Partnership Opportunities

Although traditional financial institutions like banks have been skeptical of many fintech solutions, the rapidly-changing market has caused them to reassess their technology in order to reach a new generation of customers. Collaboration between banks and innovative fintech startups was already on the rise before the pandemic reduced longstanding barriers to digital transformation. The challenge they now face is how to integrate their operations and data while also launching innovative services across multiple channels.

Fintech developers can streamline this process by building flexible software applications capable of handling a variety of file formats without the need for any burdensome third-party dependencies. In some cases, that may mean building entirely new solutions, while in others it might call for integrating additional features into firmly entrenched legacy applications. The fintech companies with the ability to get innovative software platforms to market more quickly will be able to make the most of their partnership opportunities.

Building Better FinTech Solutions with Accusoft

Accusoft’s diverse library of SDKs and APIs allows developers to easily integrate robust content processing, conversion, and automation capabilities into their solutions. Whether they’re using PrizmDoc Suite to give their web applications the ability to natively view, edit, and convert documents, extracting data from multiple form types with FormSuite for Structured Forms, or building image cleanup, OCR, and PDF annotation features into their on-prem applications with ImageGear, FinTech companies can trust Accusoft to help them overcome the challenges of 2021 and the years to come.