ModaSolutions <modasolutions.com> and several merchant clients including Big Al’s <bigalsonline.com> online aquarium supply store and CompSource <c-source.com>, an electronics retailer, are making waves in online bill payment circles. In one of the more counterintuitive developments we’ve ever seen, Big Al’s is seeing 6 percent of its customers opt for a convoluted two-step bill payment process at checkout. To increase buyer comfort levels, the connection to online banking is reinforced through banners and copy (see the logo from Big Al’s above and the banner at CompSource below).

ModaSolutions <modasolutions.com> and several merchant clients including Big Al’s <bigalsonline.com> online aquarium supply store and CompSource <c-source.com>, an electronics retailer, are making waves in online bill payment circles. In one of the more counterintuitive developments we’ve ever seen, Big Al’s is seeing 6 percent of its customers opt for a convoluted two-step bill payment process at checkout. To increase buyer comfort levels, the connection to online banking is reinforced through banners and copy (see the logo from Big Al’s above and the banner at CompSource below).

How it works

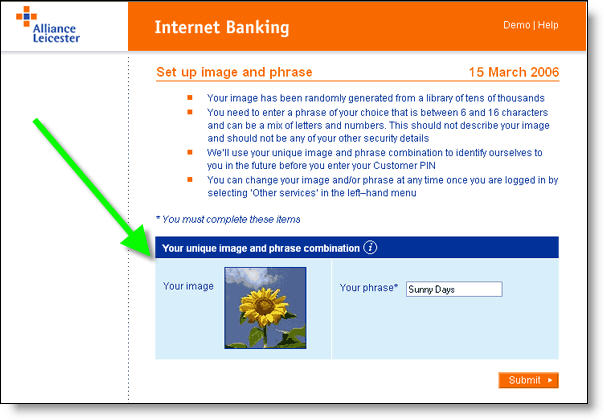

Rather than simply entering a credit card number or inputting checking account info to authorize a funds transfer, the SECURE-ebill system allows a customer to complete the checkout process without entering any personal payment info. The system then kicks an email to the customer summarizing the amount owed and the merchant’s contact info. Customers are then instructed to log in to their bank’s bill pay system, set up Big Al’s as a payee, and then pay the amount owed. Payments are routed through MasterCard’s RPPS for electronic settlement within 48 hours.

To summarize:

- Customer shops at merchant online

- Customer selects SECURE-ebill option during checkout (see screenshot #1 below)

- Email is sent to customer restating the amount due and deadline to pay (see screenshot #2 below)

- Customer logs in to online banking at their bank

- Customer sets up the merchant as a payee

- Customer pays the bill using online bill pay

- Payment is settled electronically through MasterCard RPPS

- Merchant ships the goods

Results

Approximately 6 percent of all Big Al orders now choose the SECURE-eBill option. Of those, nearly 40 percent are new customers. In addition, the cost to process the checks is 60 percent less than the discount rate the company would have paid had the customer paid with a credit or debit card.

At CompSource, customers are rewarded with a 5 percent savings ($25 maximum discount) at checkout when selecting the ebilling option. The company has not released results, but it must really like the system. Its website has numerous references to the 5 percent savings, including a link by each price reminding users that they could save "up to 5%."

Analysis

If you consider the time it takes to log in to your bank account, set up a new merchant, then pay the bill, it will take three to five times as long as using a credit card at checkout. However, it is slightly faster to check out using the ebill option because you avoid entering a credit card number, expiration date, and security code.

As irrational as it seems to regular online shoppers, this system evidently has considerable appeal. How else can you explain 6 percent penetration at Big Al’s with no merchandise discount? Evidently, it appeals to customers who are either concerned about entering payment info on a merchant’s website, or who somehow like the extra control they get by entering the payment into their bill pay system where they can keep closer tabs on the payment. It’s a good lesson in payment system design: Not all customers trust the most efficient system.

Merchants like it because it increases sales. And transactions cost less than credit card interchange, although the interchange savings are likely eaten up by extra customer service and reconciliation costs at the merchant.

—JB

Continue reading “E-billing at the Point of Sale for eCommerce” →