One of the more interesting developments in fintech in recent years has been how a number of innovators have sought to leverage the workplace as a way to make financial wellness, education, and inclusion a reality for workers. Today’s column will introduce five of fintechs – Finovate alums all – that are bringing the benefits of fintech innovation not only to where users live, but to where they work, as well.

Digital Align | Fremont, California | FinovateSpring 2019

Digital transformation consulting services company Digital Align introduced its AlignMoney solution at FinovateSpring two years ago. The offering is the world’s first, digital Banking-as-a-Benefit platform for employers to offer to their employees, helping companies both attract and retain talent. AlignMoney makes it easy for employees to secure a variety of banking products and services – ranging from savings, checking, and credit cards to home loans, insurance, and investments.

Icon Savings Plan | San Francisco, California | FinovateFall 2021

Making its Finovate debut as part of our all-digital fintech conference in 2020, Icon Savings Plan returned to the Finovate stage a year later for FinovateFall in New York. The company’s innovation is a portable retirement plan that replaces the complexity and fragmentation of the 401(k)s with a low-cost, personalized savings and investing plan for both W2 and 1099 employees. And when the employee leaves their employer, their Icon Savings Plan goes with them without any change in service or hassle – and potential expense – of having to rollover the account.

Keep Financial | Atlanta, Georgia | FinovateSpring 2022

Among Finovate’s newest alums, Keep Financial made its Finovate debut earlier this year at FinovateSpring. The company, headquartered in Atlanta, Georgia, and founded in January 2022, won Best of Show for its Cash Vesting Plans that help companies solve hiring and retention challenges while aligning interests between employees and employers. More than a typical bonus, Keep Financial’s Cash Vesting Plans vest over time, enabling workers to be rewarded for their continued contributions to the company. The plans operate like 0% interest loans from which employees can draw upon at any time and for any amount. Borrowed funds are repaid at each vesting milestone while the employee continues to work for the company.

SalaryFits | London, U.K. | FinovateFall 2019

In the same way that fintechs urge banks to leverage their relationship with customers to provide new and better financial products and services, SalaryFits seek to leverage the relationship between the employee and employer to provide better, fairer financial solutions, as well. The London-based company connects the product offers from financial institutions to the payroll of companies. This enables businesses to contribute to the financial wellbeing of their employees and gives providers a way to reach a broader market of potential customers. Financial solutions from more than 100 financial institutions are available via SalaryFit’s cloud-based platform.

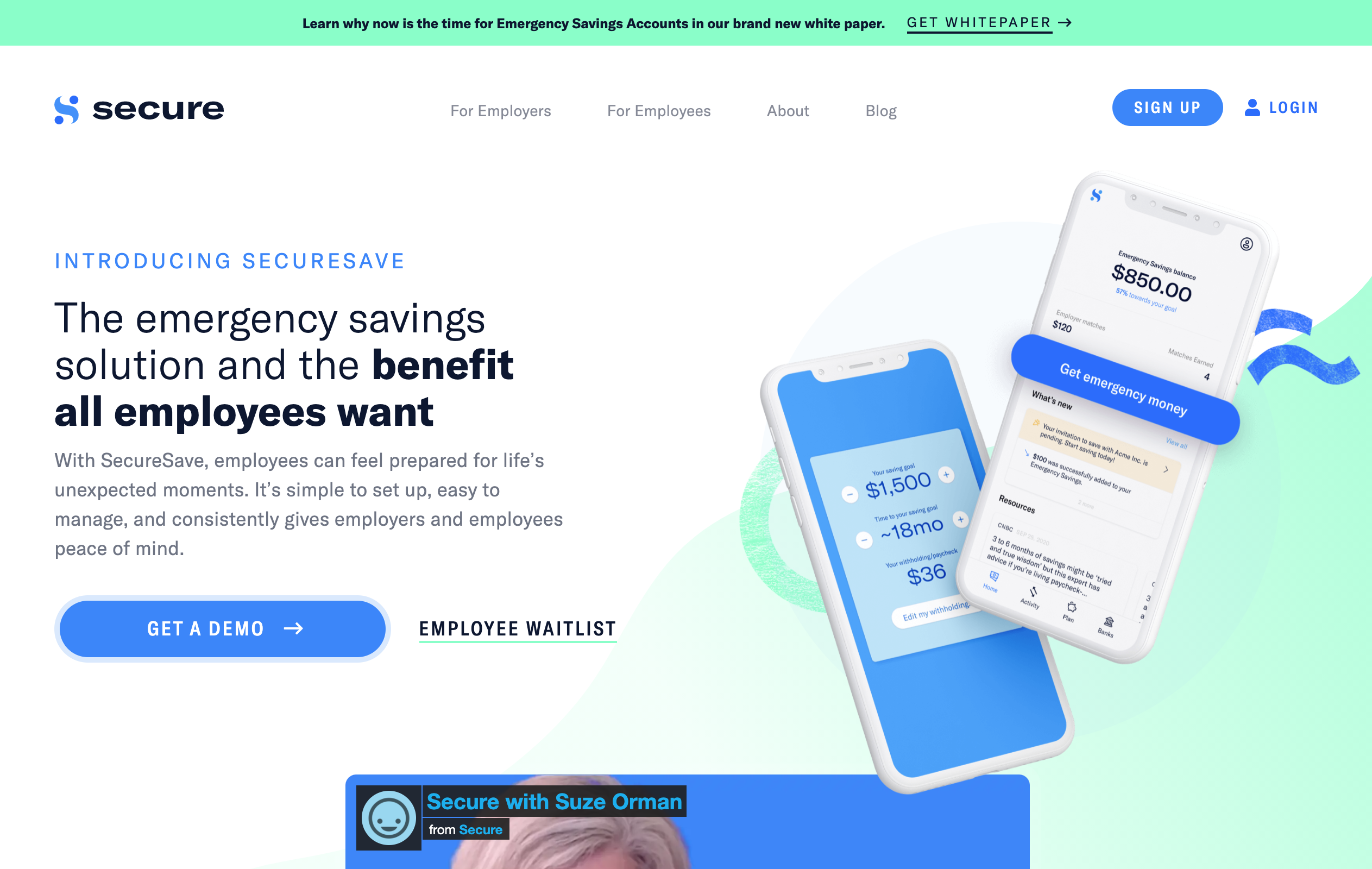

SecureSave | Kirkland, Washington | FinovateSpring 2021

Taking to the Finovate stage for the first time two years ago at FinovateSpring, Kirkland, Washington-based SecureSave offers a new type of workplace savings program that helps employees build and maintain an emergency savings account. SecureSave provides employees with a free emergency savings app to make the process of saving for an emergency fund easy and automatic via payroll deductions. The company partners with employers, benefit brokerage firms, and financial services providers to make emergency savings a component in a holistic financial wellness program.