![]() Launched May 16, Moneytrackin' <mo.neytrack.in> is a Web 2.0-inspired personal finance application from a Spanish developer. The free service, in public beta (looks more like alpha), has just one function, storing and categorizing transactions (click on screenshot below for a closeup). However, much more functionality is in the works (see blog here).

Launched May 16, Moneytrackin' <mo.neytrack.in> is a Web 2.0-inspired personal finance application from a Spanish developer. The free service, in public beta (looks more like alpha), has just one function, storing and categorizing transactions (click on screenshot below for a closeup). However, much more functionality is in the works (see blog here).

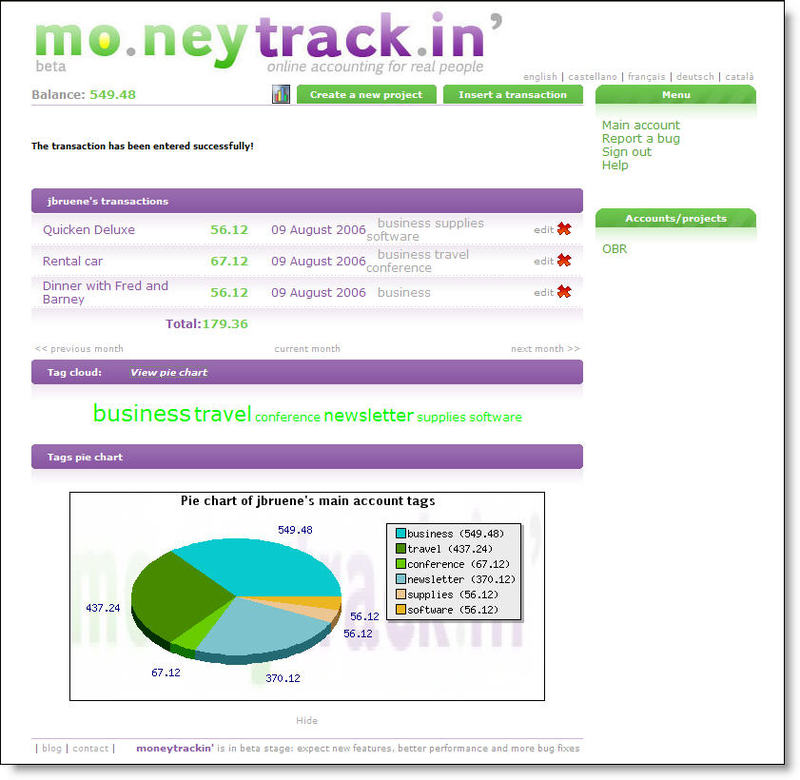

It's ultra-simple to use. Users can set up sub-accounts/projects on the fly then add transactions to each. Transactions can be "tagged" with as many categories as desired. A "tag cloud" runs on the bottom of the screen allowing users to click easily on any category to view the transactions. Finally, a pie chart shows a breakdown of expenses by tag.

It's ultra-simple to use. Users can set up sub-accounts/projects on the fly then add transactions to each. Transactions can be "tagged" with as many categories as desired. A "tag cloud" runs on the bottom of the screen allowing users to click easily on any category to view the transactions. Finally, a pie chart shows a breakdown of expenses by tag.

The multi-language service is offered in English, Spanish, French, German, and in what must be unique in the personal finance space, Catalan, a Spanish dialect spoken by 10 million Southern Europeans.

For a complete run-down of personal finance functionality for online banking, check out our next Online Banking Report, available mid-August.

—JB