(Ed. note: The original promotion shown below was made by Chase in early April, right before U.S. income taxes were due. But the bank is still offering similar balance-transfer options, as outlined below).

When I logged in to my Chase credit card account, I was greeted with an

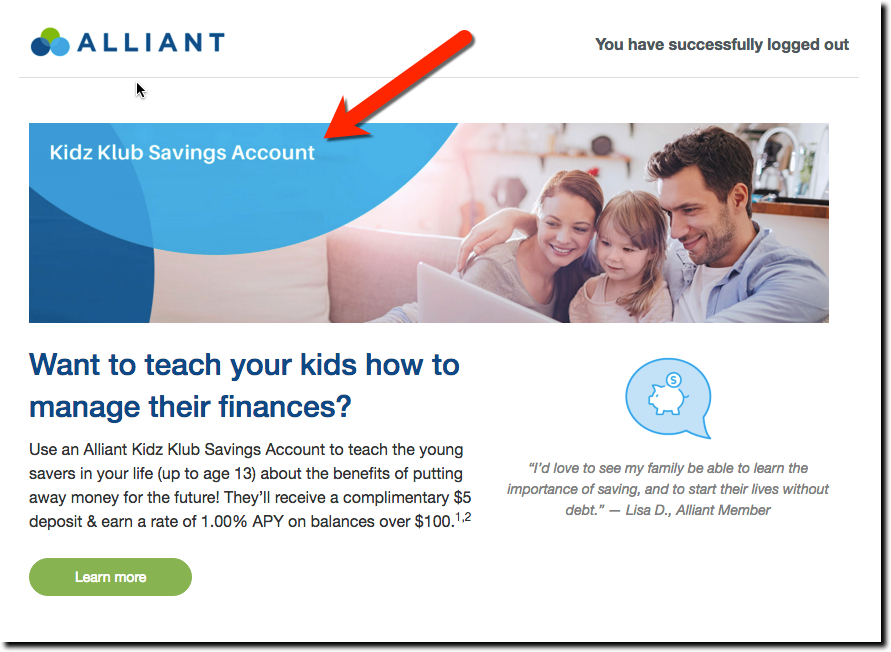

When I logged in to my Chase credit card account, I was greeted with an  attractive interstitial ad promising to save me money if I transferred a credit balance to the bank (see Figure 1).

attractive interstitial ad promising to save me money if I transferred a credit balance to the bank (see Figure 1).

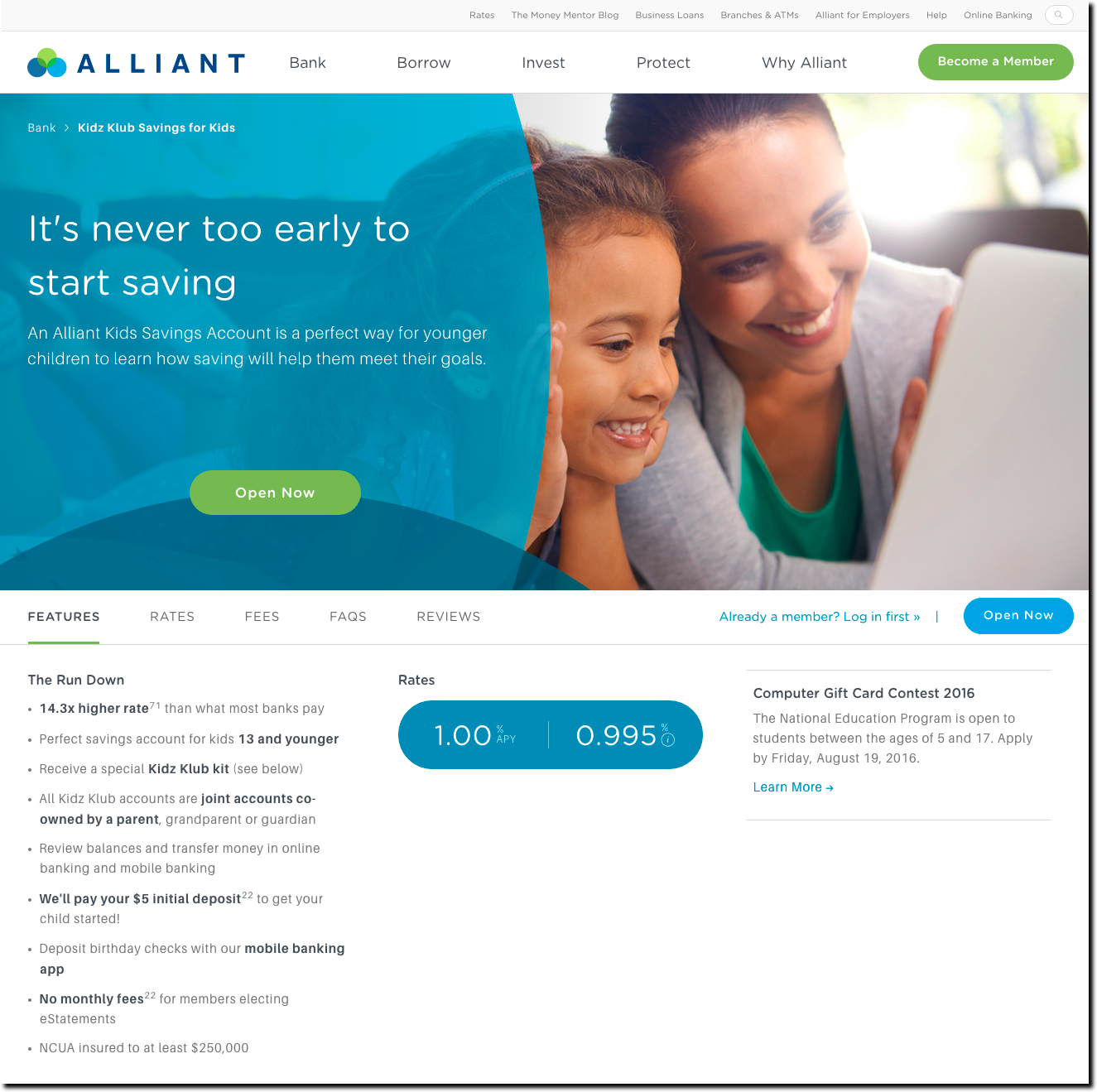

The bank offers two or three choices of terms and rates. Obviously, you can’t beat 0%, but evidently some customers prefer to lock in a lower rate longer. Last week, we had the following choices:

- 0% for 11 months (thru June 2012)

- 1.99% for 17 months (thru Dec. 2012)

- 5.99% for 22 months (thru May 2013)

Each choice also required an immediate 1% fee on the transferred amount (note 1).

_____________________________________________________________________

Analysis

_____________________________________________________________________

The interstitial ad grabs your attention and the pricing is aggressive, so I expect Chase is getting good takeup. More interesting to me is the actual online transfer process which appeared flawless, though I didn’t actually move any money. My only major criticism is that the prices are a little hard to find, especially the transfer fee.

It’s a great offer and lets the customers see the total price right away. Overall, I give it an A-.

Good:

- Great, eye-catching graphics

- Copy is very concise, passing the 25-word “Google homepage” mark

- Clear benefit, “save/saving” used twice in the 15-word ad

- Clicking through leads directly to the transfer page where users can accept the offer (see Figure 2 and 3)

Not so great:

On interstitial ad (Figure #1):

- Not super clear where to click to take advantage of savings

- The actual value of the “Great low rate” is not disclosed until after you click-through to transfer page (second screenshot)

- The laptop graphic image is not particularly interesting

On the transfer page (Figure #2), :

- Two choices are virtually identical (0% though Feb. 2012 or 0% through March 2012) and one that’s clearly less appealing (2.99% through Aug. 2012).

- There is no specific disclosure on the first page of the transfer fee (which I believe is 4%), just the famous “additional terms apply” (the fee comes in step 3, Figure 5)

Recent offers: On my original April 1 test (Figure 1 & 2), I didn’t go through the entire process. So I went back last week to see when Chase discloses the transfer fee. The user is told about the 1% transfer fee (see note 1) during the second step (Figure 5) when they are asked to agree to terms and conditions. The go-to rate after is also listed.

——————————————-

Figure 1: Chase interstitial ad at credit card login (1 April 2011, 8 PM Pacific)

Figure 2: Landing page to begin balance-transfer process (1 April 2011)

—————————————————–

Retesting the service (21 July 2011; 10 PM Pacific)

Figure 3: Step 1 — Select an offer

Figure 4: Step 2 — Enter transfer details (card number and amount)

Figure 5: Step 3 — Agree to the terms and conditions

——

Note:

1. Chase’s 1% transfer fee is much lower than the 4% seen in most other offers. The bank should highlight that number since it’s a selling point.