Last fall Finovate added an Accelerator Showcase where pre-seed startups from fintech accelerators pitch on stage for three minutes. That’s where I first heard George Cook, founder of Honeycomb Credit, one of two startups selected to pitch at FinovateSpring by accelerator AlphaLab.

The Pittsburgh-based company got its start as a class project at Dartmouth’s graduate school of business. But co-founder Cook and his classmate Ken Martin received so much positive feedback from the idea they decided to make it a real company in 2017.

The company is joining what was expected to be a crowded space of SMB crowdfunding. But the lengthy implementation of the U.S. crowdfunding framework has caused many of the 38 startups in the space to give up leaving room for new companies such as Honeycomb. The notable exception is Funding Circle which has raised $375M (note 1). Other active platforms include Finovate alums P2Binvestor (raised $9.2 million) and SeedInvest (raised $8.2 million) along with Crowdfunder (raised $6M), Fundable (acquired by Startups.co) and Wefunder (raised $2.3 million). Indiegogo (raised $56 million) is also now involved in equity crowdfunding, although it is currently a small piece of its overall rewards-based funding platform.

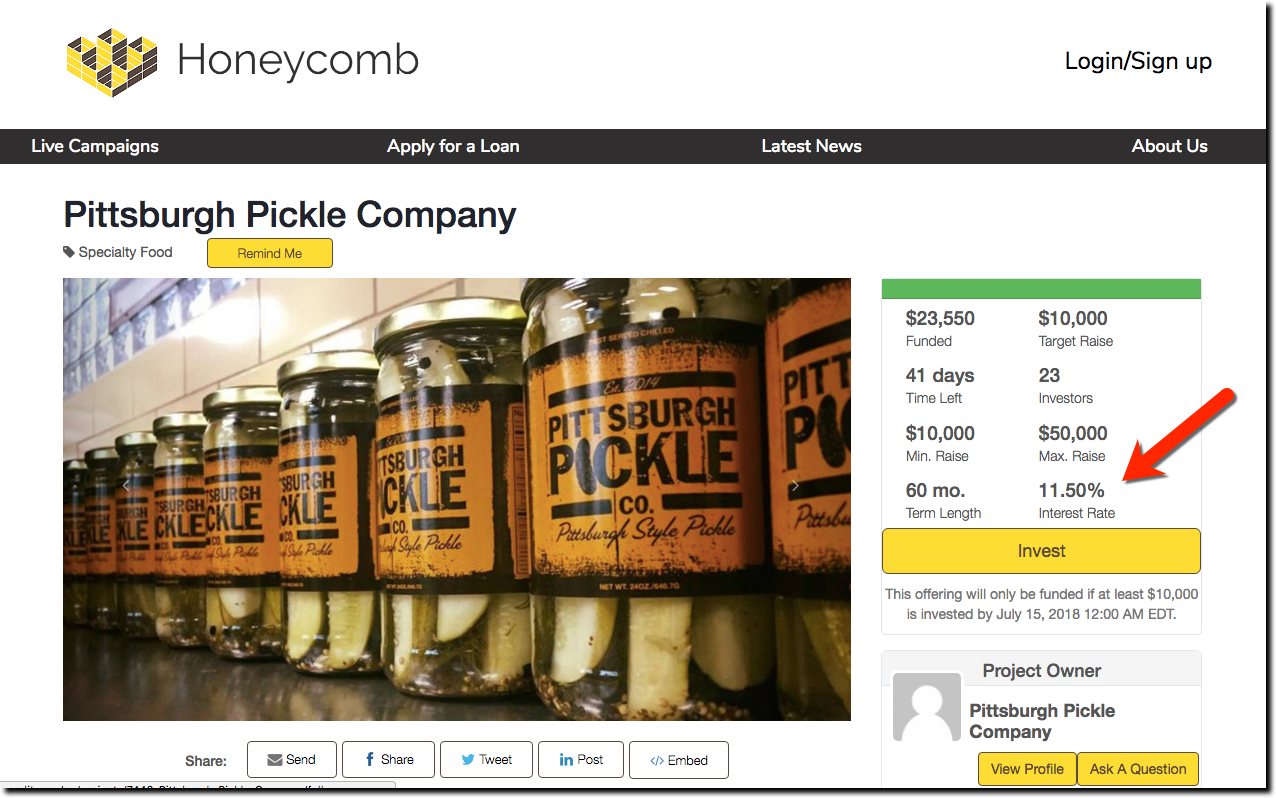

Honeycomb is a debt crowdfunder where investors loan money at bank-like rates to SMBs currently unqualified for bank funding. In addition, like Kickstarter or Indiegogo, non-monetary gifts and experiences are offered to incent action on the part of would-be-lenders. For example, Pittsburgh Pickle offered t-shirts to the first 20 investors in its $10,000 to $50,000 crowdfunding campaign (see screenshot at top). It also invited anyone who kicked in at least $1,000 to an exclusive event at the pickling facility.

The idea is to enable small businesses to tap their local community for debt capital on better terms than higher-rate alt-lenders such as Kabbage or OnDeck. According to Cook, its SMB customers are “near bank quality” but lack one or two of the typical prerequisites such as 3 years of tax returns. But at least one of their beta customers used Honeycomb not because they couldn’t get bank financing, but because they’d been burned in the past and preferred a non-bank alternative.

The loans are funded by individual investors on the platform, using the same model as Lending Club, Prosper, or Zopa. Thanks to the provisions of the crowdfunding act (specifically Reg CF), investors need not be accredited, an important aspect of the Honeycomb business model, which relies on the borrower’s friends, family and customers to fund the loan. Eventually as the business scales, HoneyComb expects to attract institutional and high net worth funds seeking yields from alternative assets.

Honeycomb’s special sauce is community and collateralization. It lends to existing businesses looking to expand expand their share of wallet within their predefined market. For example, it recently ran a successful campaign for an ice cream shop to buy a truck for mobile sales. And whenever possible, HoneyComb takes equipment as collateral on the loans.

Pricing

Borrowers typically pay platform lenders 8% to 12% interest on 3- to 5-year installment loans. At the conclusion of a successful money-raising campaign, Honeycomb charges borrowers an 8% fee and investors 2.85%. Honeycomb doesn’t hold loans on its balance sheet, so all credit risk is pushed to investor/lenders.

Go-to-Market Strategy

The startup has begun rolling out the platform having ran two successful campaigns, raising $50,000 for an ice cream truck and $25,000 for several new greenhouses. There are currently two more in process, one of which has already surpassing its minimum raise amount.

To expand, Honeycomb is currently raising a seed round. They have received good publicity in their local market, but to make that scale to other markets Honeycomb may need to find local partners such as local development groups, governments, and financial institutions. However, Honeycomb believes that the public nature of crowdfunding campaigns will drive a large number of new customers to its platform keeping customer acquisition rates low.

To reach profitability Honeycomb needs to expand beyond its Western Pennsylvania home market. That’s going to be a challenge without compromising quality. The company hopes to attract revenue from ancillary services and balance sheet lending down the road, but that’s much easier said than done in the fickle SMB sector.

Bottom Line

As with many businesses, it’s all about scale and efficiency. Honeycomb will need to automate its processes while simultaneously increasing loan size. But as loan sizes increase, they will begin to run up against a raft of competitors, including banks and credit unions. But I also think there is a good opportunity to license the Honeycomb platform to banks and credit unions wanting to add crowdfunding to their SMB services.

Author: Jim Bruene (@netbanker) is Founder & Advisor at Finovate as well as Principal of BUX Certified, a financial services user-experience standard.

Notes:

1. Also in the UK there are 4 other platforms with good traction: Crowdcube (£21.2M raised for itself) Seedrs (£13.7M raised), SyndicateRoom (£8.7M raised) and Venturefounders (£6.8M raised).

The bank isn’t commenting on this particular loan application, so we don’t know if there are other extenuating circumstances. Perhaps the couple had a debt go into collection or other credit problems. But since I’ve personally run into similar problems while maintaining excellent credit, I believe the couple’s story is probably accurate.

The bank isn’t commenting on this particular loan application, so we don’t know if there are other extenuating circumstances. Perhaps the couple had a debt go into collection or other credit problems. But since I’ve personally run into similar problems while maintaining excellent credit, I believe the couple’s story is probably accurate.