Once again alt-lending dominated the dollar volumes flowing into fintech accounting for close to a half-billion this week. The majority ($400 million) went to Chicago-based Avant. We should note that with all the money flowing to alternative lending, it’s getting a bit harder to classify the funding between a lending pledge, straight debt, traditional equity or a hybrid.

Once again alt-lending dominated the dollar volumes flowing into fintech accounting for close to a half-billion this week. The majority ($400 million) went to Chicago-based Avant. We should note that with all the money flowing to alternative lending, it’s getting a bit harder to classify the funding between a lending pledge, straight debt, traditional equity or a hybrid.

On the equity front, a good variety of firms were funded from billpay, ranging from remittances and insurance to direct banking.

Five Finovate alums took in a total of $35 million:

- $10.7 million to CurrencyFair

- $10 million to Yoyo

- $9.5 million to Interactions

- $3.2 million to MoneyStream

- $1.2 million to StockTwits

In total, 18 private fintech companies raised $695 million, at least $450 million was debt and $245 million was equity. Here are the deals from April 11 to 17 by size:

Avant

Direct online lender

HQ: Chicago, Illinois

Latest round: $400 million Debt

Total raised: $1.4 billion ($350 million equity; $1.05 billion debt)

Tags: management, investing

Source: Crunchbase

PrimeRevenue

Supply-chain financing marketplace

HQ: Atlanta, Georgia

Latest round: $80 million Private Equity

Total raised: $91.6 million

Tags: Lending, SMB, factoring, investing

Source: Crunchbase

Applied Data Finance

Lending to underbanked via Personify Financial Services

HQ: New York City

Latest round: $50 million Debt + undisclosed equity

Total raised: Unknown

Tags: Data analytics, underbanked, lending, underwriting, consumer credit

Source: Crunchbase

PolicyBazaar

Indian insurance-comparison portal

HQ: Gurgaon, India

Latest round: $40 million Series D

Total raised: $69.6 million

Tags: Insurance

Source: Crunchbase

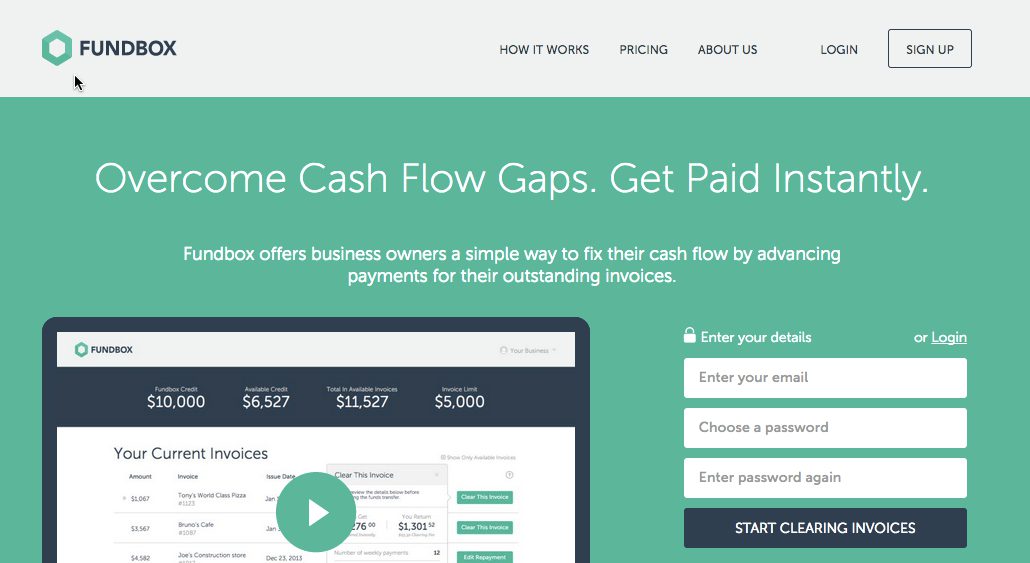

Billtrust

B2B invoicing and payments

HQ: Hamilton, New Jersey

Latest round: $25 million Series C

Total raised: $54 million

Tags: SMB, invoicing, billpay, bill payment, accounts receivable, accounts payable

Source: FT Partners

Acorns

Saving and investing app

HQ: Newport Beach, California

Latest round: $23 million Series C

Total raised: $32 million

Tags: management, investing

Source: FT Partners

InGo Money (formerly Chexar Networks)

Mobile money movement and card reloads

HQ: Roswell, Georgia

Latest round: $13.5 million

Total raised: $21.9 million

Tags: management, investing

Source: FT Partners

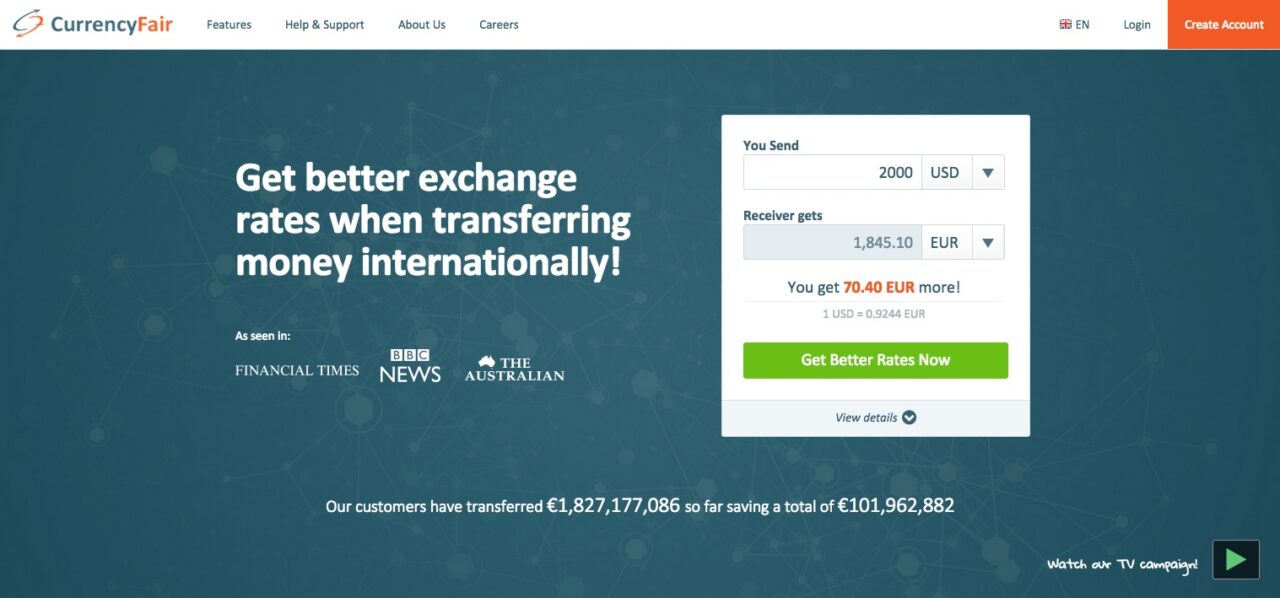

CurrencyFair

Remittances and foreign exchange

HQ: Dublin, Ireland

Latest round: $10.7 million Series A

Total raised: $15.4 million

Tags: Fx management, funds transfer, international money exchange, Finovate alum

Source: Finovate

Number26

German direct bank startup

HQ: Berlin, Germany

Latest round: $10.7 million Series A

Total raised: $12.7 million

Tags: Banking, mobile, neo-bank, direct bank, branchless

Source: Crunchbase

Yoyo

Mobile wallet

HQ: London, United Kingdom

Latest round: $10 million Series A

Total raised: $15 million

Tags: Mobile, payments, credit cards, debit cards, Finovate alum

Source: Crunchbase

Money360

Commercial real estate loan marketplace

HQ: Ladera Ranch, California

Latest round: $10 million

Total raised: $13 million ($11 million equity; $2 million debt)

Tags: Lending, credit, real estate, commercial mortgage, investing, P2P, crowdfunding

Source: P2P-Banking.com

Interactions

Customer service technology

HQ: Franklin, Massachusetts

Latest round: $9.5 million

Total raised: $110+ million

Tags: Service, call center, mobile, speech recognition, biometrics, security, Finovate alum

Source: Crunchbase

TouchBistro

Mobile POS system for restaurants

HQ: New York City, New York

Latest round: $6 million Series A

Total raised: $12 million

Tags: Mobile, point-of-sale, credit/debit card, acquiring, merchants, SMB

Source: FT Partners

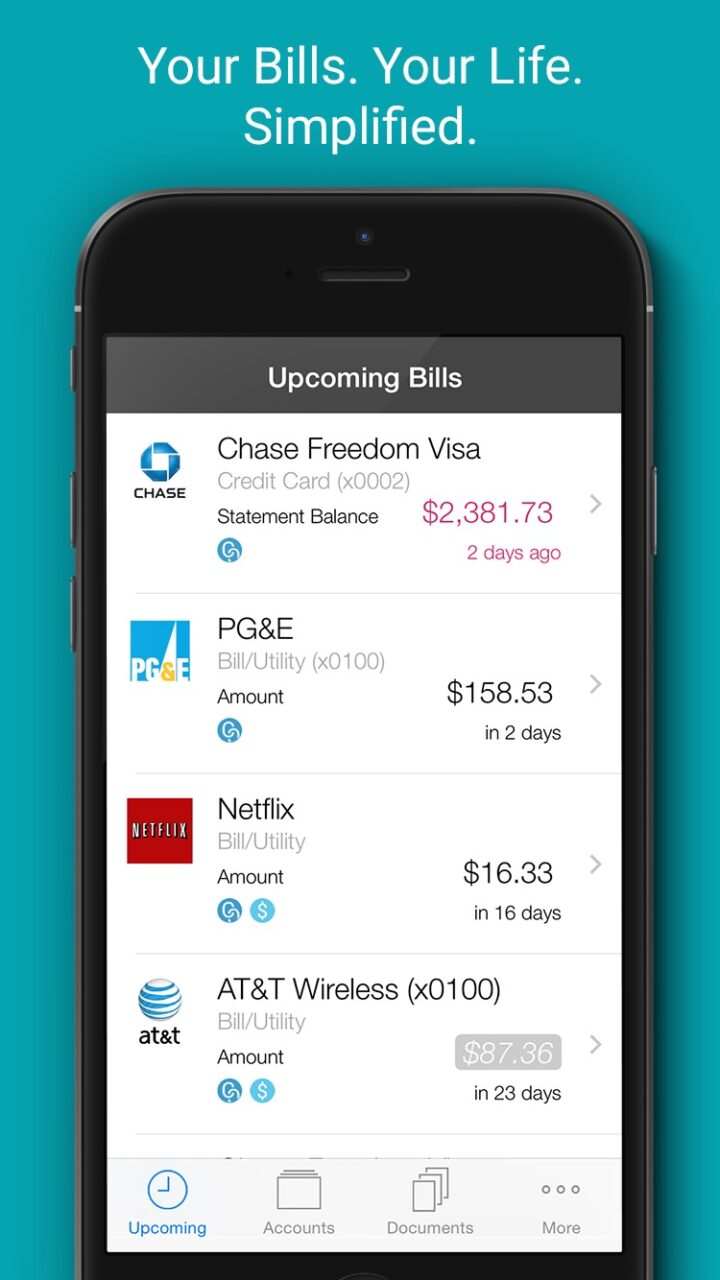

MoneyStream

Money and bill management

HQ: Los Gatos, California

Latest round: $3.2 million Series A

Total raised: $3.2 million

Tags: Billpay, PFM, payments, money management, H&R Block (investor), Finovate alum

Source: Finovate

Ascend Consumer Financial

Loan comparison and rewards

HQ: San Francisco, California

Latest round: $1.5 million Seed

Total raised: $1.5 million

Tags: Lending, rewards, underwriting, credit, loans, lead generation, consumer

Source: Crunchbase

StockTwits

Investment sentiment analysis

HQ: New York City, New York

Latest round: $1.2 million

Total raised: $9.8 million

Tags: Investing, analytics, mobile, Twitter, Finovate alum, FinDEVr alum

Source: FT Partners

CommonLedger

Accounting data-aggregation tool

HQ: Wellington, New Zealand

Latest round: $1 million Seed

Total raised: $1 million

Tags: Accounting, metrics, data analysis

Source: Crunchbase

FriendlyScore

Alternative credit score

HQ: London, United Kingdom

Latest round: $375,000 Seed

Total raised: $395,000

Tags: Lending, underwriting, credit scoring, data analytics

Source: Crunchbase