Scalable Capital landed $58 million (€50 million) for its roboadvisory platform this week. The new funds come courtesy of BlackRock, HV Holtzbrinck Ventures, and Tengelmann Ventures.

Today’s round brings Scalable Capital’s total funding to $133 million (€116 million) and boosts the Germany-based company’s valuation to $460 million. Scalable Capital will use the investment to grow in the wealth management and brokerage spaces, and invest in the B2B side of its business.

“In times of COVID-19, our funding round is a powerful signal; it shows that our focused, digital business model is convincing the investors,” said company Co-founder and Co-CEO, Erik Podzuweit. “We will use the additional capital to expand our position as the market leader in digital wealth management and to reach new customer segments with the broker.”

With 80,000 customers across Germany, Austria, the U.K., and Switzerland, Scalable Capital has $2 billion in assets under management. The company offers personalized, fully managed investment portfolios.

Using its risk management technology, Scalable Capital’s B2C offering aims to make investing accessible for everyone by charging simple, transparent fees.

“We established Scalable Capital to make investing easier and better through technology,” said Scalable Capital Co-founder and Co-CEO Florian Prucker. “Not only has our B2C business grown strongly over the last few years, but Scalable Capital’s technology is also used by more and more B2B partners; most recently we launched our partnership with Barclays. With this funding round, we also want to expand our team of currently 130 employees in order to drive our expansion and the further development of our platform.”

The company’s flagship offering is a B2B approach that brings its roboadvisory technology to help banks offer their clients a different flavor of investing. Scalable Capital recently added three additional partners to its roster and now boasts partnerships with firms including Barclays, Gerd Kommer Capital, Raiffeisen Banking Group Austria, ING Deutschland, Siemens Private Finance, Openbank, Targobank, Oskar, and Baader Bank, and others.

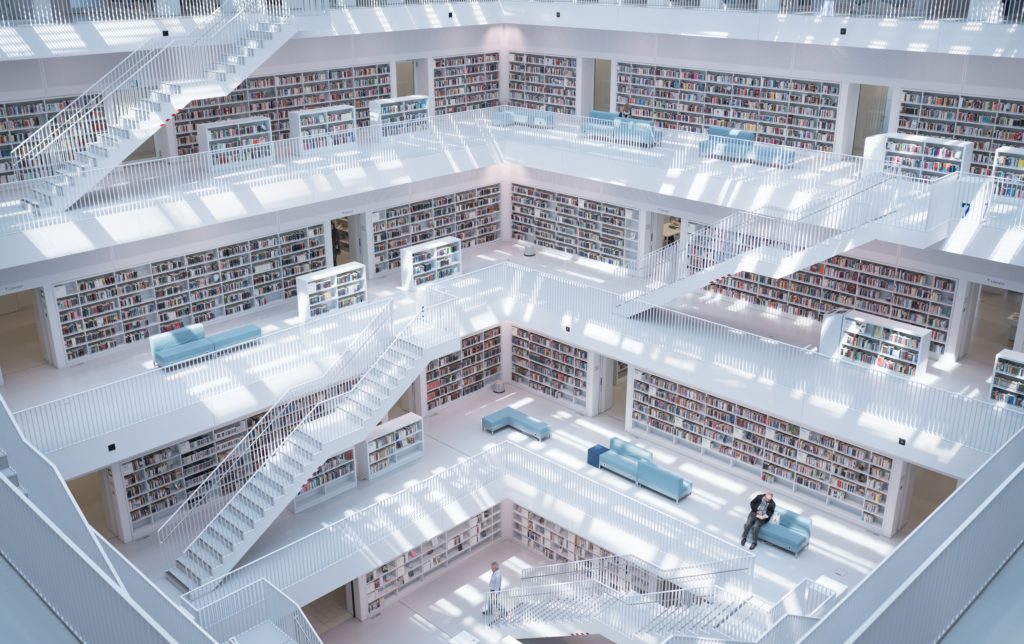

Photo by Maarten Wijnants on Unsplash