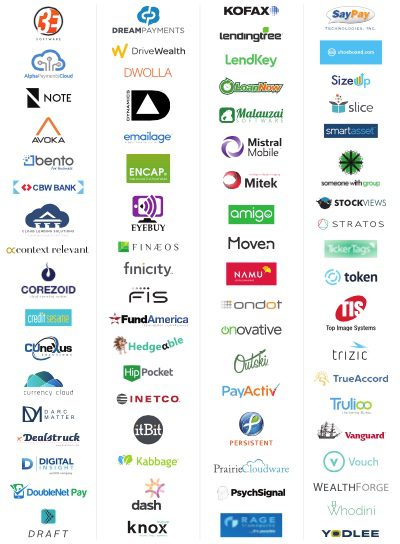

Today marks our final Sneak Peek preview. We hope you’ve enjoyed the opportunity to get to know a little about the companies that will be taking the stage at FinovateSpring 2015.

Register today to see and meet these innovators in person on 12/13 May at our upcoming conference in San Jose, California.

If you’ve missed an edition, our complete Sneak Peek series for FinovateSpring 2015 is below:

- Sneak Peek Part 1: Alpha Payments Cloud, CUneXus, DRAFT, FundAmerica, SayPay, StockViews, and TrueAccord

- Sneak Peek Part 2: Bento for Business, DoubleNet Pay, Karmic Labs, SizeUp, Stratos, TickerTags, and Trulioo

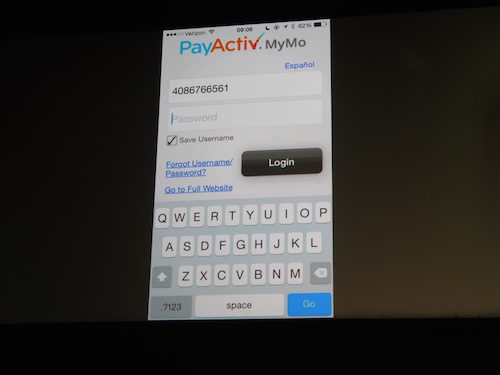

- Sneak Peek Part 3: 3E Software, Corezoid, Malauzai Software, PayActiv, PsychSignal, Someone With Group, and Trizic

- Sneak Peek Part 4: Currency Cloud, Dream Payments, Hip Pocket, INETCO Systems, LoanNow, WealthForge, and Yodlee

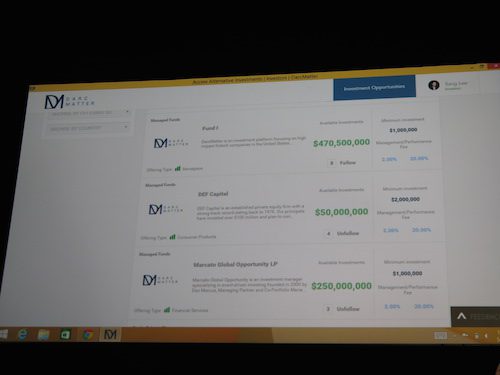

- Sneak Peek Part 5: DarcMatter, Digital Insight, Emailage, Hedgeable, Moven, RAGE Frameworks, Shoeboxed

- Sneak Peek Part 6: Credit Sesame, Hip Pocket, itBit, Kofax, Mitek, NAMU Systems, Persistent Systems

- Sneak Peek: Aurora Financial Systems and Mistral Mobile

- Sneak Peek Part 7: Avoka, CBW Bank, Cloud Lending Solutions, Context Relevant, Dealstruck, DriveWealth, Dwolla, Dynamics, Encap Security, EyeBuy, FIS Mobile, Kabbage, Knox Payments, Lending Tree, LendKey

And now let us introduce you to the final fourteen companies of FinovateSpring 2015. See you in San Jose!

Finaeos automates the back office and capital-raising compliance.

Finaeos automates the back office and capital-raising compliance.

Why it’s great

Serves the demand for new ways to invest, save, and generate income by investors across the globe.

- Founded: 2015

- HQ: Victoria, British Columbia, Canada

Finicity helps developers build powerful apps to drive financial software innovation.

Finicity helps developers build powerful apps to drive financial software innovation.

Why it’s great

TXPUSH Interface to the Finicity API Platform.

- Founded: 1999

- HQ: Salt Lake City, Utah

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked.

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked.

Why it’s great

Money Amigo makes managing money fast, fair, and friendly.

- Founded: 2015

- HQ: Las Vegas, Nevada

Ondot Systems builds white-label solutions that enable financial institutions to provide security and convenience for their customers.

Ondot Systems builds white-label solutions that enable financial institutions to provide security and convenience for their customers.

Why it’s great

Our platform brings innovation to mobile card services.

- Founded: 2011

- HQ: San Jose, California

Onovative’s powerfully simple marketing automation software helps financial institutions meet the challenge of cross-selling current customers.

Onovative’s powerfully simple marketing automation software helps financial institutions meet the challenge of cross-selling current customers.

Why it’s great

Onovative provides banks and credit unions with modern APIs and a simple UI to help them grow.

- Founded: 2013

- HQ: Jeffersonville, Indiana

Outski’s platform improves employee health and wellness, increases productivity, and reduces job-related stress.

Outski’s platform improves employee health and wellness, increases productivity, and reduces job-related stress.

Why it’s great

Outski helps companies improve margins and reduce costs by focusing on the health and well-being of their employees.

- Founded: 2013

- HQ: Tucson, Arizona

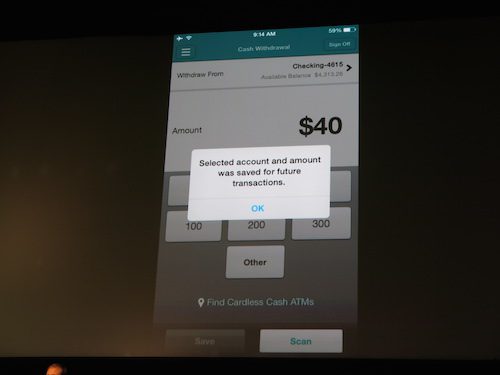

Prairie Cloudware provides a comprehensive set of omnichannel, digital payment services to solve the need for more security, convenience, and control when purchasing goods and services online and in-store.

Prairie Cloudware provides a comprehensive set of omnichannel, digital payment services to solve the need for more security, convenience, and control when purchasing goods and services online and in-store.

Why it’s great

We are a cloud-based, open platform that allows consumers to access and use their preferred payment mechanisms and accounts via the financial institution’s digital channels.

- Founded: 2012

- HQ: Omaha, Nebraska

Slice’s technology provides item-level purchase-data across the largest base of online consumers (two million and counting).

Slice’s technology provides item-level purchase-data across the largest base of online consumers (two million and counting).

Why it’s great

Slice’s one-of-a-kind Purchase Graph technology.

- Founded: 2010

- HQ: Palo Alto, California

SmartAsset provides a tools-and-content platform to give consumers personalized and actionable advice.

SmartAsset provides a tools-and-content platform to give consumers personalized and actionable advice.

Why it’s great

Leverage our Automated Financial Modeling technology to make significant personal finance decisions.

- Founded: 2011

- HQ: New York City, New York

Token is a new payment rail that solves the “faster payments” problem for banks, businesses, and consumers.

Token is a new payment rail that solves the “faster payments” problem for banks, businesses, and consumers.

Why it’s great

A new open bank API, an unbreakable identity system, developer tools, and a wallet app for business and consumers.

- Founded: 2015

- HQ: Los Altos Hills, California

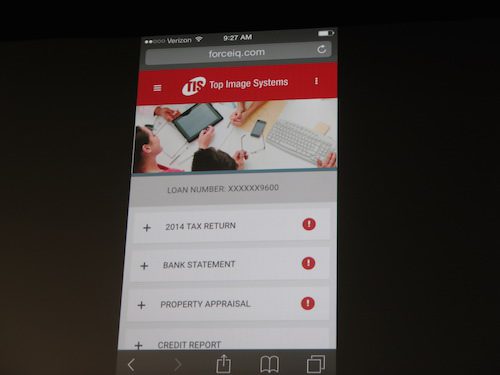

Top Image Systems introduces the eFLOW mortgage, which eliminates the manual, time-consuming and expensive mortgage-origination process.

Top Image Systems introduces the eFLOW mortgage, which eliminates the manual, time-consuming and expensive mortgage-origination process.

Why it’s great

Top Image Systems’ IQA (Image Quality Analysis) provides unparalleled accuracy, security, and ease of use.

- Founded: 1991

- HQ: Tel Aviv, Israel

Vanguard introduces the Funds Visualizer to rid investors of suboptimal portfolio construction.

Vanguard introduces the Funds Visualizer to rid investors of suboptimal portfolio construction.

Why it’s great

Our interactive, 3-D, data visualizations of diversification provide unique insights when it comes to building portfolios.

- Founded: 1975

- HQ: Valley Forge, Pennsylvania

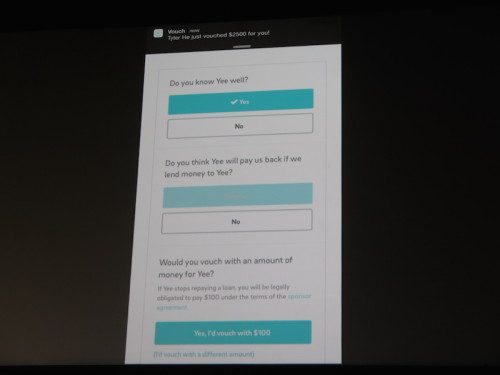

Vouch is the first social network for credit, enabling consumers to connect and share creditworthiness so they get the financial products they deserve.

Vouch is the first social network for credit, enabling consumers to connect and share creditworthiness so they get the financial products they deserve.

Why it’s great

Vouch is for anyone who believes they are more than their credit score.

- Founded: 2013

- HQ: San Francisco, California

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.

Why it’s great

At Whodini, we help local businesses know their customers better.

- Founded: 2004

- HQ: Westport, Connecticut

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked.

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked. Outski’s

Outski’s

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.