A look at the companies demoing at FinovateAsia Digital on June 22, 2021. Register today and save your spot.

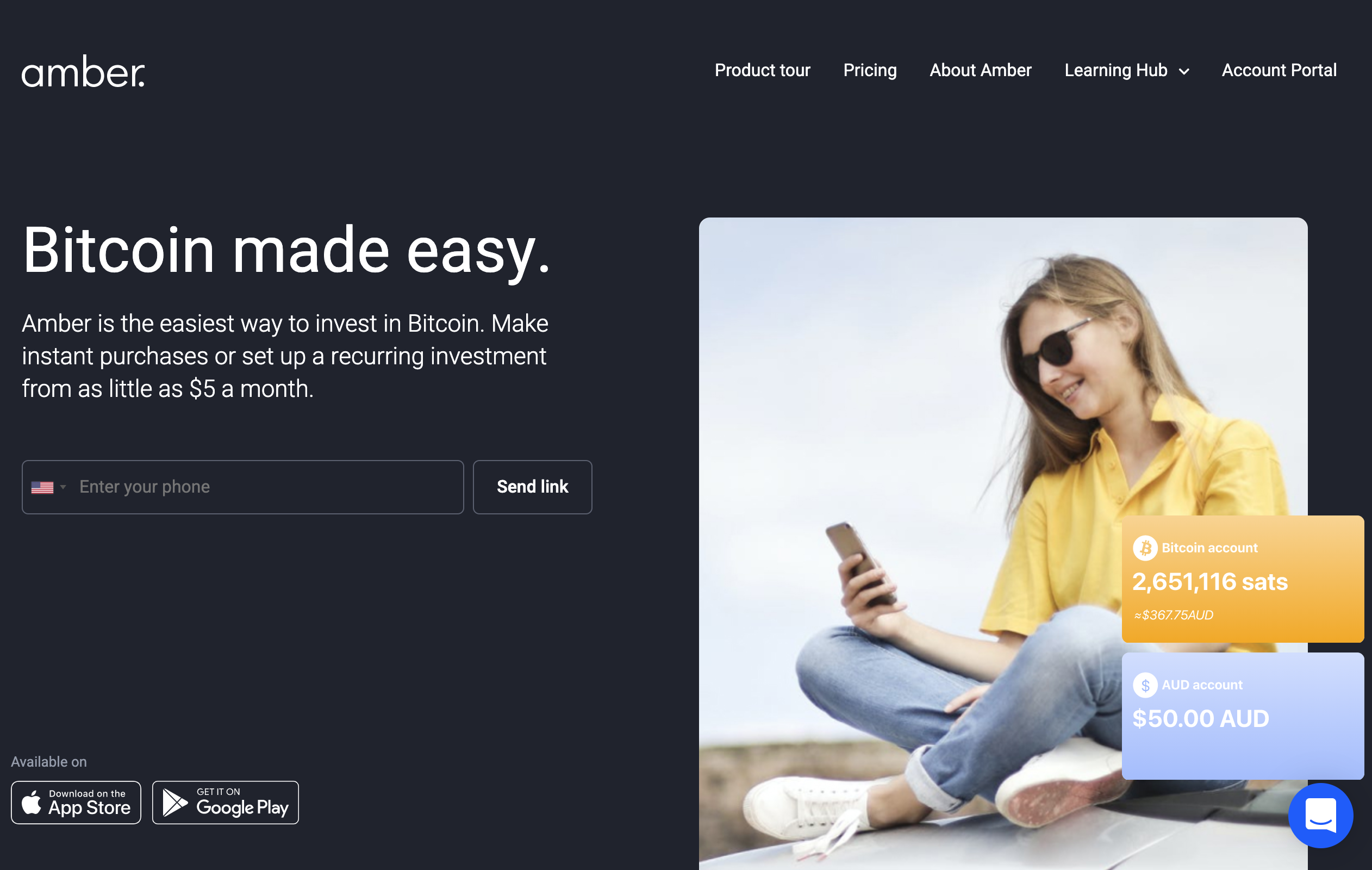

Amber is an Australian-based Bitcoin accumulation app. It makes it easy to Dollar Cost Average (DCA), auto-buy-the-dip, auto-withdraw, and accumulate the hardest money, scarcest asset on Earth.

Features

- Auto-accumulate Bitcoin

- Spend your Fiat

- Borrow Fiat against your Bitcoin

Why it’s great

With Amber you can collect Bitcoin and self custody it without having to think too hard about it.

Presenter

Aleks Svetski, CEO & Founder

Svetski is a controversial writer, researcher, keynote speaker, and scholarship recipient who pursued entrepreneurship instead of textbooks. He founded Amber in 2018, the world’s first Bitcoin-only DCA app.

LinkedIn