A look at the companies demoing at FinovateFall on September 13-15, 2021. Register today and save your spot.

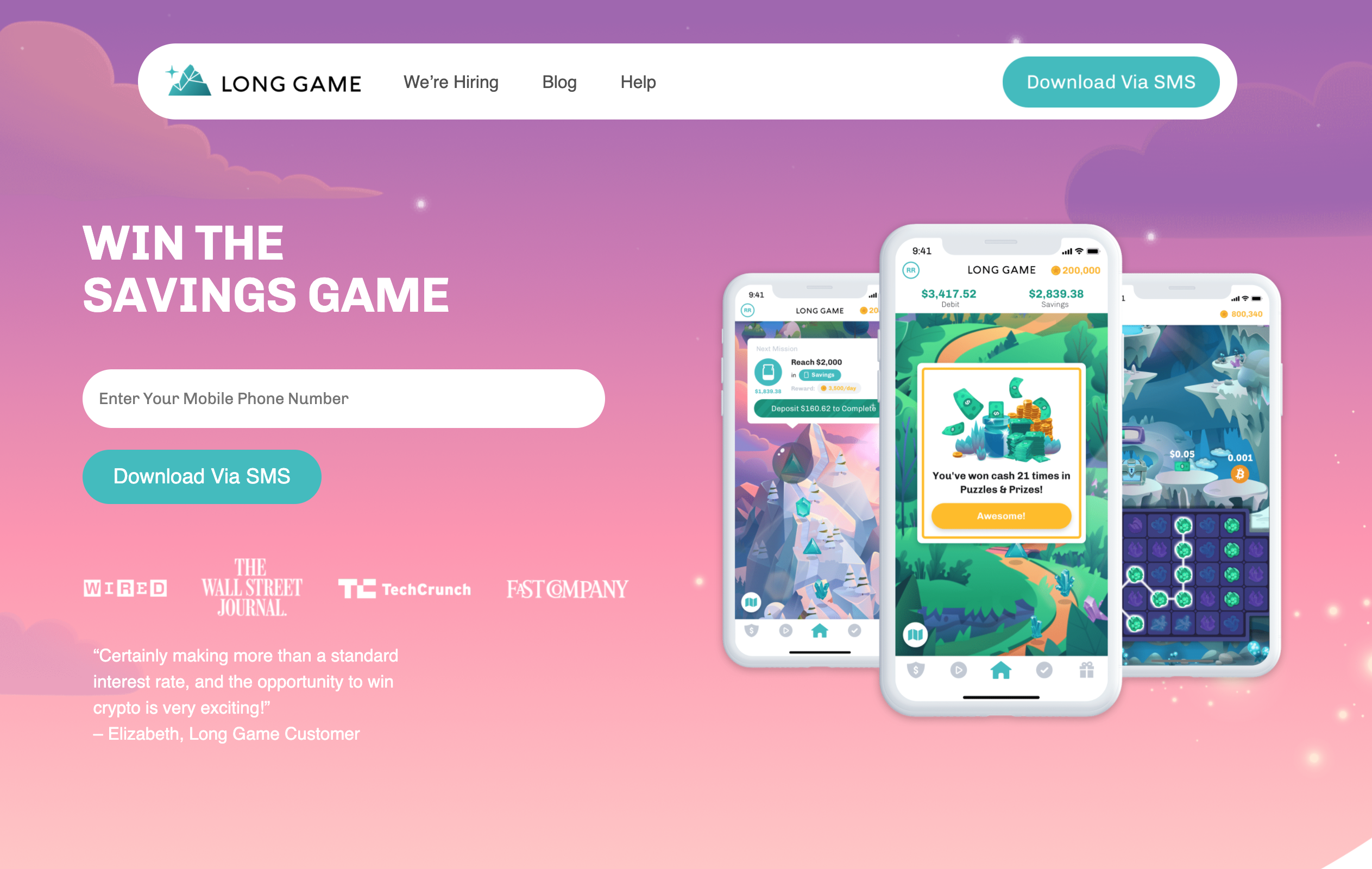

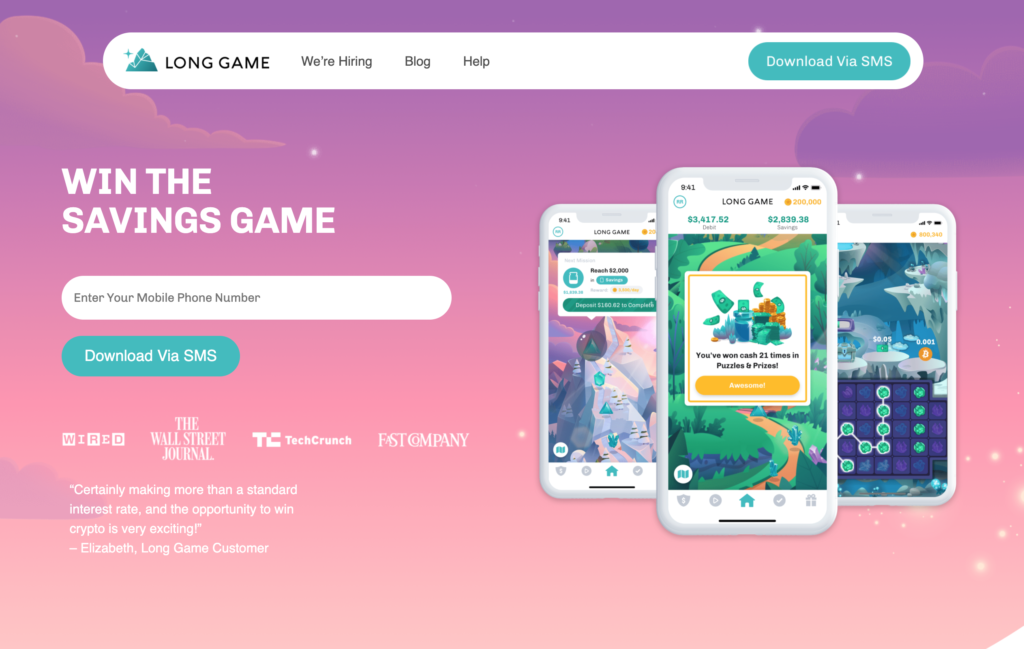

Long Game‘s gamified finance app helps banks acquire new customers and increases engagement with their current customers in the Millennial and Gen Z demographics.

Features

- Engagement with bank products

- Acquisition of new accounts

- Promotion of financial literacy

Why it’s great

Long Game is a turn-key, bank-branded mobile game that drives new account sign-ups, savings, financial literacy, and brand affinity with Millennial and Gen-Z customers.

Presenter

Lindsay Holden, CEO & Co-Founder

Holden is Co-Founder and CEO of Long Game, a mobile app that uses gamification and behavioral finance to make finance fun.

LinkedIn