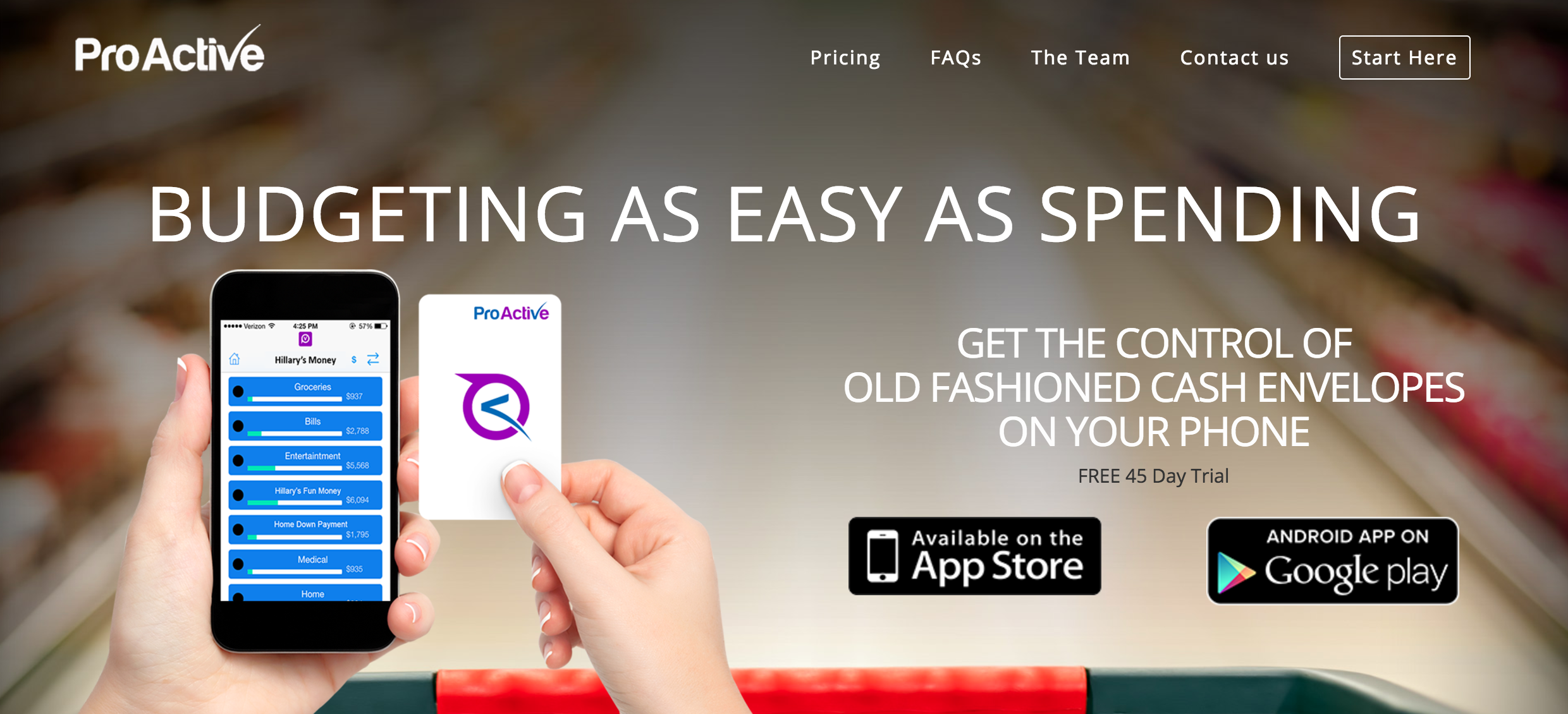

At FinovateFall 2016 in New York, ProActive Budget debuted a digital twist to cash envelope budgeting. Given the prolific, user-friendly financial management solutions of today, cash budgeting may seem dated, but it’s really not—many of us, myself included, have friends who still use this method of budgeting today. As the company’s adviser Ross Jardine said in ProActive Budget’s FinovateFall 2016 demo, “Personal finance apps don’t work. All those fancy graphs and charts rarely change behavior.”

ProActive Budget’s system works similarly to cash-envelope budgeting. But instead of opening an envelope and removing cash to spend in a certain category, users open the app and instantly load funds onto a specialized, prepaid card to make the transaction. As CEO and founder Ryan Clark says in the demo, the reason this works is that “both cash envelopes and ProActive require users to think before they spend … and that is the key to changing the behavior.”

Company facts:

- $137,000 invested

- 3 employees

- Pre-sales

- Live with 120+ users 2 weeks after Finovate demo

- Founded in 2015

- Headquartered in Utah

ProActive Budget CEO and founder Ryan Clark demos the startup’s digitized cash-envelope budgeting system alongside Ross Jardine.

ProActive Budget CEO and founder Ryan Clark demos the startup’s digitized cash-envelope budgeting system alongside Ross Jardine.

We chatted with Ryan Clark, CEO and founder of ProActive Budget, for further insight into the startup and its goals for the long run. Clark has 10 years of experience as a personal finance adviser and has ranked in the top 10% of advisers nationwide.

We chatted with Ryan Clark, CEO and founder of ProActive Budget, for further insight into the startup and its goals for the long run. Clark has 10 years of experience as a personal finance adviser and has ranked in the top 10% of advisers nationwide.

Finovate: What problem does ProActive Budget solve?

Clark: Consumers want better budgeting, savings, and debt-elimination tools for their money. They want to teach their children about money and share or pay others easily. Financial institutions and advisers want better leads and user engagement, customer retention and acquisition. Employers want happier, more committed employees with fewer sick days and an easier way to do payroll

Finovate: Who are your primary customers?

Clark: We are B2C or B2B2C. Our customers are everyday people, but it may be delivered through existing B2B channels.

Finovate: How does ProActive Budget solve the problem better?

Clark: All existing budgeting apps fail to change spending behavior because they are reactive. You spend and then they tell you about it. They all lack the power to require thought at the critical moment of the purchase. Only cash envelopes have had this ability, but it’s cash-based. ProActive is cash-less and requires its users to think before they can spend, just like cash.

When the spending problem is solved, debt and savings take care of themselves. This builds trust, commits employees, reduces money fights with spouses, and makes people happier.

Finovate: Tell us about your favorite implementation of your solution.

Clark: Having come from the financial adviser/coach world, my focus was always in helping people create more wealth. I stopped selling investments because I saw that it did little for the masses. They needed more focus on the basics. Budgeting is one of those things where, if we solve it, everything else will take care of itself. It’s amazing! But there’s little money in it so the financial industry does nothing in that space.

My favorite implementation is through an adviser or coach. Our system will help instill the discipline the users want and get them out of the paycheck-to-paycheck grind and out of debt. It will move them along toward being a great saver and eventually a savvy investor because it gives them control—simple, easy, control.

Finovate: What in your background gave you the confidence to tackle this challenge?

Clark: I had a failure on some software we tried to build in my practice. I tried very hard to make a software initiative work. I read books about software and project management, but after a year we tossed in the towel. Six months later we organized ProActive and began building. This time I knew much better how to do software.

Finovate: What are some upcoming initiatives from ProActive Budget that we can look forward to over the next few months?

Clark: The most exciting is the release of our 2.0 version. This will give the currently available prototype a massive facelift and a host of new features. Watch for it in Q1 of 2017.

Finovate: Where do you see ProActive Budget a year or two from now?

Clark: In a year, I see us integrated with several banks, credit unions, adviser groups, and employers. Thousands are experiencing the peace and simplicity that comes from making choices before purchasing. They’re saving more, and their relationship with their spouse is better. They’ve had fewer money fights because of the increased communication and better decisions about money. Our testimonials page will be filled with such stories.

Check out ProActive’s live demo video from FinovateFall 2016 in New York: