Phygital may not be heading for inclusion in the Oxford Dictionary anytime soon. But it does attract attention to your fintech startup, especially when you are specializing in integrating digital and physical channels.

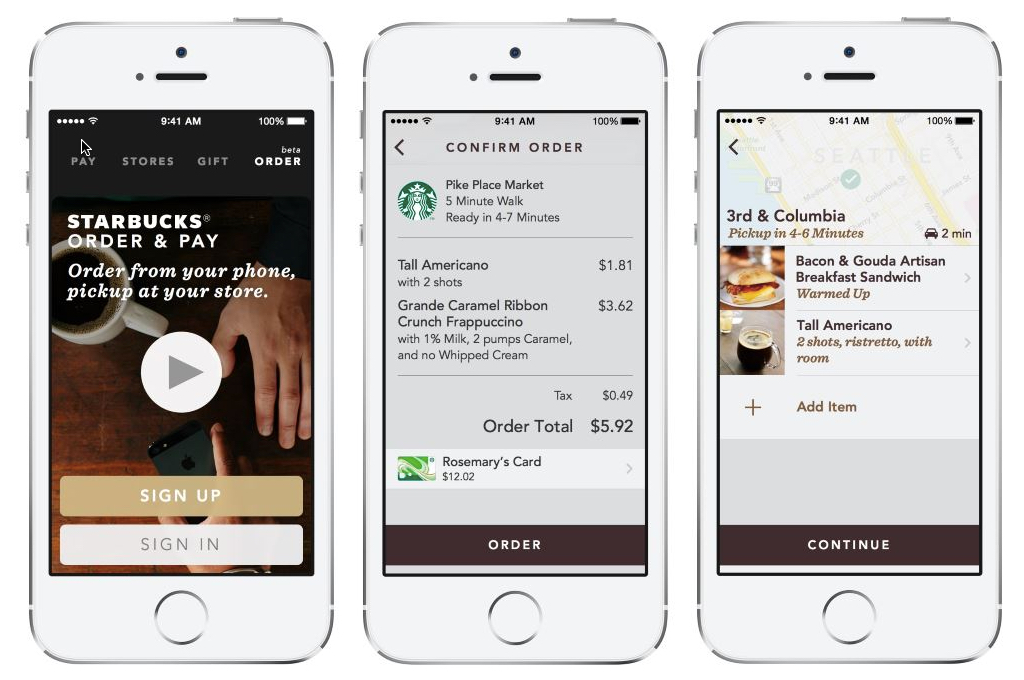

Enter Root Banking, a San Francisco-based startup from industry veteran Matt Krogstad (see note 1). I met Matt when he was at mobile banking pioneer M-Com (acquired by Fiserv in 2011). Fast forward six years, and after stints at Bank of the West and First Republic, Matt is back in the fintech startup world, with a service designed to bring Starbucks-level channel integration to banking.

Root Banking’s service connects mobile customers to their branch to order ahead. For example, last Friday I needed a money order to pay a local tax bill when my ACH was inadvertently returned. This was double frustrating. First, my bank fumbles the electronic transaction, then I had to make a trip to the branch and wait in line, then wait at the teller station while they printed up a money order. Had I been able to order it in advance, and just picked it up, the whole thing would have been less unpleasant.

Root Banking’s service connects mobile customers to their branch to order ahead. For example, last Friday I needed a money order to pay a local tax bill when my ACH was inadvertently returned. This was double frustrating. First, my bank fumbles the electronic transaction, then I had to make a trip to the branch and wait in line, then wait at the teller station while they printed up a money order. Had I been able to order it in advance, and just picked it up, the whole thing would have been less unpleasant.

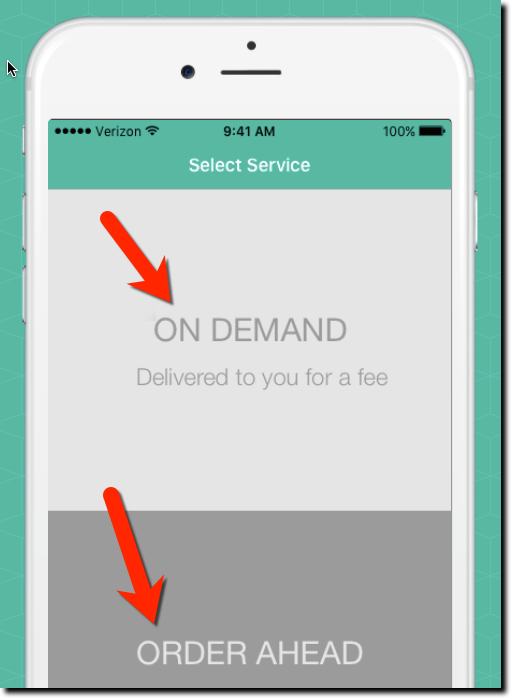

The other primary use cast for Root Banking is mobile delivery. Imagine if my bank would have dropped the money order off at my home (or better yet, mailed it to the City of Seattle treasurer). I probably would have opted to avoid a delivery fee, but it would be nice to have the option.

The startup hopes to integrate their phygital services into the FI’s existing mobile app. But Root will make a standalone app available if necessary. Several banks are piloting the service and are not yet integrating the requests into branch systems, instead simply delivering the requests through secure digital channels.

Bottom line: To me, the order ahead use case is most interesting. Most times I’ve needed to visit the branch (usually for small business matters), there is paperwork that could have been uploaded in advance to reduce my time at the branch by an order of magnitude. Not only is that good for customers, it potentially drives costs out of the system at the branch level. A win-win.

Contributor: Jim Bruene (@netbanker) is Founder & Advisor at Finovate as well as Principal of BUX Certified, a financial services user-experience accreditation program.

Note:

1. For reference, see Penny Crosman’s 10 January article in American Banker

One of my favorite features unveiled last week, was Universal Checkbook from

One of my favorite features unveiled last week, was Universal Checkbook from