It comes as no surprise to anyone that online banking and bill pay customers are more profitable than non-adopters. This correlation, driven by the favorable demographics and lower attrition of online adopters, has clearly been established since the early days of the Web.

It comes as no surprise to anyone that online banking and bill pay customers are more profitable than non-adopters. This correlation, driven by the favorable demographics and lower attrition of online adopters, has clearly been established since the early days of the Web.

What's far more difficult to prove is causation. Does online banking/bill pay actually lead to more profits? The main hypothesis: by locking customers into an electronic service, they are not only less likely to move their accounts, they will also consolidate deposits and other financial activity at the provider of the online services. We'll get back to that.

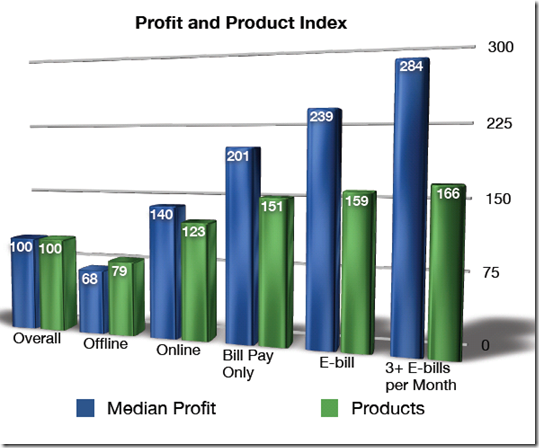

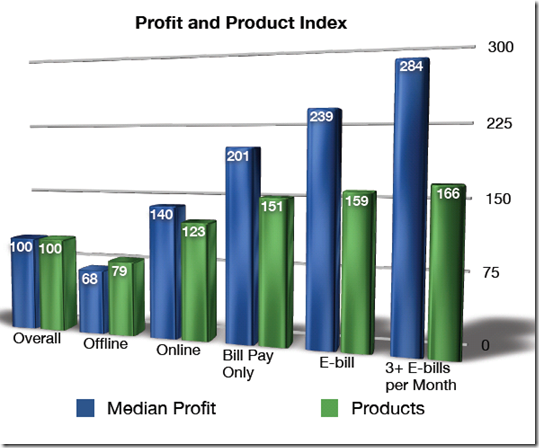

It's not surprise that ebill users are more profitable

But first, here's some new correlation data from SunTrust that can help you benchmark your own performance or serve as a proxy for your business case. The study was released in late 2007 and was underwritten by ebill provider, CheckFree. The research company, Aspen Analytics, published a short white paper on the project here. And Forrester's Cathy Graeber published a research note three weeks ago here. The two companies presented their findings in a webinar this week (replay here).

One interesting aspect of this study is that ebill customers were segmented into casual users that viewed one or two ebills per month and heavy users that looked at 3 or more ebills each month. The heavy users owned 5% more SunTrust products and were 20% more profitable to the bank (see chart 1 below).

Source: Aspen Analytics/CheckFree, Nov. 2007

Projections based on 13 months of SunTrust data captured between Feb. 2006 and Feb. 2007

Even more dramatic was the correlation between online product usage and attrition, defined as the closure of the primary SunTrust checking account. Offline customers were six times more likely to close their accounts in the six-month observation period

than heavy ebill users (see note 1).  Source: Aspen Analytics/CheckFree, Nov. 2007

Source: Aspen Analytics/CheckFree, Nov. 2007

The bottom line: 5-year NPV for heavy ebill users was 36% higher than those that used bill-pay only and nearly double the online-banking-only population (no use of bill pay

or ebilling).

Source: Aspen Analytics/CheckFree, Nov. 2007

But does ebill use CAUSE profits to increase?

The correlation data above illustrates the importance of taking good care of bill pay/ebill customers. However, to justify incremental investment, you need to know the expected payback, i.e., how much more revenue/profits can you expect by moving customers into ebilling.

This study made a concerted effort to determine if the use of free ebilling services can leads to more profits. The researchers normalized the population across hundreds of product, tenure and demographic variables drawn from SunTrust's own CRM files and from appended Equifax info. But absent full before-and-after interviews with the subjects, it's still just a model it hard to fully test. There could be important factors outside the SunTrust/Experian datasets that account for lower attrition. For example, perhaps the well-heeled online banking customers who closed their primary SunTrust checking account in late 2006 stayed away from ebills because they had a sense they would be moving in the near future, so why bother setting up ebills.

But with these caveats in place, it does appear this study demonstrates that moving customers into the heavy ebill category causes them to be more loyal, at least in the short term. Cathy Graeber, the Forrester VP participating in the webinar, certainly thinks so.

The following chart shows that about half the decline in customer churn (36 points) has nothing to do with ebill usage but should be attributed to the favorable customer profile of ebill users. However, the remainder of the decline (32 points), is attributable to being heavily involved in ebills (viewing 3 or more per month). Put another way, ebilling decreases the expected attrition of this type of customer household by almost 50%.

Source: Aspen Analytics, The E-Bill Effect: The Impact on Customer Attrition from Banks that Offer E-Bill, Nov. 2007

Note: Ebill customers in this example are heavy users looking at 3 or more ebills per month.

Bottom line

If those results hold true for other banks' customer bases, it could justify significant investment in ebilling activation programs. For example, if you value an active checking account at $200 per year and it costs $100 to convert them to ebilling, and you achieve a 33% reduction in attrition, the net gain is $230 per new ebill account over five years. Convert 10,000 users and the NPV would be more than $1.5 million (see note 2).

Even if you discount the results due to research bias (it was after all underwritten by the leading ebill provider) or you take issue with the methodology, it does appear that the companies have proven a material reduction in attrition by frequent ebill usage.

And to give it the final "co

mmon sense" test. It does seem logical that someone who's taken the trouble to set up online banking, online bill pay, and register three or more bills for delivery, would tend to be less likely to ditch their checking account for that sexy deal across town.

Notes:

Definition of customer segments:

- Overall = Entire SunTrust customer base

- Offline = SunTrust customers that do not use its online banking or bill pay/ebills

- Online = SunTrust customers who use online banking but NOT bill pay/ebills

- Bill pay only = SunTrust customers who use its online bill pay system, but NOT ebills

- E-bill = SunTrust customers who use its ebill service and view 1 or 2 bills per month on average

- 3+ E-bills = SunTrust customers who use its ebill service and view 3 or more bills per month

1. Attrition was defined as anyone who closed their primary SunTrust checking account between Sep 2006 and Feb 2007 and did not open a new one during that period. It's a pretty short window, so that's one limitation of the findings that you should be aware of. Over a two or three year period, their could be much different results.

2. $200 saved x 5 years x 33% attributed to the ebill program = $330 gain less the $100 cost to convert to ebilling = $230. Across 10,000 customers the total net gain would be $2.3 million. Discounted at 12%, the NPV is more than $1.5 million.

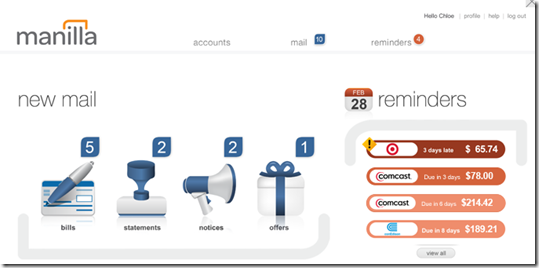

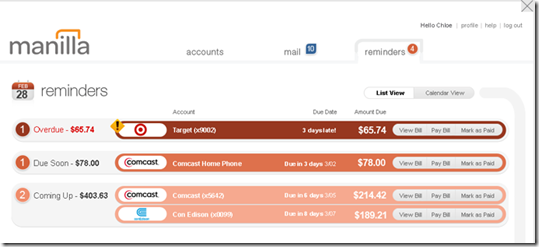

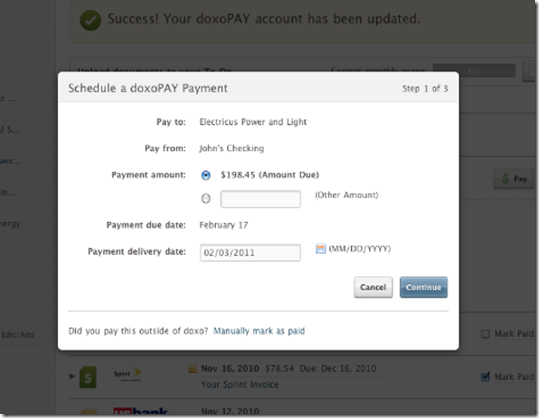

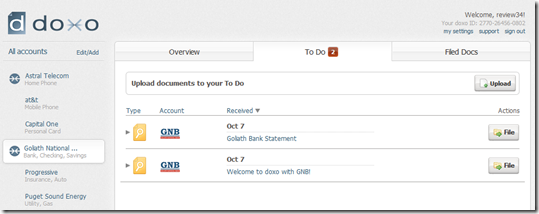

I dropped by doxo’s Pioneer Square (Seattle) digs this morning to get an update on their latest news, payment capabilities added to its mobile app. That’s potentially game changing for smaller billers who still struggle with online payments, let alone the nuances of mobile delivery. We’ll get back to that later.

I dropped by doxo’s Pioneer Square (Seattle) digs this morning to get an update on their latest news, payment capabilities added to its mobile app. That’s potentially game changing for smaller billers who still struggle with online payments, let alone the nuances of mobile delivery. We’ll get back to that later.

It comes as no surprise to anyone that online banking and bill pay customers are more profitable than non-adopters. This correlation, driven by the favorable demographics and lower attrition of online adopters, has clearly been established since the early days of the Web.

It comes as no surprise to anyone that online banking and bill pay customers are more profitable than non-adopters. This correlation, driven by the favorable demographics and lower attrition of online adopters, has clearly been established since the early days of the Web.