SmartyPig, which launched its social savings program in March 2008 (previous post) and debuted at Finovate Startup (video here), hit the world stage Dec. 16.

SmartyPig, which launched its social savings program in March 2008 (previous post) and debuted at Finovate Startup (video here), hit the world stage Dec. 16.

The company, operating out of world headquarters in Des Moines, Iowa, partnered with ANZ Bank to launch SmartyPig in Australia. ANZ was able to lay claim to being the first to offer social savings down under (see note 1).

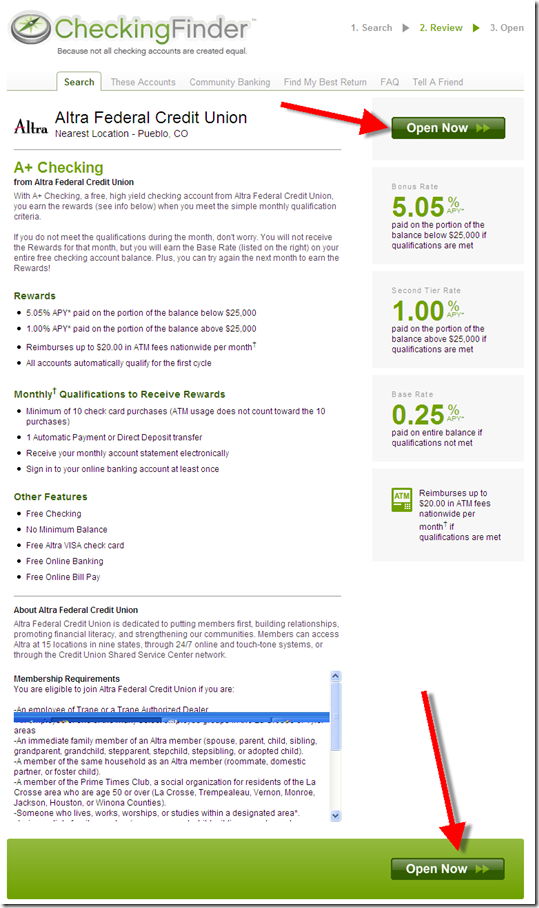

The site is nearly identical to the stateside version, but ANZ has a smidgen more branding (see screenshot below). Also note the new emphasis on being 100% free, a benefit echoed on the U.S. site as well.

However, unlike U.S. partner and part owner, West Bank (note 2), which has the SmartyPig logo plastered all over its site (see screenshot below), the ANZ site has no mention of the product, it even draws a blank using ANZ site search.

Social savings metrics from SmartyPig

Because SmartyPig’s sole emphasis is on goal-based savings, its results provide unique insights into the market. While the company has not released account totals, its partner, West Bank disclosed that total deposit in the program amounted to $5.6 million at the end of Q3.

While that’s less than $1 million per month since launch, since many accounts start very small, it could be a healthy number of accounts. And with the requirement of automated savings additions, the growth potential is excellent. Assuming a $1,000 average account balance (note 3), the company would have attracted more than 5,000 total accounts during its first six months.

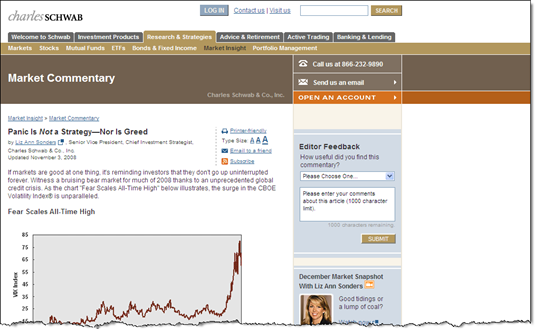

After the initial launch spike, site traffic has been steadily increasing to 25,000 monthly visitors in December (see chart below).

SmartyPig has made available information on the savings goals made by users. The data is through Oct. 2008 (except total deposit amount) and includes only the totals from the U.S. site.

Total amount on deposit (30 Sep 2008, per West Bank 10Q): $5.6 million

Primary account holder by age*:

18-25 >>> 30%

26-35 >>> 37%

36-45 >>> 20%

46+ >>>>> 13%

*By law, primary account holders must be 18 or over,

so children’s goals are owned by their parents

Average goal amount across all holders on the following dates:

April 1 >>> $3,900

May 1 >>>> $7,300

June 1 >>> $7,400

July 1 >>>> $7,400

Aug 1 >>>> $7,900

Sep 1 >>>> $7,700

Oct 1 >>>> $8,600

Goal amount by category:

Travel >>>>>>>>>>>>> 21% (Avg = $4,400)

Holiday spending >>> 12% (Avg = $900)

Electronics >>>>>>>> 10% (Avg = $2,500)

Home improvement >> 6% (Avg = $12,900)

Unspecified >>>>>>>>> 5% (Avg = $9,800)

Weddings >>>>>>>>>>> 5% (Avg = $7,900)

House down payment or addition >>> 4% (Avg = $22,200)

Emergency fund >>>>> 3% (Avg = $6,600)

Babies >>>>>>>>>>>>>> 3% (Avg = $5,100)

Home furnishings >>>> 2% (Avg = $3,500)

Car or car expenses >> 2% (Avg = $6,800)

College >>>>>>>>>>>>> 1% (Avg = $9,700)

Other >>>>>>>>>>>>>> 26% (Avg $10,700)

Average projected time until goal met based on savings rate: Just over 4 years

SmartyPig ANZ Version (13 Jan 2009)

USA partner West Bank’s homepage (14 Jan 2009)

Traffic chart from Compete (14 Jan 2009)

Notes:

1. See our most recent Online Banking Report: Growing Deposits in the Digital Age, for more info on social savings, along with 16 other strategies.

2. Des Moines, Iowa-based West Bank owns 18% of SmartyPig according to its 30 June 2008 SEC filing.

3. My guess, not a number that has been disclosed.

Next up is

Next up is