In more direct banking news,* Citibank landed all over the media with the launch of a 4.5% no-minimum-balance savings account. A Citi checking account is required to qualify. The reason for the media attention had nothing to do with the rate, and everything to do with the channel conflict inherent in the offer.

In more direct banking news,* Citibank landed all over the media with the launch of a 4.5% no-minimum-balance savings account. A Citi checking account is required to qualify. The reason for the media attention had nothing to do with the rate, and everything to do with the channel conflict inherent in the offer.

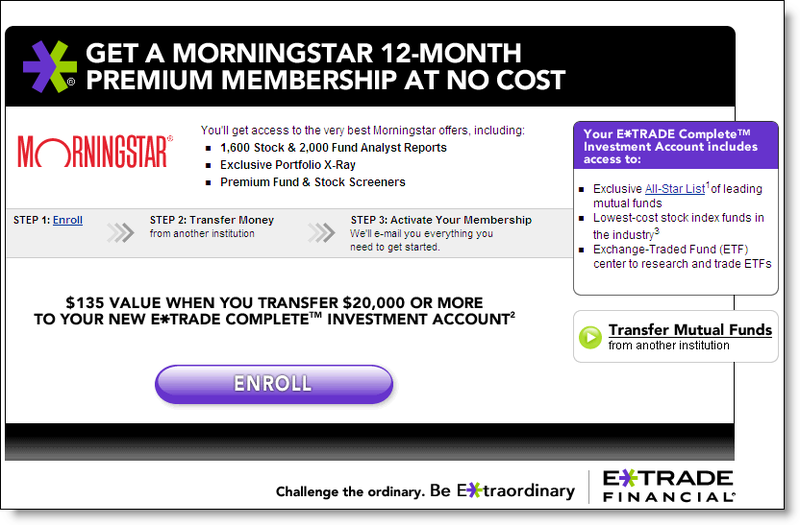

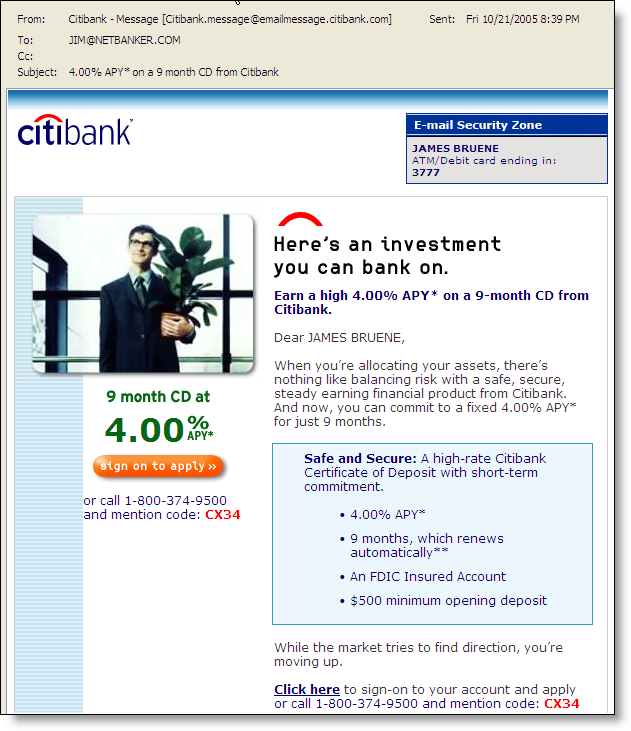

The first line of fine print under the offer was (click on screenshot below for closeup; click on "Continue reading…" below for the full text of the mousetype):

This offer is not available at Citibank financial centers

Many stories contained an inaccurate observation that Citibank was launching an entirely new Internet bank. This inaccuracy seems to have its roots in the Reuters wire piece that first discussed the savings account offer.

Many stories contained an inaccurate observation that Citibank was launching an entirely new Internet bank. This inaccuracy seems to have its roots in the Reuters wire piece that first discussed the savings account offer.

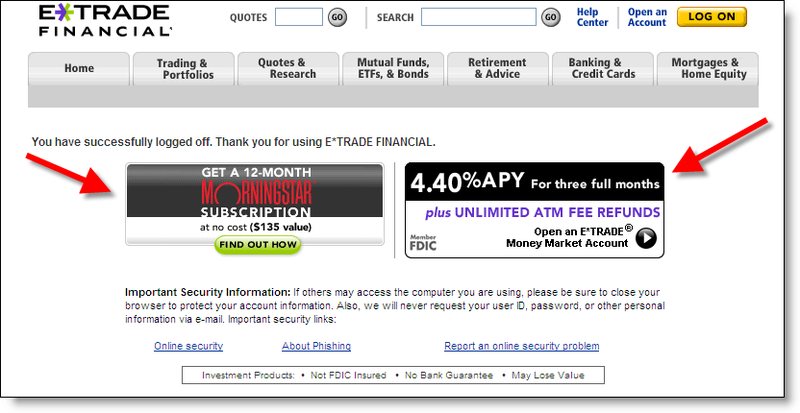

The truth: This is NOT a new bank. It’s NOT a new website. It’s NOT even a strategic shift for Citi, which has previously made high-rate deposit offers to online customers (see OBR 120/121). This is simply a new advertising campaign targeted to online users, especially those frequenting Yahoo’s homepage (click on inset to see the ad positioning).

Any of Citi’s existing 2.5 million online banking customers can open the account by logging in to online banking and selecting "open an account" and following the directions. A small link in the lower right of the landing page directs existing Citi customers to these instructions.

Initial funding can be made by mail, credit card, debit card, or ACH (electronic interbank funds transfer). After the account is open, additional deposits can be made at Citi ATMs or through IN-BRANCH deposits.

Analysis

You’ve seen high-rate savings account offers before. There is little new here. What can you really say about a savings account once you deal with the rate and the balance requirement?

What sets Citibank apart in this instance is its near-perfect sign-up form (click on inset right). The page is dominated by a banner promising that it will "take 10 minutes & 4 simple steps." The bank backs that up by showing the four steps immediately below the banner.

What sets Citibank apart in this instance is its near-perfect sign-up form (click on inset right). The page is dominated by a banner promising that it will "take 10 minutes & 4 simple steps." The bank backs that up by showing the four steps immediately below the banner.

-

Tell us about yourself

-

Confirm your identity

-

Fund your account

-

Provide your E-Signature

Although these steps are the same as what thousands of banks have done for years, Citi’s language is exceptional in its clarity and how it addresses consumer fears. The "confirm your identity" demonstrates the bank’s commitment to stopping fraud. The "provide your e-signature" lets customers know they won’t have to mail some old-fashioned signature card to the bank before they can start enjoying the new rate.

The bank also uses several other devices to ensure that customers feel confident about acting on this offer:

- "We care about your privacy and security" box with link for more info (upper left)

- VeriSign clickable logo (left)

- Ability to save and complete the application later (upper left)

- Ability to print a blank application to mail in (upper left)

- Link to account details and fees (upper right)

- Link to live chat or toll-free number (right)

But we called this "near-perfect" for a reason.

There are several concerns not addressed on this page:

- Timing: How long will it take before my initial deposit starts earning 4.5%?

- Guarantee: Even though they address the need to confirm your identity, the bank doesn’t come right out and guarantee the safety of the process.

- No reinforcement of account benefits: Although it’s been only a few moments since the customer navigated to this page, don’t let them lose sight of why they should go through the uncomfortable process of typing their personal details into a browser that may or may not be transmitting their keystrokes to Uruguay. Keep that 4.5% number right in their face.

Another weakness: navigation overload. Citi has included its full My Citi personal navigation across the top along with all the site utilities in the upper right. While this is helpful for research purposes, it tends to be distracting and will pull customers away from the savings account application.

Final Grade

Despite a few minor weaknesses, it’s impressive work. Definitely scores an A and is closing in on A+.

Web address for offer: http://direct.citibank.com/CBOL/06/esavings/default.htm?

*We’ve started a new Direct Banking category for Financial Marketing Week, so you can easily find all the articles on the topic with a single click.

Continue reading “Citibank’s 4.5% Direct Banking Savings Account”