As the price of bitcoin returns to old highs, we see a renewed appetite for cryptocurrencies and digital assets of all kinds. Add to this a new generation of investors raised on the wealth-building possibilities of alternative assets like private securities.

The result is a range of new opportunities – as well as customer expectations and regulatory obligations – for financial services firms and fintechs alike to deal with.

We checked in with Scott Purcell, CEO and Chief Trust Officer of Prime Trust, to discuss this new landscape of digital asset investment and management, and find out what we should expect in terms of innovation in this space in 2021.

Many longer-time Finovate watchers will recall the work you did with FundAmerica, which was acquired by Prime Trust a few years ago. Tell us about what you are doing as CEO of Prime Trust today?

Scott Purcell: I am very proud of the work we did for the crowdfunding industry with FundAmerica, and in fact it continues to provide escrow, compliance, payment processing, and other services to about 75% of the market – just now under the Prime Trust umbrella. My role has evolved rapidly as Prime Trust has grown to provide services to new industries, most notably blockchain, real estate, and the next generation of alternative trading systems (ATS), which are exchanges for private securities.

We are one of the top financial institutions servicing the cryptocurrency market, and by far the leading infrastructure provider for ATS. That means a lot of growth, which has taken me away from being hands-on with sales, product development, operations, and accounting to a point where I now have an incredible team of people who are responsible for those areas, and frankly they are way better than me at doing them.

This has set me free (well, if 12-hour days are considered “free”) to focus on the vision and product roadmap, overall market strategy, and closer engagement with key investors, partners, vendors and customers. It’s fun to see the company grow and we are incredibly excited about the things on our plate for 2021.

Prime Trust recently announced a partnership with Zytara to help them launch their stablecoin. How did this relationship come about and what do you believe will come of it?

Purcell: Zytara is built on the Stably stablecoin platform which integrates into Prime Trust’s API’s for back-office infrastructure. As the online gaming industry continues to grow, so does the need for a common stablecoin that can be used across multiple platforms. Zytara will be covering this and also plans to bring a variety of other items to involving digital assets to the gaming community. We are excited to see Prime Trust infrastructure being leveraged for video gaming as a new industry sector with unlimited upside.

There’s been a resurgence in interest in cryptocurrencies of late – and the rise of stablecoins has been a part of this. What do you think are the key drivers of interest in stablecoins right now? How powerful and enduring do you believe those drivers to be?

Purcell: Prime Trust provides services for over two dozen stablecoins, so I’ve got pretty good visibility into what works and what doesn’t. The key thing is utility. People need to have a frictionless and compelling reason to use a stablecoin. Zytara is a great example of that, as it will be used for easy transactions in a gaming environment. Others are specifically built for use on crypto exchanges as a mechanism to de-risk from volatile crypto or to take a break from trading, while keeping funds in electronic form so they are easy to re-engage in the markets. The more that stablecoin issuers can add utility and ease of use, then the more enduring they will become.

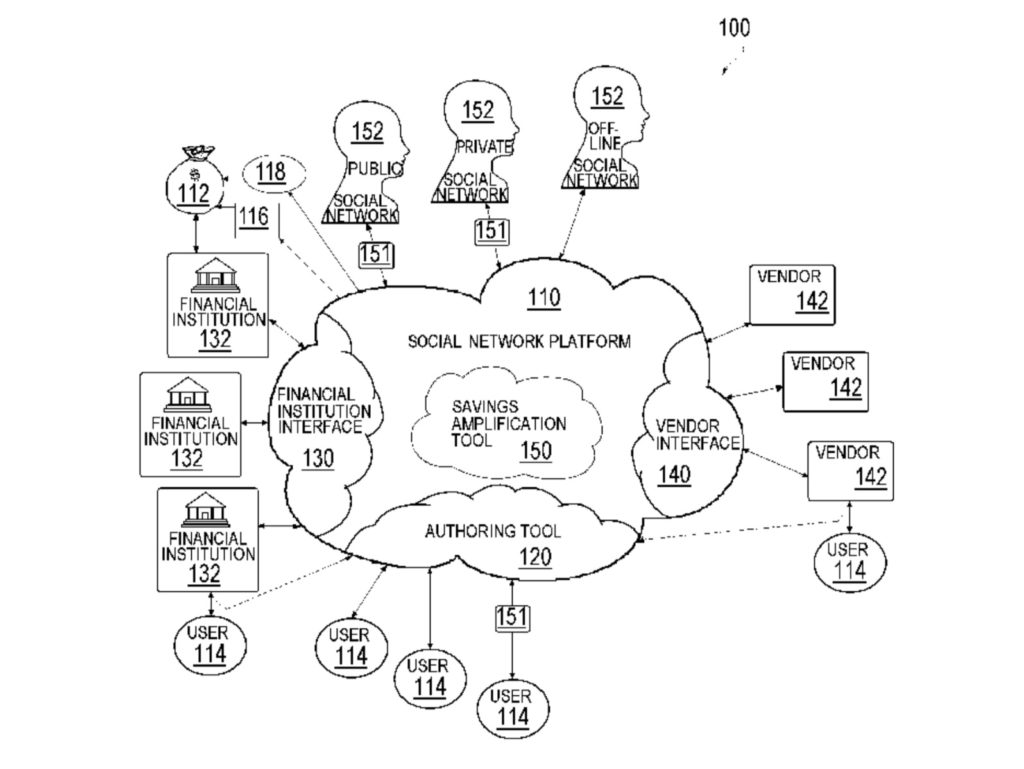

Let’s talk about Prime Trust more broadly. When it comes to fintech headlines, financial infrastructure companies are among some of the most critical – and sought after – partners in financial services right now. What role are financial infrastructure companies like Prime Trust playing in helping facilitate the next generation of fintech apps and innovations?

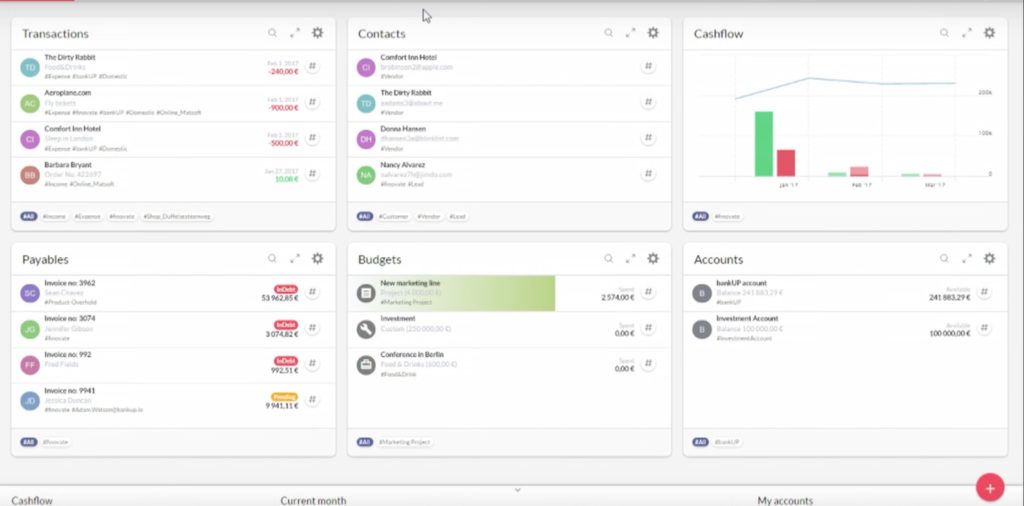

Purcell: Every single fintech innovator needs a set of financial services in order to build their businesses, with APIs to integrate into. And surprisingly there are very few who do this. That’s why you’ve seen Robinhood, CashApp, Chime, Acorns, Betterment, and so many others scramble around cobbling together different bank, compliance, custody and other vendors. The set of services these innovators need is common across all markets and includes payment processing, compliance, custody of alternative and traditional assets, accounts for individuals, businesses and retirement programs, trusted transaction settlement, reporting, escrow, debit cards, and (especially in crypto) fiat on/offramps and liquidity.

Prime Trust is the only partner from start through growth that fintech innovators can rely on as a single API-driven source for all of these services. Thus, the next generation of fintech success stories can build and launch their businesses in record time to market, and confidently scale their back-office operations.

This fall you launched a core accounting and customer asset management platform, PrimeCore. What capabilities does this platform provide banks, exchanges, and other financial institutions? How has the solution been received?

Purcell: The traditional bank core systems – FIS, Fiserv, and Jack Henry as well as traditional trust company core systems, SunGard, Innovest and others – are expensive, slow and clumsy at handling non-traditional business models … which is what fintech innovation is all about. For instance, none of them can hold assets out to 18 decimal places of precision, which both fractionalized and digital assets require, and none provide multi-asset transaction settlement systems. And they are incredibly slow at onboarding new customers and enabling modules on-demand.

So, we built PrimeCore out of frustration at trying to work with some of these vendors, who just weren’t interested in the rapid innovation and speed of service required for new and emerging markets. Not only does this give us control over our costs and our product rollouts, it also provides a much better experience for our B2B customers (and, thus, their retail and business customers).

How has the COVID-19 pandemic impacted Prime Trust’s operations – as well as those of your company’s clients and partners?

Purcell: The good news is that we’ve continued to grow like crazy during the pandemic. It’s been incredibly frustrating to not be able to hop on planes to visit customers, partners, vendors, and our investors in person. And it’s caused some havoc at times when employees or their relatives tested positive, and we had to send the whole company home until people tested negative. This may not be a huge problem for some departments, such as engineering or sales, but it is hard on compliance, the wire room, accounting and the executive team.

Also, as a financial institution, each employee is required to take at least one contiguous week a year of vacation, and at this time that’s not exactly fun telling them “okay, just stay home even more now!” Like everyone else, we can’t wait for this to be behind us so we can get back to business … and living our lives.

What trends this year in the financial services industry do you see as becoming even stronger in 2021? In what way will Prime Trust be a part of those trends?

Purcell: Payments is a $110 trillion annual market and, with the pandemic, the drive to “contactless” and remote systems has been exponential. And the fractionalization of traditional and alternative investments, which has been a proven trend by WealthFront, Acorns, and others, will drive an entirely new phase for capital markets. Prime Trust is looking forward to servicing these trends as they continue to build momentum and disrupt the status quo of financial services in 2021. It’s going to be a great year!

Photo by Joshua Woroniecki from Pexels

In the run-up to FinovateFall, we interviewed George Anderson, CEO and founder of

In the run-up to FinovateFall, we interviewed George Anderson, CEO and founder of