Mambu, the cloud-based banking platform based in Germany, is partnering with U.K. business banking platform Tide to power the company’s revolving credit facilities and overdrafts for small businesses.

“There is a need to be flexible, agile, and customer-centric in the design of financial products,” Managing Director of Mambu EMEA Eelco-Jan Boonstra explained. “Legacy technology constraints can undermine even the best innovation strategy.”

The collaboration will enable Tide to overhaul its product suite in order to better serve customers in a number of locations around the world. This includes offering larger overdrafts, credit cards, and invoice financing, as well as enabling Tide members to lend to each other leveraging solutions managed by Mambu.

“When today’s customers evaluate financial institutions, they no longer compare different banks, they compare experiences,” Boonstra said. “We see this partnership approach as the future of banking technology.”

Regtech is all the rage in fintech these days. From helping businesses negotiate a wave of new regulation – from GDPR to PSD2 – to empowering firms to combat fraud, companies involved in developing technologies to ensure that businesses are getting and staying compliant are enjoying rare attention from the rest of the industry.

A recent review of top regtech startups in Europe in Fintech News was an example of the light increasingly shining on these companies and their vital role in supporting a fintech industry that a growing number of financial services customers – and other businesses – are relying on.

The review cited research from KPMG that anticipates regtech spending in 2022 climbing to $76 billion. Analysis from XAnge, a European VC firm, finds approximately 140 regtech startups in the E.U., divided fairly equally between compliance management, KYC/AML, and risk management solutions.

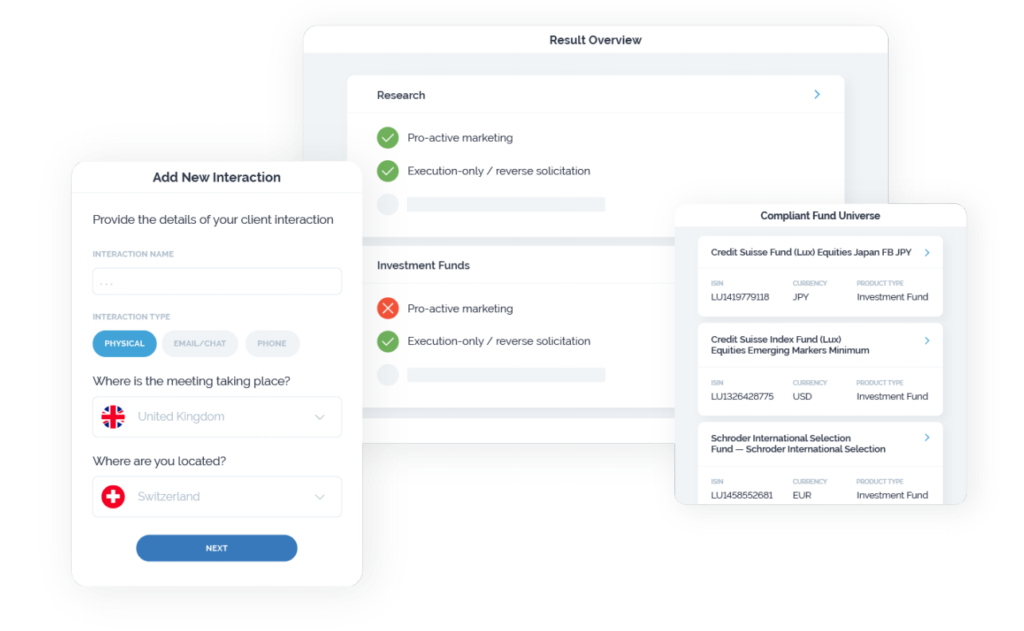

We were especially please to see that, of the ten regtech startups highlighted in the feature, four of the companies are Finovate alums. Apiax and NetGuardians, which most recently demoed at FinovateEurope and at FinovateAsia respectively, both hail from Switzerland. Apiax, recently profiled here on the Finovate blog, offers a comprehensive compliance solution that leverages APIs to integrate its compliance rules into digital processes. NetGuardians focuses on Big Data and uses it to help banks fight fraud and automate compliance.

Also earning recognition on the top European regtech list was Ireland’s Fenergo. The company, founded in 2009 and having made its Finovate debut back in 2012, specializes in client onboarding and account opening solutions for banks and financial services companies. Just this week, Fenergo announced that it was launching a new remote account opening solution in both the EMEA and APAC regions.

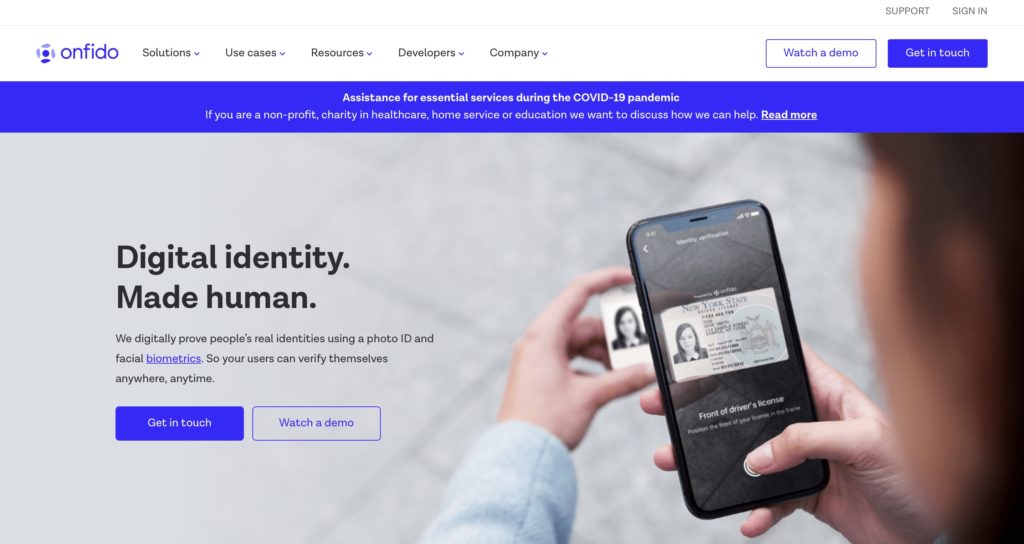

Half of the companies on Fintech News’ regtech roster are from the U.K. The Finovate alum among this group, Onfido, leverages automated machine learning, optical character recognition (OCR), and other technologies to provide identity verification to combat fraud. Demoing its technology at both FinovateEurope and FinovateFall in 2018, the company earlier this month announced a major $100 million fundraising that brought the company’s total capital to more than $182 million.

“We’ve naturally chosen the grow-fast path because we strongly feel that the time to solve the digital access problem is overdue, and urgently needs to be solved, for good,” Onfido CEO and co-founder Husayn Kassai said. “We didn’t fundraise to just get to the next milestone, we need the funding as we’re changing the world.”

The Buy Now Pay Later Revolution is sweeping the world. Check out Finovate Senior Research Analyst Julie Muhn’s coverage of Tencent’s $300 million investment in Australia-based Afterpay this week:

Tencent’s move comes shortly after its rival Ant Financial took a minority stake in Afterpay competitor Klarna. Afterpay has 3x the web traffic of Klarna and 1.5x the traffic of its other major competitor Affirm.

The buy-now-pay-later segment of fintech has been heating up this year, despite– or perhaps because of– the current economic and health crises.

Here is our weekly look at fintech around the world.

Asia-Pacific

- V Capital, and advisory firm based in Malaysia, and U.S.-based Cross River Bank partner to apply for a digital banking license in the country.

- Hong Kong-based Oriente, a fintech that provides digital infrastructure for financial services, secures $50 million in its still-open Series B round.

- South Korean cryptocurrency startup Childly teams up with blockchain analysis company Chainalysis.

Sub-Saharan Africa

- Nigerian fintech startup Okra, which facilitates the exchange of real-time financial between banks, customers, and apps, locks in $1 million in pre-seed funding in a round led by TLcom Capital.

- Flutterwave, based in San Francisco, California and Lagos, Nigeria, introduces new portal for African e-commerce merchants.

- Visa and Kenya’s Pesapal team up to support connected digital payments.

Central and Eastern Europe

- Resistant AI, a cybersecurity startup based in the Czech Republic, raises $2.75 million in funding.

- Azer Turk Bank (ATB), based in Azerbaijan, deploys technology from Lithuania’s Ashburn to manage EFTPOS networks.

- Germany’s Celonis leverages its process mining platform to develop new AI-powered accounts payable solution.

Middle East and Northern Africa

- Egypt’s Commercial International Bank acquires 51% stake in Kenya’s Mayfair Bank.

- BenefitPay, Bahrain’s national electronic wallet, announces 1257% increase in remittance volume in March.

- Tata Consultancy Services to launch a digital only bank in Israel.

Central and Southern Asia

- Indian cryptocurrency exchange CoinDCX announces trading availability of two native tokens from Crypto.com, MCO and CRO, on its platform.

- Amazon launches new credit service, Amazon Pay Later, in India.

- India-based ecommerce firm Paytm unveils contactless dining solution for restaurants in the coronavirus era.