If you’ve ever worked in lending (or for a nonprofit), you know there’s always far more need than funds that are available. That is unlikely to change at a macro level. But that doesn’t mean we can’t reach tens of millions more by deploying capital more widely and more efficiently (and at a profit).

If you’ve ever worked in lending (or for a nonprofit), you know there’s always far more need than funds that are available. That is unlikely to change at a macro level. But that doesn’t mean we can’t reach tens of millions more by deploying capital more widely and more efficiently (and at a profit).

Enter crowdfunding, and the subset, P2P lending.

I’ve been a huge fan since it burst on the scene in 2006, authoring several reports (note 1) along with the only open letter in my life when the SEC squelched P2P in 2008/2009. I just could not believe that something with so much potential for good was curtailed while in its infancy.

But luckily, the tide is turning. Even though last year’s Jobs Act is being held up (by guess who again), I’m encouraged that our government is seeing the light, although I wish Washington would embrace P2P like the Brits have.

And despite onerous disclosure requirements, Lending Club is on fire (with a $1.4 billion run rate in Feb) and proving to investors, and industry observers, that crowdfunding works. For the sake of the nascent industry, let’s hope it doesn’t stumble.

We are working on a new report on the space (note 1), but in advance of that, take a look at Pave (see below), one of hundreds of newcomers. Maybe I’m a just a sucker for the drama, but it absolutely gives me chills to see web-based investment/lending platforms helping to move deserving folk forward. It’s like a virtual credit union.

We are working on a new report on the space (note 1), but in advance of that, take a look at Pave (see below), one of hundreds of newcomers. Maybe I’m a just a sucker for the drama, but it absolutely gives me chills to see web-based investment/lending platforms helping to move deserving folk forward. It’s like a virtual credit union.

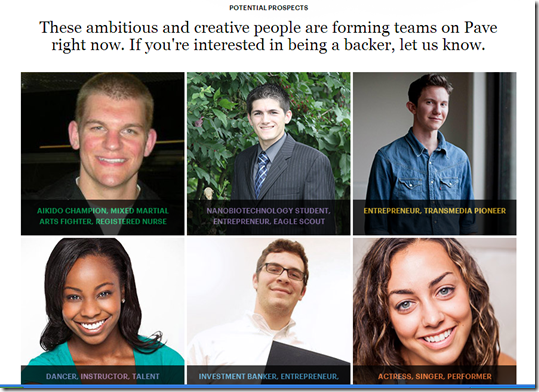

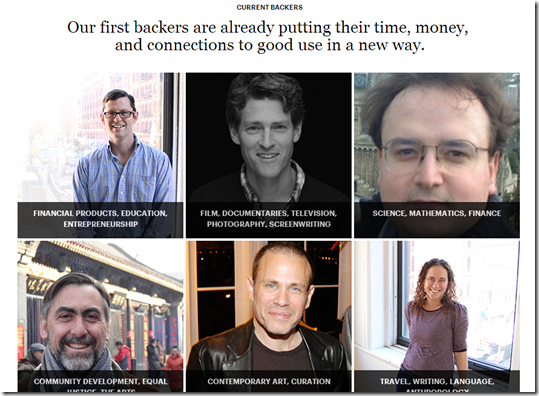

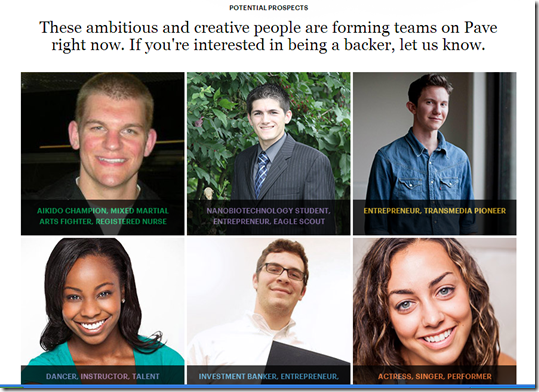

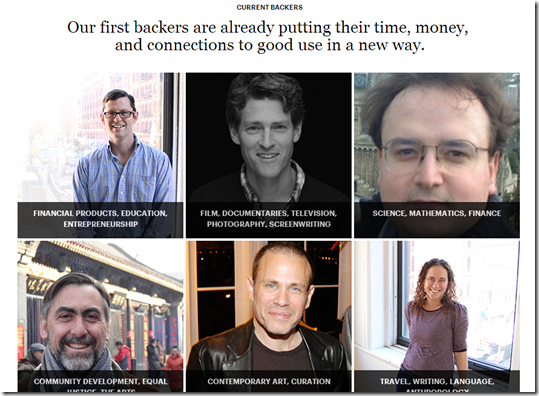

At Pave, backers pledge money to prospects and form a team. In return, backers receive a portion of the prospects’ future income. It’s like angel investing, but focused on careers. Pave is just getting started, with eight funded teams, but the stories are compelling and the future is bright, just as it is for the whole industry.

———————————————

Pave brings mentors/benefactors together with talented individuals needing support (28 Feb 2013)

Pave prospects

Pave backers

Pave teams

———————————–

Notes:

1. We have published three reports in this area (OBR 127 in 2006, 148/149 in 2007, and SR-5 in 2009). We are working on our fourth. It will focus more on equity and debt crowdfunding for small and mid-sized businesses. Our latest P2P lending market forecast is contained in the current Online Banking Report here (Jan 2013, subscription).

TSYS

TSYS

Looking for the best in fintech innovation? According to American Banker, there’s a Finovate alum (or three) for that.

Looking for the best in fintech innovation? According to American Banker, there’s a Finovate alum (or three) for that.