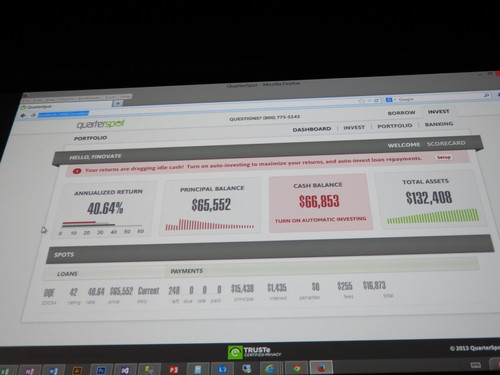

“QuarterSpot’s innovative Artificial Intelligence-driven underwriting platform can incorporate millions of pieces of real time data from business bank accounts, business credit profiles and more to execute a pre-approval decision in milliseconds. The QuarterSpot AI is also able to learn on the fly by monitoring loan repayment and trends to improve its scoring and approval terms in real time.Through this use of AI-driven underwriting and as one of the only online lenders to amortize interest, QuarterSpot offers small business owners a cost of capital as much as 85% lower than other lenders and does not require personal collateral to secure loans.”

This post is part of our live coverage of FinovateFall 2013.

Next, QuarterSpot showcased its unique underwriting platform:

Product distribution strategy: Direct to Business (B2B)

HQ: Wayne, NJ

Founded: April 2011

Website: quarterspot.com

Mitek Debuts Mobile Photo Account Opening

This post is part of our live coverage of FinovateFall 2013.

Then, Mitek showcased its Mobile Photo Account Opening solution:

“Mitek’s new Mobile Photo Account Opening solution enables financial institutions to take advantage of mobile for customer acquisition by reducing the friction for users with mobile imaging. The engaging user experience will attract digital natives and mobile first then retain them throughout their financial life.The user simply takes photos of personal and financial documents instead of entering information on a device keypad. This greatly reduces the time and effort required by the user to open and fund an account on a mobile device. Mitek’s Mobile Photo Account Opening provides flexible deployment options and seamlessly integrates with FIs’ existing account origination and identity verification providers.”

Product Launch: Q4 2013

Metrics: Mitek (MITK) is publicly traded on NASDAQ

Product distribution strategy: Direct to Business (B2B)

HQ: San Diego, CA

Founded: 1986

Website: miteksystems.com

Twitter: @miteksystems

Online Payments Startup Spreedly Introduces its Credit Card Vault in the Cloud

This post is part of our live coverage of FinovateFall 2013.

This post is part of our live coverage of FinovateFall 2013.

Spreedly is our next presenter. They are making their way to the stage right now to debut their “credit card vault in the cloud.”

“In the world of online payments much is made of the fees that are charged by payment gateway providers. Very little is known about the relative performance of payment gateways. Lost transactions based on time outs/false declines/overly aggressive fraud filters can cripple a business. Spreedly sits at a unique juncture where we can share what we see across a range of gateways.”

Product Launch: September 2013

Metrics: Raised $420,000 in seed funding, 5 employees, 100 paying customers, & 30% month over month transaction growth

Product distribution strategy: Direct to Business (B2B)

HQ: Durham, North Carolina

Founded: January 2008

Website: spreedly.com

Twitter: @spreedly

Presenting Justin Benson (CEO)

The full demo video will be available at Finovate.com in mid-September.

Simple Verity Launches Automated Small Business Credit Verification Process

This post is part of our live coverage of FinovateFall 2013.

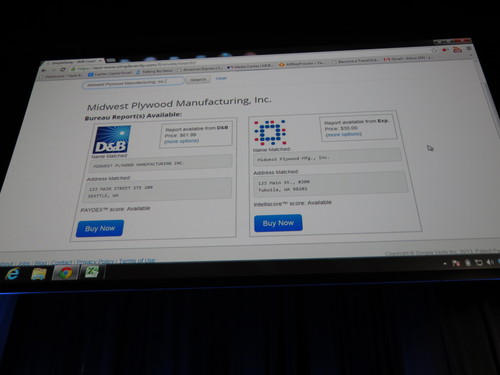

Then, Simple Verity launched its credit verification process for small businesses:

“Simple Verity is a fully automated small business credit verification process. The system can produce a reliable credit report on any small business in America – including the millions of businesses with little or no data on file at the major bureaus.Using a social approach and proprietary analytics, SimpleVerity elevates small business credit from uncertainty and risk into the light of consistent, data-driven analysis.”

Product Launch: September 2013

Metrics: 1000 business references in private beta, $250,000 raised, 3 employees

Product distribution strategy: Direct to Business (B2B), through financial institutions, & through other fintech companies and platforms

HQ: Seattle, WA

Founded: June 2012

Website: simpleverity.com

Twitter: @simpleverity

Innovation Agency Launches Innovation Café, a Platform to Engage Innovation Communities

This post is part of our live coverage of FinovateFall 2013.

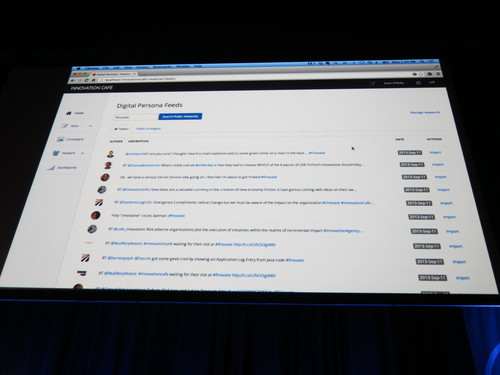

Then, Innovation Agency demonstrated its platform that facilitates collaboration around ideas and innovation:

“Innovation Café is an advanced crowdsourcing innovation platform for companies to engage their innovation communities. It is highly configurable and is able to provide for both private and public ecologies as well as emergent and structured innovation approaches. Innovation Café is a lightweight platform with advanced white labeling and custom theme capabilities and the ability to integrate with SharePoint, HR and other systems to provide detailed reporting. It is able to deal with a high volume of users and ideas and has a sophisticated social ranking and rating mechanism.Crowdsourcing and community collaboration pay attention to business objectives that are focused through idea challenges. Social Media Integration and Social Network Analysis releases are our primary focuses at FinovateFall. These innovations provide a comprehensive mechanism to track public sentiment and include it in the internal innovation community.”

Product Launch: September 2013 at FinovateFall

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), & through other fintech companies and platforms

HQ: New York, NY

Founded: December 2008

Website: innovationagency.com

Twitter:@InnovationInfo

Socure’s Social Biometrics Provides Real-Time Protection Against Fraudsters and Bots

Our next presenter is Socure. The company specializes in real-time, online identity verification solutions.

Our next presenter is Socure. The company specializes in real-time, online identity verification solutions.

“Socure’s Social Biometrics utilizes a patent pending artificial intelligence system and proprietary machine learning algorithms along with social behavior pattern analysis to detect if an online ID is authentic, a fraudster or a bot.Socure’s Social Biometrics solution showcases its ability to capture non-authentic (fake) online identities as a way to guard against identity theft and account takeover fraud. Our demonstration also shows the ability to de-risk each side of a peer-to-peer payment.”

Product Launch: August 2013

Metrics: $1.6M raised & 12 employees

Product distribution strategy: Socure is partnering with industry leading MSPs, social sign-on providers, and traditional identity databases to leverage their existing distribution channels. Socure is also selling into businesses directly with an internal sales team.

HQ: New York City, New York

Founded: August 2012

Website: socure.com

Presenting Sunil Madhu (CEO) and Johnny Ayers (Director, Business Development)

The full demo video will be available at Finovate.com in mid-September.

mBank and Accenture Present Their Redesigned, Bank 3.0 Online Platform

This post is part of our live coverage of FinovateFall 2013.

This post is part of our live coverage of FinovateFall 2013.

Next to the stage is a demo from mBank and Accenture, working together to present their next generation, online banking platform.

“mBank is the first established European bank to undergo a comprehensive, mass-scale, ‘Bank 3.0’ revolution of its direct channels by introducing re-designed Internet and mobile banking fully leveraging modern technologies to deliver state of the art, end-to-end, customer experience and unparalleled sales effectiveness for the bank. New online banking platform includes modern UI/UX, PFM, video banking, real-time marketing, social channels, and gamification.”

Product Launched: June 2013

Metrics: (mBank) ~6,000 FTEs & 4.1M customers in Poland, Czech Republic & Slovakia; (Accenture) 266,000 FTEs operating in 120+ countries, net revenues of $27.9B USD

Product distribution strategy: Direct to Consumer (B2C) & Direct to Business (B2B)

HQ: Lodz, Poland (mBank) & Warsaw, Poland (Accenture)

Founded: November 2000 (mBank) & 1950 (Accenture)

Website: mbank.pl & Accenture.com

Twitter: @mBankpl & @Accenture

Presenting Michal Panowicz (Managing Director, New mBank Project) and Maciej Jopyk (Senior Manager, Accenture)

The full demo video will be available at Finovate.com in mid-September.

Jumio’s Netverify Now Enables MultiDocument Validation and Facial Recognition

This post is part of our live coverage of FinovateFall 2013.

Next, Jumio debuted enhancements to its Netverify solution:

“Our solutions have already launched with continued iterations resulting from ongoing customer feedback. Enhancements to Netverify including facial recognition, multi-document validation, and other features to further fit specific business needs and use cases will be showcased at FinovateFall 2013.”

Product Launch: 2012

Metrics: Over 100 customers & growing

Product distribution strategy: Direct to Business (B2B)

HQ: Palo Alto, CA

Founded: 2010

Website: jumio.com

Twitter: @jumio

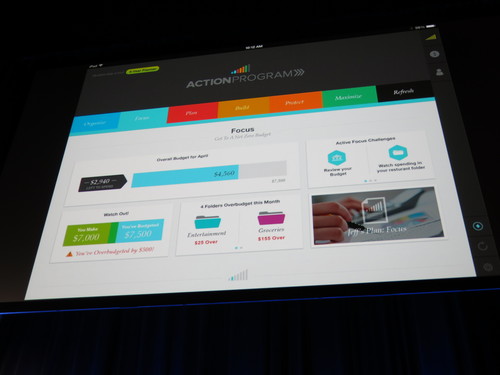

LearnVest Debuts iPad App and Action Program

This post is part of our live coverage of FinovateFall 2013.

Up next, LearnVest demonstrated the functionalities of its new iPad App:

“LearnVest is debuting an iPad App, which will allow clients to access their custom Action Program on the go. This App brings an unprecedented level of mobility to the financial planning process. Not only will clients be able to see their plan and individual CFP-issued challenges, they will also be able to access LearnVest’s Money Center tool for a snapshot of their entire financial life.”

LearnVest will also debut a new distribution channel (“Workplace Solutions”) to provide financial wellness solutions in the workplace, allowing employers nationwide to give their employees access to LearnVest’s holistic financial planning services.”

Product Launch: Fall 2013

Metrics: $41M raised & 100 employees

Product distribution strategy: Direct to Consumer (B2C) & Direct to Business (B2B)

HQ: New York, NY

Founded: Fall 2009

Website: learnvest.com

Twitter: @LearnVest

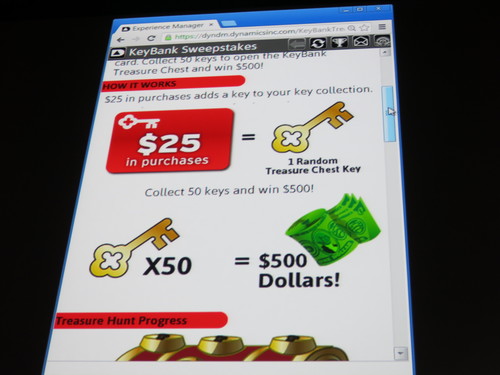

Dynamics Showcases its Solution to Gamify Your Checking Account

This post is part of our live coverage of FinovateFall 2013.

Then, Dynamics took the stage:

“Dynamics brings a new solution to stimulate fee income from checking accounts in a post-durbin world. It aims to convert cash-heavy consumers to a prepaid card by drawing them in with a real-time rewards-based platform. This brings them directly to POS, driving value through interchange.”

Product Launch: September 2013

HQ: Pittsburgh, PA

Founded: September 2007

Website: dynamicsinc.com

Twitter: @DynamicsInc

Presenting Jeff Mullen (CEO, Dynamics), Jonathan Beaver (Chief Architect, Dynamics), and Brandon F. Nowac (Team Leader Prepaid Cards, Key Corporate Bank)

The full demo video will be available at Finovate.com in mid-September.

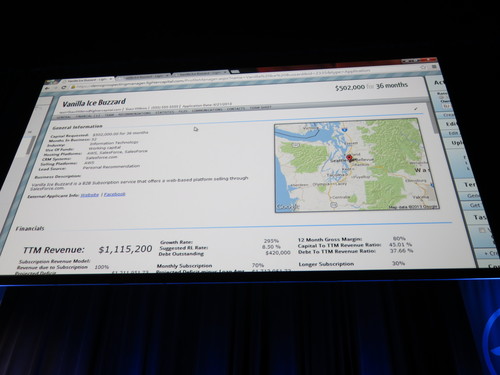

Lighter Capital Unveils Loan Analysis and Monitoring Program

This post is part of our live coverage of FinovateFall 2013.

Then, Lighter Capital took the stage to demo its unique lending platform for small businesses:

“Lighter Capital has developed the first small business lending platform to integrate CRM data and predict a borrower’s future performance. In addition to automatic integration of accounting and banking data, which provides “rearview mirror” information, Lighter Capital is the first company to seamlessly integrate CRM data to forecast the future performance of small businesses, providing lenders a “windshield” perspective on borrowers.By crunching key sales, opportunity and customer data, Lighter Capital’s technology improves underwriting and borrower monitoring, predicting financial instability months before it shows up in financial statements.”

Product Launch: September 2013

Metrics: $6M raised to date, 10 employees, 30 loans issued, average investment $200,000

Product distribution strategy: Direct to Business (B2B), through financial institutions, & licensed

HQ: Seattle, WA

Founded: June 2010

Website: lightercapital.com

Twitter: @lightercapital

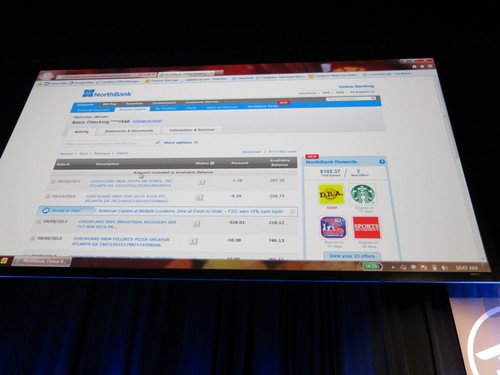

Cardlytics Debuts Geolocation Functionality Within Targeted Offers

This post is part of our live coverage of FinovateFall 2013.

Up next, Cardlytics demonstrated its new geolocation technology:

“Cardlytics will demonstrate our new geo-locator technology that empowers our partner banks’ customers to receive ads and offers based on their recent purchase behavior, no matter where they are in the U.S.”

Product Launch: Q1 2014 (tentative)

Metrics: Cardlytics is a private company with nearly 250 employees. We’ve raised nearly $100M from venture capital and private investors and we serve ~30M customers per month through partnerships with nearly 400 financial institutions across the US.

Product distribution strategy: Through financial institutions

HQ: Atlanta, GA

Founded: 2008

Website: cardlytics.com

Twitter: @cardlytics

Presenting John Brown (EVP Financial Institutions)